- You are here:

- Home »

- Blog »

- CPA Career »

- ACCA vs CPA (USA): Which Is Better for Your Career?

ACCA vs CPA (USA): Which Is Better for Your Career?

If you are an accountant and are working towards a prestigious qualification, CPA (Certified Public Accountant) and ACCA (Association of Chartered Certified Accountants) may come to mind. However, my readers have many questions about the ACCA to CPA credentials. Should you go for ACCA vs. CPA? Or, what if you have ACCA and need a CPA? Does it make sense to get ACCA after CPA?

In this article, I’ll answer some of these questions. I’ll also discuss US CPA to ACCA exemptions and the CPA US and ACCA agreement.

ACCA vs. CPA: Organization Structure

US CPA

In the United States, the CPA license is granted by each of the 55 jurisdictions, specifically by the state board of accountancy in each state and US territory. There is no centralized body, and each state has slightly different CPA exam and licensing requirements. Additionally, two professional bodies—the AICPA and NASBA—assist the jurisdictions in specific ways. But still, each state has the right to establish its own benchmarks. Therefore, international candidates are often confused and frustrated by the complicated application process.

ACCA

The Association of Chartered Certified Accountants, based in the United Kingdom, is the professional body behind the ACCA exam. It operates as a single entity with a much simpler application process.

International candidates generally consider the certification as a global brand for financial professionals. In fact, many commonwealth countries highly regard ACCA.

CPA vs ACCA: Application & Qualification

The most significant differences between ACCA and CPA are in the qualifications and the application processes.

US CPA

Candidates must have a minimum of a 4-year bachelor’s degree and preferably a master’s degree to get a US CPA license. After all, almost all jurisdictions require CPAs to have at least 150 credit hours of higher education, equivalent to 5 years of full-time study (or a US master’s degree).

Before you can even sign up to take the exam, your state board will review your educational background. Then, once you are approved for the exam and receive your Notice to Schedule (NTS), you are on your own to get prepared.

Although several CPA Exam review courses can help you study, states don’t have their own CPA classes.

Moreover, the CPA exam is a “qualifying exam,” not a “program.”

In programs such as the ACCA and CIMA, you can get textbooks from the exam administrator, follow a syllabus, and study accordingly.

CPA State Boards do not provide any courses or study materials for the CPA Exam. Candidates enroll in commercial review courses on their own to prepare for the exam. So if you’re going from the ACCA to CPA USA, I recommend reading my assessment of CPA courses.

In addition to passing the CPA Exam (and an ethics exam in some states), candidates must also have 150 hours of education and at least one year of qualified experience. You can learn more about the CPA requirements. However, if you’re registering for the CPA with ACCA, you’ll still have to meet these requirements.

ACCA

The ACCA entry level is much lower than the CPA. Plus, the ACCA has two entry points depending on your education and experience. The ACCA labels these levels as “ACCA Foundations in Accountancy” and the “ACCA Qualification” level.

ACCA Foundations in Accountancy

The foundations level is for people who are new to accountancy and don’t have an education threshold. It’s also the best place to start for people working in finance but who don’t have adequate education levels or qualifications to apply for higher-level positions.

The exams at the Foundations level test your understanding of basic accounting principles. Basically, the ACCA feels that you should have mastered these topics before going for the ACCA Qualification exams. So if you’re passing the ACCA exam after CPA, you probably already have this level of knowledge.

ACCA Qualification

If you have more experience and/or education, you can start at the ACCA Qualification level. The ACCA’s exact requirements state that you can begin at this level “as long as you have 3 GCSEs and 2 A Levels in 5 separate subjects including maths and English.” Basically, this means you need a bachelor’s or master’s degree.

However, if you only have a high school diploma, you can begin the ACCA Qualification exams if you pass the ACCA Advanced Placement Examination. This test analyzes your proficiency in the material that appears in the ACCA Foundations of Accountancy program.

Unlike the US CPA, once candidates are registered, ACCA takes an active role in preparing you for the exam by providing study guides and sample exam papers. They also maintain a database of ACCA Approved Learning Partners.

In addition to passing all papers for the ACCA Qualification, candidates must also take the Ethics and Professional Skills module. Additionally, they need to gain 3 years of appropriate work experience before calling themselves ACCA-certified.

ACCA versus CPA: Exam Content and Format

US CPA

Candidates must pass 4 parts of the CPA Exam. The three Core sections include Financial Accounting & Reporting (FAR), Auditing & Attestation (AUD), and Regulation (REG). Plus, starting in 2024, candidates must also pass one of three Discipline sections, which include Business Analysis & Reporting (BAR), Information Systems and Controls (ISC), and Tax Compliance and Planning (TCP). (You can read more about the 2024 CPA Exam Changes.)

The exam is 100% computerized, consisting of multiple-choice questions and task-based simulations (similar to case studies). Grading is mainly computerized.

You can choose to take the 4 parts separately, 2 at a time, or even 4 at the same time. Although you had to wait for specific “CPA testing windows” in the past, you can now sit for the exam any time during the year. You take the exam at Prometric testing centers, which are located throughout the US and in Japan, South Korea, Brazil, and several European and Middle Eastern countries. Discover the CPA Exam locations.

ACCA

The ACCA Qualification has several smaller exams to pass, called “papers.” The ACCA exam is divided into 13 papers as follows::

Applied Knowledge

- Accountant in Business

- Management Accounting

- Financial Accounting

Applied Skills

- Corporate and Business Law

- Performance Management

- Taxation

- Financial Reporting

- Audit and Assurance

- Financial Management

Strategic Professional – Essentials

- Strategic Business Leader

- Strategic Business Reporting

Strategic Professional – Options (complete 2)

- Advanced Financial Management

- Advanced Performance Management

- Advanced Taxation

- Advanced Audit and Assurance

Candidates can apply to waive some papers based on their education levels. Or, they can take the “Certified Accounting Technician Qualification” assessment to waive some papers according to practical experience. However, please note that you can only receive a maximum of nine exemptions for the Applied Knowledge and Applied Skills papers. Plus, you cannot receive any exemptions for the Strategic Professional portions. So, all candidates must sit for those papers. If you think you might qualify for any exemptions, you can use this tool from ACCA Global to find out.

Some—but not all—papers are computerized. Furthermore, the exam is offered four times a year at more than 500 testing centers worldwide.

Difference between ACCA and CPA: Time Required to Pass

US CPA

Most candidates aim to pass the CPA exam within 12 to 30 months. After all, once candidates pass the first of their 4 CPA Exam sections, they must pass the other 3 within 30 months.

Candidates who have the time and commitment to study can take all exam parts in one go. In that case, you can complete the exams within 3 to 6 months. However, please note that this timeframe requires a substantial study commitment. If you might go this route, I suggest reading about how long it takes the pass the CPA Exam.

ACCA

Given the number of papers to pass, candidates generally need 3 to 4 years to complete all papers and become ACCA members. Candidates can sit for the papers during four exam sessions held each year. However, candidates can only take four exams per session and a max of eight papers in a year.

So, in theory, you could pass all papers in 2 years. But because of logistics issues, most need 3-4 years. Plus, candidates need 3 years of work experience before receiving their ACCA credentials.

ACCA and CPA: Reciprocity and Exemptions

US CPA

The US has mutual recognition agreements with 8 accounting bodies in the world. To gain a US CPA license, their members can take a simplified version of the CPA Exam known as the IQEX.

However, please note that the ACCA is not among these 8 accounting bodies. Therefore, there is no MOU for CPA, and ACCA and ACCA members do not qualify for CPA exemptions. So, if you hold an ACCA certification, you MUST complete the CPA requirements, including 150 hours of college education (5 years).

Many ACCA members have passed the CPA Exam. However, since ACCA does not have a recognition agreement with either the National State Boards of Accountancy (NASBA) or the AICPA, ACCA members with advanced degrees find it less challenging to qualify to sit for the CPA Exam. ACCA members with master’s degrees or higher must also have a minimum number of accounting and business courses (this number will vary by jurisdiction, and there are 55 in the United States).

ACCA members without advanced degrees will need to seek education from a degree-granting institution.

ACCA

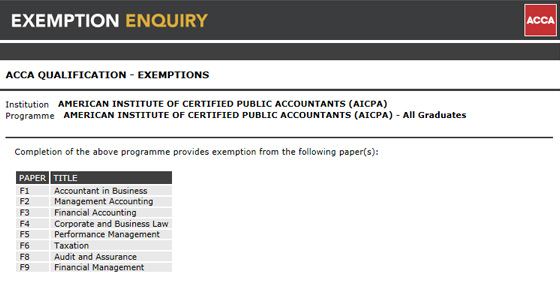

If someone is already a CPA, can they become an ACCA member? Well, ACCA is more generous in this regard — ACCA grants exemptions to AICPA members for several of the papers. And if you are a holder of the US CPA credential, you are subsequently a member of the AICPA. Moreover, AICPA members may be able to skip the Foundations of Accountancy papers. You can check out the exemptions CPAs will receive who are interested in becoming ACCA members.

CPA vs ACCA: Which is Tougher?

What test is easier – ACCA or CPA? Honestly, that depends on what you consider to be tough. Is ACCA harder than the CPA? In some ways, yes. But in other ways, no.

Deciding which one is tough – US CPA or ACCA – there are several factors to consider. First, the US CPA has fewer sections (4 exam sections vs 13 papers for the ACCA Qualification), but they are all hard. In fact, the US CPA pass rate hovers around 45-55%. Likewise, the ACCA estimates their mean pass rate is about 55%.

However, CPA candidates can benefit from studying with a review course. Luckily, I have reviews of the top CPA courses, including exclusive discount codes.

What about the ACCA vs CPA vs MBA?

Readers sometimes ask me to compare the ACCA or CPA credential with the MBA or Master of Business Administration. Really, it isn’t easy to compare these qualifications because they are vastly different.

The ACCA and CPA prove that you have the skills for upper-level accounting positions. And both open up job opportunities. However, they are geared toward candidates who work in different regions and with different accounting standards.

The MBA, in contrast, is a degree, not a credential. MBA holders must understand accounting but also general business and management principles.

Furthermore, some professionals combine the CPA and MBA to push their qualifications further.

ACCA Exam vs CPA: Other Considerations

US CPA

Depending on your country of residence, you may be able to take the CPA Exam at several international sites. The latest updates are listed below. However, please note that if your country isn’t listed, you will have to take the exam in the United States.

Taking the CPA Exam in the United States

All eligible CPA candidates can take the exam in any US jurisdiction, including Guam.

CPA Exam Testing in Brazil

You must be a citizen or long-term resident of the United States, Central America, or South America.

To test in Japan and South Korea

To take the CPA Exam in Japan or South Korea, you must be a resident of one of these countries: the United States, Japan, South Korea, China, Hong Kong, Macau, Mongolia, Republic of Korea, Republic of Singapore, Republic of the Philippines, or Taiwan.

Sitting for the CPA Exam in the Middle East

In recent years, several testing centers have opened in Middle Eastern countries. Specifically, the CPA Exam is available in Bahrain, Egypt, Jordan, Lebanon, Kuwait, and the UAE. To test there, you must be a resident of one of those countries, the United States, India, Pakistan, Qatar, Saudi Arabia, or Yemen.

CPA Exam in India

You can now take the CPA Exam in India, too. However, you must be a resident of the US, India, Bangladesh, Bhutan, Maldives, Myanmar, Nepal, or Sri Lanka.

Taking the CPA Exam in Europe

CPA candidates can now take the exam in European countries too. These include England, Germany, the Republic of Ireland, and Scotland.

ACCA

ACCA allows candidates to take their papers in 500+ testing centers globally. Candidates who struggle to get a US VISA may prefer ACCA.

ACCA Program vs CPA: Summary

US CPA

- Recognized in the US and anywhere with US regional offices

- 55 jurisdictions with complex licensing requirements

- High entry barrier: master’s level and/or 150 hours of higher education

- Exam offered year-round

- Exam sites in the US + multiple other countries

- 4 parts

- 12-30 months to complete exam, plus an additional 1+ years of work experience (more in some jurisdictions)

ACCA

- Recognized in the UK and commonwealth countries

- One single entity with a simple application

- Low entry barrier: post-secondary education needed

- Exam only offered 4 times a year

- 500+ testing centers across the globe

- 13 papers

- 3-4 years to complete

How about Chartered Accountant vs CPA?

The different chartered accountant designations around the world and their respective comparisons to the CPA license can be quite different.

In general, chartered accountants are more country-specific or regional designations. For example, CAs from Australia, India, and Pakistan are well-recognized in their respective countries. Outside of that, though, their value drops considerably.

If you plan to work in your own country long-term, it makes a lot of sense to go for your local chartered accountant certification. However, if you aspire to work abroad or in multi-national companies, you may want to take a further look at the CPA license.

Conclusion: ACCA vs CPA

The US CPA is arguably the most prestigious accounting qualification. The entry barrier is high, with an equivalent of a master’s degree together with strict working experience requirements.

Because of these stricter requirements, the CPA Exam itself has fewer parts than the ACCA — only 4 sections compared to 14 papers for the ACCA.

Some jobs can only be performed by a CPA. For example, only CPAs can sign audit reports under the US GAAP standards. Besides, only CPAs can launch a CPA firm in the US. Therefore, the CPA title has distinct advantages if you are interested in public accounting in the United States or American firms.

For ACCA, the application process is much simpler, and the entry barrier is lower than the CPA. However, it takes years to complete the studies and obtain membership. While ACCA is globally recognized, it is not as highly regarded outside the UK and Commonwealth countries.

If I Must Pick ACCA vs CPA… Which One Should I Go For?

Since it is not possible to take advantage of the ACCA membership to get exemptions from the US CPA exam, I suggest that you target one—not both.

Regarding which qualification is better, it is like a question on Coca-Cola vs. Pepsi: it really depends on where you plan to work.

For Your Further Reading

Next Step

- How to become a CPA as an international candidate

- How to become a CPA (US candidates)

- Possible exemptions for the CPA exam

I am Ready to Start!

If you are serious about the CPA exam, check out this e-course that is absolutely free. You can also read more about this mini-course before signing up.

Enter your name and email address and

I will send you the newsletter right away!

About the Author Stephanie Ng

I am the author of How to Pass The CPA Exam (published by Wiley), and I also passed all 4 sections of the CPA Exam on my first try. Additionally, I have led webinars, such as for the Institute of Management Accountants, authored featured articles on websites like Going Concern and AccountingWeb, and I'm also the CFO for the charity New Sight. Finally, I have created other accounting certification websites to help mentor non-CPA candidates. I have already mentored thousands of CPA, CMA, CIA, EA, and CFA candidates, and I can help you too!