- You are here:

- Home »

- Blog »

- CPA Review Courses »

- Becker CPA Review 2025: Becker CPA Discount & Exclusive Becker Info

Becker CPA Review 2025: Becker CPA Discount & Exclusive Becker Info

Becker CPA Review is the most well-known guided review course in the accounting industry. In fact, over 1 million CPA candidates have used Becker review. Furthermore, the Big 4 CPA firms all have relationships with Becker CPA. And Becker CPA Exam Review is our #1 rated course, too.

Still, is Becker the best CPA review? And most importantly, is Becker enough to pass the CPA Exam? Well, I’m here to share my personal experiences with Becker’s CPA review, including the Becker Final Review course. (I passed the CPA Exam on my first try!) And with this info, you can decide if Becker CPA prep is right for you. I also have exclusive discounts to reduce the Becker CPA Review cost.

Number of MCQs: 7,400+ (& another 1,100+ with the Pro, Pro+, and Concierge packages bonus banks) | Number of TBSs: 475 | Access Length: Unlimited/Until You Pass | Cost: Options range from $2,499 to $6,349 before our exclusive discounts.

Why You Should Pick Becker CPA Review:

- Becker is ready to help you pass the 2025 CPA Exam with a revamped course that delivers a more personalized learning experience with new tools like more engaging video lectures, lecture slides, Core + Discipline sections, Deep Dive Workshops, and a more diverse team of CPA instructors.

- New! Becker AI Chatbot that offers real-time in-depth study help.

- The updated 2025 Becker course has an updated Study Planner that helps you create a custom study plan.

- The Becker courses are clearly mapped to the AICPA Blueprints.

- Becker utilizes Adapt2U Technology, an adaptive learning platform enhanced by integrating Sana Labs, an award-winning AI technology.

- The Becker courses have more video lecture hours than ever before.

- Becker equips you to triumph over task-based simulations, the CPA Exam’s most difficult question type, with the course’s exclusive SkillBuilder videos. In fact, each simulation is accompanied by a video walk-through that shows you how to solve it.

- Just as importantly, the Becker CPA pass rate is high. Specifically, 94% of Becker users who are “Exam Day Ready” pass the CPA Exam.

- And finally, Becker has more Elijah Watt Sells Award past winners than any other review provider.

But still, is a Becker CPA course enough to pass the CPA Exam? Read on to learn more about the Becker pass rate and how to become a Becker accounting master.

Disclosure

Disclosure: The I Pass Team may earn a small amount of compensation if you purchase CPA review courses from our links. However, our team uses these revenues to maintain the site and produce awesome free content just for you!

Table of Contents

- Becker CPA Review Savings

- Background of Becker CPA

- Overview of Becker CPA Review

- Course Features

- Best Parts of Becker CPA Review

- Worst Parts of Becker CPA Review

- Becker CPA Course Options

- Using Your Becker CPA Exam Review Course

- Becker CPA Questions

- My Becker CPA Conclusion

- Becker CPA Review Discounts

Becker CPA Review Savings

With my exclusive offer for I Pass readers, you can save hundreds of dollars on your Becker CPA Review course.

Background of Becker CPA

Becker CPA was one of the first CPA review courses ever. Accountant and entrepreneur Newton Becker developed Becker CPA Review in 1957 as a training course for Price Waterhouse. Then, in 1960, he launched Becker as an independent company. The company quickly grew and maintained its solid reputation in the industry to the extent that it became part of DeVry in 1996. Now, Becker is the largest provider of U.S. CPA Exam prep in the world.

Therefore, Becker’s history is not only long, but it is also successful. For example, Becker has global partners in about 65 countries. Actually, they also serve all of the Big 4 global accounting firms and have strong relationships with 100 of the top accounting firms in the United States. What’s more, Becker usually produces the most Elijah Watt Sells Award winners each year. For more than a decade, over 90% of all Watt Sells Award winners prepared with Becker. Consequently, Becker truly has a stellar reputation in the industry.

Overview of Becker CPA Review

To provide a fair and objective review of all major CPA review courses, I provide a thorough and impartial evaluation of the Becker CPA program in addition to my personal view based on firsthand experience. (Yes, I used Becker to pass my own CPA exams!) But like every other CPA review course, Becker may not be the best course for everyone. Yet, everyone can find the best CPA review course for them. So, if you need help with this process, please contact me.

CPA Review Becker Course Features

Each Becker CPA Review package presents an integrated and guided review course containing adaptive technology, video lectures, proprietary textbooks, practice questions, mock exams, a final review, a study planner, different levels of customer support, various course formats, a mobile app, a learning game, flashcards, and more all in one online platform. And that’s a long list! Although the Becker price is a little higher than some other CPA review courses, you also get lots of tools to help you pass the CPA Exam faster.

1. Adaptive Technology

Becker’s proprietary adaptive technology is called Adapt2U Technology, and it is powered by Sana Lab’s AI technology. The Swedish Sana Labs is one of the leading AI companies for education in the world. Plus, they have won awards for their adaptive learning technology constructed by their interdisciplinary team of experienced engineers and scientists.

Becker is proud to have invested a great deal of time and effort into their partnership with a world-class developer such as Sana Labs. Furthermore, Becker explains that the Sana Labs AI technology within the course tracks every student interaction to generate a unique review experience for each student according to their individual weaknesses and learning needs.

Becker’s AI technology tracks every student interaction to generate a unique review experience according to their individual weaknesses and learning needs.

Becker’s courses are adaptive

Beckers CPA courses are adaptive. That is, as you take practice tests, the AI technology actually learns your strengths and weaknesses.

To begin with, the adaptive course creates a customized study path for each student. For instance, you can choose to either begin with a comprehensive lecture-based review or move right into application by answering the practice MCQs and task-based simulations (TBSs).

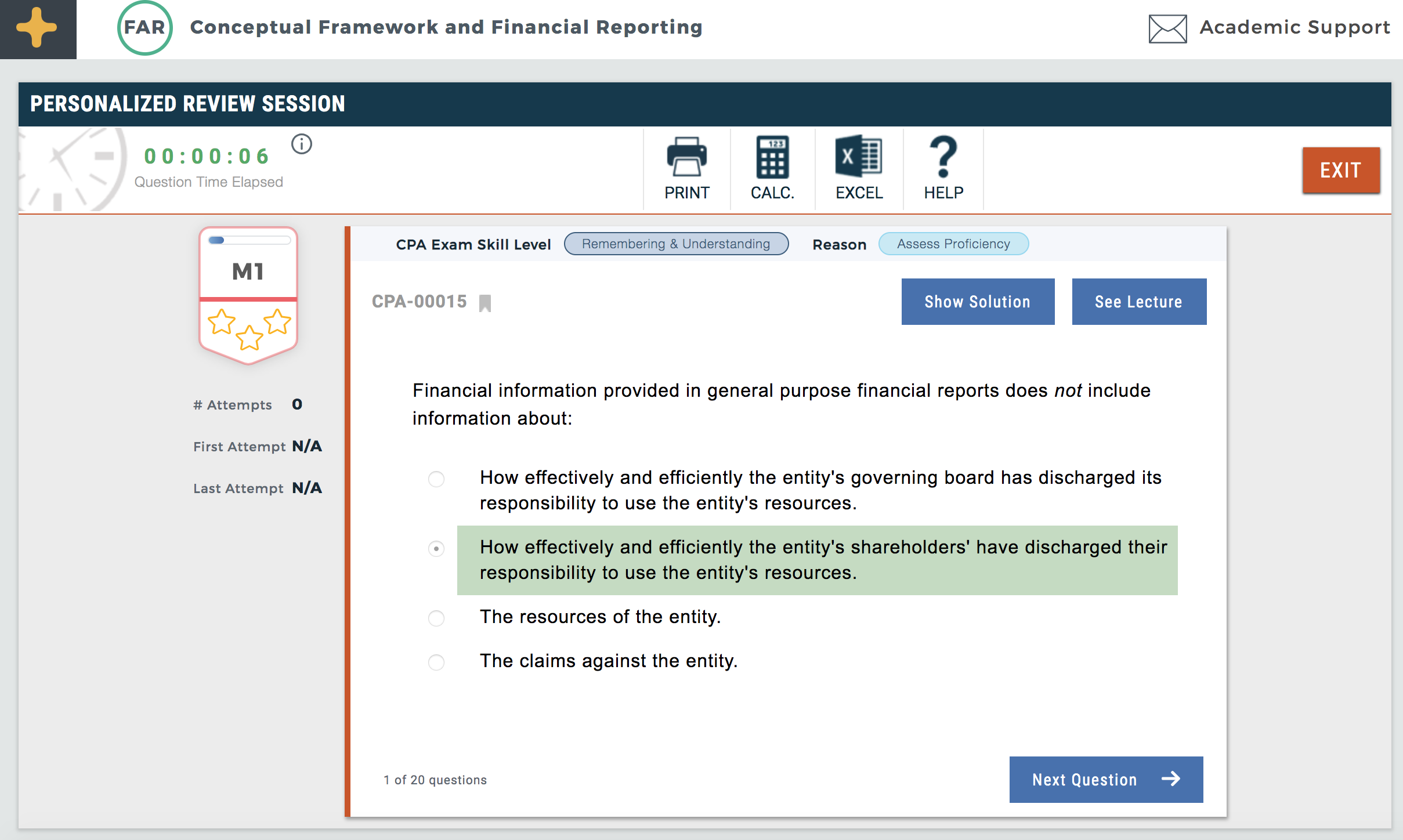

Review Session

Once you finish a unit, the course allows you to work through a personalized review session that accommodates your learning needs. For instance, you could work on targeted practice questions to deepen your understanding of the unit’s key concepts.

You can decide how many questions you would like to answer in each CPA Becker review session. The course will serve you a mixture of MCQs and TBSs that the AI technology has selected for you in light of your performance within the course.

As you answer each question, the course tracks whether your proficiency has increased or decreased. And with this information, Becker’s CPA course continues to assemble the optimal mix of practice questions for the review session.

Each question within the review session indicates the CPA Exam skill level at which it is testing you. The question also comes with an explanation as to why the course provided that question to you.

However, don’t be discouraged if you feel that the Becker questions are hard. After all, when you compare the Becker vs CPA Exam questions, many users find that the Becker CPA practice exam MCQs are tough.

Before you answer each question in the review session, you can choose to watch the lectures discussing the topics tested by the CPA sample questions. This method ensures you’re mastering the information.

Then, once you’ve answered all of the questions in the review session, you can go through a detailed list of the questions that appeared within that module. From this list, you can choose to return to particular questions. Next, you can read the in-depth explanations about why the correct answer was right and the incorrect answers were wrong. If you want, you can also work through additional review sessions to become even more proficient with the exam topics.

Proficiency Tracking

The CPA Becker review session also tracks your proficiency with the unit. The proficiency tracker reports the module number or unit number along with your level of proficiency. This way, you can determine what content areas you need to study more.

2. Audio and Video Lectures

The Becker CPA prep courses also include both video and audio lectures. Specifically, the Pro and Pro+ courses have over 900 bite-sized video lessons, each about 10-20 minutes long. And Becker has recently re-recorded the video lessons in a few format that feels more like sitting in a classroom. This new format helps with engagement and retention and make the videos much less boring to watch!

The lecture material is of the highest quality. For example, Becker constructs the lectures in such a way that candidates can truly comprehend the subject matter rather than settle for rote memorization. Moreover, the lectures strictly cover the format and questions of the real CPA Exam. And such intentional focus on the CPA Exam questions is rare among CPA review providers.

Likewise, the pacing of the lectures is also convenient for quick and painless learning. The lectures in each module can be 10-60 minutes in length, but the course divides them into 2-5 minutes sections. As a result, you can focus on one topic at a time.

Finally, the instructors that lead these lectures are CPAs, PhDs, and accounting, law, or business professionals with real-world experience. Becker trains them to use engaging and informative teaching techniques. As a matter of fact, thousands of accounting firms, corporations, universities, and government agencies trust Becker’s lectures.

3. SkillBuilder Videos from Becker Review

SkillBuilder videos are exclusive to Becker. They really help to set the course apart from others on the market. (They used to be called SkillMaster videos, but Becker recently revised their terminology.)

Becker’s exclusive SkillBuilder videos delve deeply into the process of completing TBSs (task-based simulations), the CPA Exam’s most difficult questions.

Specifically, these videos feature an instructor using custom animation and touchscreen technology to guide candidates through the steps of answering practice TBSs. The instructors provide step-by-step tips and strategies so you can apply key exam concepts to each TBS. In fact, Becker has SkillBuilder videos for every single TBS in their course because they are so important to master for the CPA Exam.

Essentially, the SkillBuilder videos serve as personal tutoring sessions for each of Becker’s 475 TBS questions.

Essentially, the SkillBuilder videos serve as personal tutoring sessions for each of Becker’s 475 TBS questions. Therefore, these videos give Becker students a big advantage over the CPA Exam TBSs. If you learn the tactics to solve these CPA Exam example questions, you’ll be better prepared on exam day.

4. Becker CPA Review Books and Content Updates

When you purchase a Becker course, you receive printed textbooks and/or e-books, depending on your selected package. Becker lets you choose when you want the printed textbooks delivered according to their content update schedule. What’s more, digital textbooks are annotated to guide you through the most important information you must know to pass the exam.

All of the Becker CPA books are fairly comprehensive and well-written. Because Becker has been in the industry for so long, they’ve been able to assemble a team of very skilled and experienced writers. Plus, they know the ins and outs of the CPA Exam Blueprints and can distill that exam content into material candidates understand.

Becker updates their lectures and textbooks twice a year, on June 11 and December 11, to cover the new content that becomes testable each July 1 and January 1. They stop covering old concepts as soon as the CPA Exam stops testing on these concepts. By following this schedule, Becker doesn’t interfere with your studying. And Becker’s CPA schedule ensures you are only studying the topics most likely to be tested according to the most current CPA Exam syllabus. So, for example, the Becker updates for 2025 have already happened, and the Becker courses are now current for 2025. Likewise, if you purchase a Becker course now, you’ll also receive content for the updated CPA Exam.

Becker also supplies lecture outlines at the unit level. These outlines summarize the main concepts for each module within the unit.

How to Get Free Becker Replacement Books

Given that the AICPA’s CPA Exam syllabus (aka, the Blueprint) can change throughout the year, you must ensure you are using the latest materials. Specific Becker CPA packages include printed copies of the Becker textbook, and if the exam changes during the year, you may request a textbook from Becker that consists of the changes.

Unfortunately, there is no way to get these textbooks for free. What’s more, you must be a *current* Becker student to purchase new books, so if your course access has expired, you’ll need to reach out to the Becker team.

If you have the budget to purchase a new textbook, each replacement will run you $125. However, the updated *digital* textbook is always available in your Becker course. You can download and print the updated pages, so purchasing a new textbook is unnecessary unless the AICPA has made significant changes to the syllabus. For example, let’s say you bought the Concierge, Pro+, or Premium version of the Becker course. With these course versions, you have unlimited access, so if it’s taking an unexpected amount of time to pass the CPA Exam, you might want to buy a new book, especially if the exam has experienced significant changes since you began your studies.

If you purchased Becker before the AICPA removed BEC, consider purchasing a textbook covering your desired discipline: BAR, ISC, or TCP. You should not use your BEC textbook to study as you’ll be learning information that is no longer covered and missing newly added information about the discipline you chose.

5. Simulated Exams

Each full Becker CPA course also comes with 8 full simulated exams. The 8 simulated exams break down into 2 exams for each of the 4 CPA Exam sections.

But how does the CPA Exam compare to the Becker exams? These simulated exams replicate the format and functionality of the exam down to the smallest detail. For instance, when you enter a simulated exam, you’ll see the CPA Exam interface, and your exam will start with information for that exam section. The prompts that lead you through the simulated exam also look exactly like they do on exam day.

All of the questions within the simulated exams are new to you; they have not been recycled from other practice exams.

Finally, all of the questions within the simulated exams are new to you. To clarify, they are not questions you would have seen on the other practice tests within the course.

Mini-Exams

All Becker CPA reviews now come with mini-exams, too. Basically, you can take these short simulated exams in half the time as a full-length one. I like this option because you don’t always have the time to sit down and take an entire test. These mini-exams are another example of how CPA review with Becker is a little easier.

Becker CPA Mock Exam vs Actual

So, just how similar are the Becker questions to the CPA Exam? When you compare Becker vs the actual CPA exam, you’ll probably find that the Becker questions are harder overall than the ones on the exam. Plus, many candidates have lower scores on their Becker CPA mocks exams and still pass the CPA Exam. That’s called the “Becker bump” – keep reading to learn more about Becker vs actual CPA Exam results.

6. Unlimited Practice Tests

All of the Becker courses also come with unlimited practice tests. These tests differ from the simulated exams because practice tests randomly pull from all of the questions within the Becker test bank. These tests allow you to get even more practice before you take the simulated exams.

Becker has added the Adapt2U technology into unlimited practice tests so they can be more personalized to really focus on areas of weakness. This targeted, personalized feature can help candidates save time and effort when practicing for the exam.

The practice tests supply a mini CPA Exam experience by featuring 2 testlets. By working through these testlets, you can develop your familiarity with the look and feel of the exam while reinforcing your retention of the exam content. And really, the availability of unlimited practice tests could be one of the reasons why the Becker CPA Exam pass rates are so strong.

Becker CPA practice exam vs actual

When you’re taking a Becker CPA practice exam, just remember that the Becker questions are a little harder than the ones you’ll see on exam day. So in this way, Becker almost overprepares CPA candidates.

7. Practice Questions in the Becker Test Bank

The number of practice questions Becker supplies varies according to the course package you purchase.

Specifically, the Advantage course includes 7,400+ MCQs and 475 TBSs, while the Pro course comes with a bonus bank with another 1,100+ MCQs.

Additionally, Becker constantly compares the quality of their questions against the most recent version of the CPA Exam to ensure that their questions remain up-to-date and effective for helping candidates pass.

This is another reason why Becker pass rates for CPA candidates are high.

Still, could you pass the CPA Exam by only doing Becker MCQs? Although the practice questions are great, why limit yourself to just one learning tool when a Becker course gives you so many ways to study?

8. Becker CPA Final Review

Becker’s final review is a cram course that you complete closer to your exam date. Most candidates start their final review 1-2 weeks prior to their actual exam date.

Becker is one of only a small handful of CPA review companies to provide candidates with a fully comprehensive final review. So, what does this mean?

Becker’s Final Review covers more than 115 topics with 39 hours of new lectures; 1,000 new MCQs; and 108 new TBSs.

In Becker’s final review, you’ll find condensed material with brand-new lectures that Becker has pared down to only include the most crucial content. Additionally, you’ll also receive never-before-seen multiple-choice questions and simulations that allow you to get even more prepared. And in case you’ve memorized some questions, having brand new ones served at this stage is immensely helpful. Becker’s Final Review covers more than 115 topics with 39 hours of new lectures; 1,000 new MCQs; and 108 new TBSs.

Plus, Becker students can even purchase the Final Review per exam part. For example, let’s say you’re really struggling with the FAR concepts. In that case, you can opt to just buy the Becker Final Review for FAR.

Is the Becker Final Review worth it?

In contrast to CPA review providers that don’t include this level of final review, Becker gives you everything you need in the end to wrap up your studies in an efficient way. An effective CPA final review stage could be the difference between passing or failing the CPA Exam, so this is a truly important feature. In fact, this final review could contribute to the high Becker CPA pass rate statistics.

9. Becker Online CPA Review Study Planner

The Becker study planner helps you create the most efficient study schedule according to which exam section you are taking and when. The Study Planner feature is included with all of Becker CPA’s full courses (Concierge, Pro, Premium, and Advantage) as well as individual parts (AUD, FAR, REG, BAR, ISC, and TCP). Becker recently updated the Study Planner tool, and it’s now much more customizable than before.

The study planner is easy to use. Just start by adding your exam information. Next, the study planner will tell you which study units to complete and the order in which to finish them. This personalized Becker CPA Review schedule will help you stay on track. In fact, compared to earlier versions, the new Becker Study Planner has more options:

- With the help of the Study Planner, you can schedule your study sessions and determine how many hours you will study each day of the week.

- You have the option to include practice exams, studying flashcards, and taking a final review.

- You can adjust your study schedule to fit your pace. That is, you can proceed through the content at your own pace.

- If you become behind on your daily study assignments, Becker’s planner can help you catch up. You can also decide to study the content in a different order than what is recommended.

- Once study materials are finished, they can be marked off your list.

- Furthermore, Becker’s Study Planner gives you a warning if you attempt to create a study plan that is overly ambitious based on the date of your CPA Exam. This is a useful tool, because you don’t want to set yourself up for failure by studying too quickly.

10. Unlimited Academic Support, Access to Success Coaches, and Academic Tutoring Sessions

Becker allows all candidates to receive as much academic support from experienced professors as they need. Specifically, you can receive professor mentoring by posting your exam-related questions to a forum and getting a response within 48 hours or less. You can also search through archived discussions to get immediate access to similar candidate questions and their answers.

However, candidates who purchase the Premium or Pro course packages will also receive access to success coaches. These coaches will recommend that candidates set specific goals for their CPA Exam journey and help candidates formulate plans to meet these goals. The success coaches will also suggest which Becker course can best meet a candidate’s learning needs.

Finally, candidates who go with the Pro course package can also take advantage of the 5 tutoring sessions that Becker offers, and the new Becker Concierge package even includes an amazing 50 CPA tutoring sessions. These 1-on-1 tutoring sessions afford Becker students the opportunity to receive personalized help from CPA-certified instructors. During each 1-hour session, you can ask the instructor specific questions about the CPA Exam content with which you are struggling.

11. LiveOnline and Live Classroom Scheduling Options

If you’d like to watch live lectures from the comfort of your own home or wherever you prefer to study, you’ll appreciate Becker’s LiveOnline classes. With these classes, you can join a live webinar, listen to the lecturer, and ask a question in real time. Therefore, these classes let social learners get the additional support and instruction they need to succeed on the CPA Exam.

Becker live classes

Becker is the only CPA course provider that has a live classroom teaching experience.

Did you know that you can take Becker CPA review classes in person? Becker is also the only CPA review provider to continue to offer live classes in a classroom setting, with more than 80 classes worldwide. Within the classroom learning environment, you’ll enjoy a structured schedule, regular teaching, and dedicated attention from Becker’s expert instructors.

The LiveOnline classes are available to Premium and Pro course students, and the Becker CPA live classes come with the Pro course. You can find the schedules for these resources on Becker’s website.

12. Becker CPA Flashcards

Becker includes 1,350+ digital flashcards in all three of their course packages. As these flashcards contain questions and brief answers, you can use them to solidify your understanding of the most important exam concepts.

When you access the flashcards within the online course, you can use the search function to locate cards about certain topics. If you want to drill yourself, you can tell the course to present the flashcards in random order or in order of lecture and topics. What’s more, the digital CPA review flashcards also display statics about your progress with them.

If you purchase the Pro course, you can also receive printed flashcards. Otherwise, you can add the printed flashcards to your course for $179.

13. Becker Review Native App and Accounting for Empires Learning Game

The Becker mobile app lets you view lectures, use flashcards, and answer practice questions on your phone or tablet. If you download the content to the app on your mobile device, you can access the course offline.

Becker Review CPA learning game

You can also use your phone or tablet to play the Becker Accounting for Empires, a unique learning game. This app is an interactive mobile gaming experience that lets you answer CPA Exam questions to build your empire. You can choose the topics and the number of questions so you can work on content areas where you need the most help. Then, you can get credit in your Becker course for the MCQs you answer correctly in the game. In this way, you can really enjoy your studies while increasing your skills.

You can play individually or with a group of other CPA candidates. And when you play with others, you can create alliances, conduct espionage, and challenge other players so you can boost your resources. Finally, because Accounting for Empires is available on Android™ and iOS® phones and tablets, you can play anytime, anywhere.

14. Flexible Financing: Flexpay

Becker also offers a unique way to pay for your course with its flexible financing option called Flexpay.

With Becker financing, you open a new credit card that you can use to pay for your course over time. This no-interest financing option charges your credit card based on the monthly option you choose.

Becker payment plan

You can pick either a 6-, 12-, or 24-month installment plan for eligible Becker purchases over $500. And because you’re using a new credit card, this option won’t affect your credit score.

A $49, $69, or $99 non-refundable processing fee applies, but all applicants are pre-approved, and Becker does not charge interest. With this financing, the cost of the Advantage course can be as low as $99.95 a month, the Premium course can come to just $249.91 a month, and the Pro course can cost you only $183.25 a month (after your Becker discount).

15. Becker Promise

The Becker Promise is a pass guarantee of sorts. Specifically, Becker explains that the Becker Promise is a tuition waiver program for people who finish the review course but don’t pass the CPA Exam. If you find yourself in this situation and meet the specific Promise requirements, Becker will let you repeat the course at no additional cost. But because the most complete Becker course features access until you pass, the Becker Promise only seems relevant to the smaller Becker study option.

Plus, with the high Becker CPA pass rates, you hopefully won’t even need to worry about this.

16. Personal Support with the New Becker CPA Concierge Package

Becker recently announced the launch of the Concierge package. Becker developed this package for anyone in need of a little more assistance during their CPA journey. For instance, CPA candidates receive individualized coaching and support from Becker instructors. With the exception of a few extras like a pass guarantee, specialized Success Coaches, and up to 50 weekly hour-long one-on-one tutoring sessions, Becker Concierge essentially includes everything in the Pro/Pro+ plans plus more. In addition, Becker provides you with access to a License Navigator who explains the license application procedure in accordance with the State Board of Accountancy in your state or jurisdiction. So as you can see, the Becker Concierge package basically includes everything you need to pass the CPA Exam.

17. New Becker Academy Can Help You Pass the CPA Exam

The new Becker Academy can help you prepare for the CPA Exam by improving your basic accounting skills. Becker has shown that certain aspiring CPAs may benefit from a more thorough understanding of basic accounting principles before starting their exam prep. For these reasons, Becker Academy CPA Foundation Courses were established online. Becker Academy is ideal for non-accountants or those who didn’t study accounting in college because they welcome all students. Courses were developed with the University of Missouri College of Business, so you can be sure that the content will be on point. Becker Academy’s first course, Financial Accounting Foundations, covers the accounting cycle and FAR concepts, which is one of the hardest sections on the CPA Exam. If you purchase the Becker Academy option, you’ll receive lecture videos, practice multiple-choice questions, a diagnostic pre-exam, a post-assessment, a practice test, and a hands-on capstone project.

18. CPE Subscription with Pro Becker CPA Course Review

Becker wants to be your CPA partner throughout your career. Therefore, they offer a 1-year continuing professional education (CPE) package to students who use the Pro course package to obtain the CPA license. With this subscription, you won’t have to worry about finding and paying a provider for your first year of CPE, which is required to maintain your CPA license.

New Becker CPA Evolution Content

As you’ve probably already heard, the CPA Exam changed at the start of 2024. However, Becker has a plan for its users to make the transition with ease. In fact, Becker has updated its content and is ready to help CPA candidates study better by adding more learning tools to its packages, too.

Here’s a short list of new and updated features for the Becker CPA Evolution:

- More live online learning opportunities

- Additional instructors with a greater variety of backgrounds

- Chances to personalize your course more to make your study time more efficient

- Revamped video lectures that are more engaging

- New lecture slides

- Core and Discipline sections for the new CPA Exam

- Deep Dive Workshops

Becker CPA Course Options

Recently, Becker started offering three full CPA review course options plus the Concierge package with the following features (the Becker CPA price listed is before you apply discounts or Becker promo codes):

Becker Exam Review Packages

Remember: our exclusive Becker discounts are available, so don’t pay full price.

Concierge

- Unlimited access

- $6,349

Pro+

- Unlimited access

- $3,999

Pro

- Unlimited access

- $3,799

Premium

- Unlimited access

- $3,099

Advantage

- 24 months of access

- $2,499

Main Course Features

All study courses have certain materials and Becker CPA support services in common:

- Adapt2U Technology powered by Sana Labs

- 190 hours of video lectures

- Audio lectures

- 7,400+ practice MCQs

- 475 task-based simulations

- 400+ SkillBuilder videos

- 1,250 digital flashcards

- Content updated regularly to match CPA Exam Blueprints

- 8 simulated exams that mirror the CPA Exam

- 12 simulated mini-exams

- Unlimited practice tests

- Accounting for Empires game

- Online FAQs database

- Native mobile app

- Study planner

- User interface replicates the CPA Exam and Blueprints

- Offline access through the mobile app

- Study notes

- Flexible financing options for 6-, 12-, and 24-months

- 1-on-1 academic support from expert CPAs

In addition, the Becker Concierge, Pro+, Pro, and Premium courses have some extra perks that aren’t included with the Advantage package:

Concierge

- Bonus CPA test bank with an extra 1,100+ MCQs

- Printed textbook + annotated digital textbook

- 1,350 printed flashcards

- Access to a dedicated CPA Exam success coach

- Access to Licensing Navigator, a service that helps you find the right jurisdiction for your unique education and experience

- Becker CPE Certificate Program included

- Final Review with condensed material and new MCQs and TBSs

- LiveOnline classroom scheduling option

- Live classroom scheduling option

- Up to 50 1-hour 1-on-1 academic tutoring sessions

- 1-year CPE subscription ($699 value)

- Deep Dive Workshops Bundle

- ExamSolver Videos Bundle

- CPE Certificate Program

Pro+

- Bonus CPA test bank with an extra 1,100+ MCQs

- Printed textbook + annotated digital textbook

- 1,350 printed flashcards

- Access to CPA Exam success coaches

- Final Review with condensed material and new MCQs and TBSs

- LiveOnline classroom scheduling option

- Live classroom scheduling option

- Up to 5 1-hour 1-on-1 academic tutoring sessions ($745 value)

- 1-year CPE subscription ($699 value)

- Financial Accounting Foundations refresher course from Becker Academy

Pro

- Bonus CPA test bank with an extra 1,100+ MCQs

- Printed textbook + annotated digital textbook

- 1,350 printed flashcards

- Access to CPA Exam success coaches

- Final Review with condensed material and new MCQs and TBSs

- LiveOnline classroom scheduling option

- Live classroom scheduling option

- Up to 5 1-hour 1-on-1 academic tutoring sessions ($745 value)

- 1-year CPE subscription ($699 value)

Premium

- Bonus CPA test bank with an extra 1,100+ MCQs

- Printed textbook + annotated digital textbook

Advantage

- Digital textbook only

So as you can see, the Becker Concierge, Pro+, and Pro packages give you the most features, and the Concierge course includes the most personal tutoring.

Becker CPA Review 2025 Exclusive Features

Each Becker review course comes with features not offered by any other provider. For instance, here’s a list of features exclusive to Becker accounting courses:

- SkillBuilder videos that show you how to solve each task-based simulation in your Becker course.

- Accounting for Empires app.

- Only the CPA Exam Becker Review courses use Adapt2U Technology from Sans Labs.

- The Becker Final Review course includes questions you haven’t seen before.

- The Becker Concierge package gives you unparalleled access to one-on-one tutoring, a pass guarantee, dedicated customer support, and the help of one of Becker’s License Navigators.

- And finally, Becker is the only provider of live and LiveOnline courses. And with these online classroom options, you can take Becker CPA classes without leaving the house.

How Much Does Becker CPA Cost?

The Becker CPA Review courses are a bit more expensive than some other review providers, but that’s because you get so many diverse learning tools and personal support with your package. (Plus, remember that the pass rate for Becker CPA users is high. And in life, you often get what you pay for. And that quality is reflected in the Becker CPA Review price.)

Specifically, the Advantage course costs $2,499 before using any Becker CPA discounts. And the Premium course costs $3,099 before applying any Becker CPA coupons. Finally, the Pro course costs $3,799 without any coupon codes.

What’s more, individual course sections of Becker cost $849.

Of course, you’ll save a lot of money using one of our Becker CPA Review discount codes.

The Best Parts of Becker CPA Review

1. A Solid Reputation with CPA Review Products

Becker is among the oldest and most established brands in the CPA Exam prep market. In fact, Becker has purchased a few competitors to become what it is today. And it now has endorsements from the Big 4 and partnerships with thousands of big companies and CPA firms.

The Becker brand also covers other accounting certifications, such as CMA certifications.

Why Top CPA Firms Endorse Becker

So, the Becker brand is pretty prestigious, and that prestige carries a lot of weight. However, the course is more than just a name. Becker includes some solid features, too. In fact, the Big 4 accounting firms endorse Becker’s CPA prep course, which speaks volumes about its quality and reliability. This endorsement isn’t just symbolic; it signifies trust and confidence from the most prestigious firms in the industry. As a result, a significant number of candidates choose Becker to prepare for the CPA Exam, knowing that the course aligns with the high standards expected by top-tier firms.

2. Clear Lecture Notes + New Lecture Slides

As a former Becker student, I must say that Becker’s notes are pretty good. They are comprehensive, and the layout is user-friendly. Becker also uses different fonts and formats to highlight important areas. Additionally, Becker’s course is one of the best at providing plenty of space to write your own notes.

This testimonial from Becker CPA’s website is a typical example:

Becker’s approach to review is concise and focused. It doesn’t overload you with extraneous or esoteric material. It teaches you to rely on your own understanding to get to the right answer.” – Tyler S. Wright

Plus, the updated Becker CPA course for 2024 also now includes lectures slides. Basically, the slides slides summarize the most important concepts from the lecture videos and textbooks with several examples plus images in an easy-to-read format. These slides are great for note-taking. Plus, you can print them out and take them with you as on-the-go study sheets.

3. Helpful CPA Practice Questions

Becker’s practice multiple-choice questions are similar to the actual exam questions and are aligned with the AICPA blueprints. Becker also has well-written answer explanations. These explanations help reinforce the concepts, so you’re well-prepared. And really, they also help boost the Becker CPA passing rate.

What’s more, Becker has video explanations for some MCQs in the test bank and all simulations. These videos involve instructors walking you step-by-step through the question-and-answer process. Consequently, these explanations can really help candidates who need to visualize the entire process.

However, this feature isn’t available for all the MCQ questions, just a big chunk of them, so you’ll still have to answer a large percentage of them on your own. Because, of course, when you go to the testing center, you won’t have a Becker professor there to help you along the way (that would be nice, though!).

4. A Sleek and Easy-to-Use Online Interface

Becker has one of the nicest interfaces on the market. The course is easy to navigate and clearly identifies the next steps that candidates must take. Moreover, taking notes, highlighting text, searching for keywords, and controlling video speed are easy, thanks to seamless navigation and effective learning tools. Furthermore, the Becker course takes every opportunity to mirror the CPA Exam, so you’ll be totally comfortable with the Prometric environment before your test.

Additionally, the Becker Review course also includes insightful reporting so you can see your progress as you move through the program. Adaptive analytics lets you know where to focus your attention so you experience minimal surprises on exam day. Moreover, you can use my Becker CPA study tips to help maximize your study time.

5. The Becker Bump

Have you heard about the “Becker bump?” I’ve been reading through some social media threads lately, and I’m surprised about the number of people talking about it.

Here’s the short of it: Becker users have noticed that their scores on mock exams are often lower than their “real” scores. To put it another way, your Becker mock exam score and the actual score on the CPA Exam can be quite different.

So then, is Becker harder than the CPA Exam? That is, are the Becker CPA questions harder than the exam questions? It seems so, and many candidates have benefited from the Becker bump.

For example, how hard is the FAR CPA Exam MCQ compared to the Becker MCQs? Well, I noticed that one CPA candidate on Reddit claimed that he got a 53 on the FAR mock exam but scored a 90 on the real FAR exam!

So how to pass the FAR CPA Exam with Becker? Keep working on your Becker course, watch the FAR videos, answer practice MCQs, take the practice exams, and be ready for the Becker bump. After all, this method seems to be working for other candidates!

6. Becker CPA Review Pass Rate

So, is Becker enough to pass the CPA Exam? Well, let’s look at the facts, including the Becker pass rate and other Becker CPA Exam statistics.

A lot of companies publicly proclaim the CPA Exam pass rates of their users. However, without explaining how they got those numbers, they are a little useless. Why? Well, when you take the CPA Exam, you don’t have to report how you studied for the exam. That is, review providers have to collect this data themselves. For example, let’s go over how Becker calculates their pass rates.

With Becker what is the CPA pass rate?

For years, Becker has been collecting data quarterly and publishing their rates annually. Becker’s team works hard to track the CPA Exam pass rate of its users. After all, the best way Becker knows its products are working is through the success of Becker’s users.

Therefore, Becker has developed a rigorous pass rate creation method. For instance, as a member of Adtalem Global Education, Becker called upon Adtalem’s Analytics Center of Excellence to analyze pass rate data. Then, Becker involved a major accounting firm to evaluate the results. Specifically, Becker asked a top-10 public accounting firm to perform an examination related to the CPA Exam pass rates and Becker’s process of gathering and analyzing pass rate data. And basically, the firm found that Becker’s approach is “fairly stated in all material respects.”

So what does this all mean? In a nutshell, it just means that you can trust Becker’s pass rates published by the company. You can be assured that Becker is being open, honest, and transparent about how it collects and presents data.

CPA pass rates with Becker

The pass rate for the CPA Exam with Becker users is about 94%. To be more precise, the CPA pass rate with Becker users who are “Exam Day Ready” is 94%. In short, these users have watched at least 80% of the lecture videos in their course and correctly answered 80% of practice questions. Plus, these users scored a minimum of 50% on three simulated exams.

To figure the CPA pass rate with Becker users, Becker asked users who met the Exam Day Ready threshold to self-report on their exam success. Then, they took the total sections passed by Becker users and divided that number by qualifying users to get their pass rate.

Becker vs. Wiley pass rates

Let’s take a look at the CPA Exam passing rate between Becker and Wiley. As I’ve already explained, 94% of Becker users who are Exam Day Ready pass the CPA Exam. In comparison, Wiley publishes a pass rate of 90%. Not only that, but Wiley doesn’t explain how they reach that number, and Becker does. Personally, I appreciate Becker’s transparency and the company’s efforts to have a top outside accounting examine their data collection methods.

Becker vs. Rogers pass rate

Roger CPA Review claims that 94% of their users pass the CPA Exam. However, I wish Roger would publicly explain how that pass rate is calculated.

7. Becker CPA Review Watt Sells Winners

The Elijah Watt Sells Award is given to CPA candidates who pass all four sections of the exam within 1 calendar year and on the first attempt. According to the AICPA, just 57 test-takers qualified for the EWS in 2021. And that’s out of the 72,000 people who sat for the CPA Exam! Of those EWS winners, over 90% were Becker users! If that doesn’t say something about the Becker pass rate, I don’t know what does.

The Worst Parts of Becker CPA Review

1. A higher price point before discounts.

As mentioned, the prices of the Becker courses range from $2,499 to $3,799, making it one of the more expensive courses on the market. However, I have several Becker CPA discounts to drop the cost considerably.

And keep in mind that in contrast to other CPA review courses that cost about $2,000 or a little less, Becker gives you a lot of added features. The lower-cost courses don’t include live online classes or 1-on-1 academic tutoring, for example.

Therefore, don’t let the Becker CPA cost be a hurdle. Click here to access some great Becker discounts.

How does Becker CPA’s value compare to less expensive review courses?

Beyond personal preference, Becker’s reputation speaks volumes. It’s the choice of all the top 100 accounting firms, including the Big 4, showcasing a high level of trust and recognition within the industry. This widespread use isn’t limited to just firms; over 2,000 organizations, government bodies, and universities rely on Becker, highlighting its effectiveness in preparing students for a successful career in public accounting.

With a blend of personal commitment and industry endorsement, Becker stands out as a valuable investment for anyone serious about passing their exams and advancing their accounting career.

2. The Becker test bank size is average.

You might be saying, “Who cares about the size of the test bank?” If you’re a logical learner like me, you like answering lots of questions about a topic before feeling confident checking that topic off your list. So when you use a test bank that is only average in size, what happens after you answer all of the questions? If you need to go through them again because you still have weak areas, you run a high risk of memorizing the questions.

Because comprehension is key to passing the CPA Exam, you won’t benefit from memorizing the questions.

Additionally, when you use a review course with an average or small test bank, you might find just one question about some topics. And even worse, some topics may not have any simulations. Or, the course may use one simulation to cover multiple exam topics or tasks. In that case, the simulation only briefly touches on each topic.

Therefore, if you purchase a CPA review from Becker, you may want to supplement with a bigger test bank.

But, if you are in this camp, you can find the best CPA test bank for supplementing on my site.

Using Your Becker CPA Exam Review Course

Becker CPA Exam Prep Study Hours

So, just how long does it take to complete a Becker review course? Well, Becker actually keeps stats on how long the typical candidate needs to study in order to pass the CPA Exam. And on average, most candidates study with Becker for about 450 hours to pass the entire 4-part exam.

However, you don’t have to tackle these study hours alone. When you start your course, you’ll begin by setting up your Becker CPA Exam study plan. You’ll input your anticipated exam date and how many days a week you can study. Then, your Becker CPA exam schedule will suggest what you should study and when, keeping you on track.

How long should I study each section of Becker CPA Exam review?

Here are the recommended number of study hours for your CPA course, according to Becker’s experts:

- FAR = 150 hours

- REG = 120 hours

- AUD = 90 hours

- DISCIPLINE = 90 hours

Becker CPA Exam changes

Did you know that the CPA Exam changes on a fairly regular basis? Specifically, it can change up to twice per year – once to reflect new tax laws and sometimes a second time for new standards.

Therefore, when the content on the CPA Exam changes Becker alters its course material, too. Likewise, the Becker CPA Exam Review update schedule is also regular.

Wondering where to download Becker CPA Exam Review updates? Don’t worry: all of your online materials will be automatically updated.

However, when you start your Becker course, you won’t receive your physical textbooks until you request them. But it’s easy to do so – you’ll find a “Redeem Books” button on the dashboard when you log into your online Becker course.

For instance, let’s assume that you purchase the 4-part Becker Pro package and you want to pass AUD first. When you start to study for AUD, you can ask Becker to send your AUD textbook in the mail. After you pass AUD and you’re ready to study FAR next, for example, you can request your FAR book. This way, your physical textbooks should be up to date.

Still, if you need updated physical materials, you can purchase them for just the cost of printing and shipping.

Becker CPA Questions

How much is Becker CPA?

How much does Becker cost? Well, it depends on what level of support you need (like options for tutoring) and your course length (24 months vs unlimited access). Here’s the breakdown of each CPA review course from Becker (before discounts):

- Becker Pro (with Becker unlimited access, bonus MCQ bank, Becker Final Review, live classes, and tutoring) = $3,799

- Becker Premium (also with Becker unlimited access and LiveOnline classes) = $3,099

- Becker Advantage (24 months of access) = $2,499

Supplemental Becker CPA materials

- Becker Final Review – one section (AUD, FAR, or REG) = $199

- Becker Final Review Package – all 4 CPA Exam parts = $599

- Supplemental Becker test bank of MCQs = $599

- Becker CPA flashcards = $179

But remember, each Becker CPA Review course cost listed is before discounts. And with our discounts, you can really bring down the cost of Becker CPA Review products.

Does Becker CPA have sales?

Becker CPA Review frequently offers sales and promotions, and we keep a list of Becker sales. The most comprehensive course, the Becker Pro, is regularly available at a discount of $1,000 or more. Although sales for the Premium and Advantage courses occur less frequently, they are available from time to time. To find the most current sales and promotional codes, potential customers should check Becker’s official website.

How much is Becker CPA Review tutoring?

If you pick the Becker Pro bundle, it includes five tutoring sessions. However, if you buy one of the other CPA review courses from Becker, you can still purchase academic tutoring. The cost is $149 per hour, and it’s available to all Becker students.

To learn more, you can call Becker at 877-272-3926.

Which Becker package should I buy?

If I had to study for the CPA Exam with Becker all over again, I would definitely pick the Pro course. It’s the most comprehensive CPA Exam review that Becker offers. And considering that it includes features like tutoring, access to live classes, and the Becker Final Review, the Pro package is actually a good value.

Are the Becker flashcards worth it?

Maybe—it depends on how you learn. Some people really like the convenience of digital or hard-copy flashcards that are already made for them. But personally, I like to make my own. And making your own flashcards is one of my CPA Exam study tips. The process of writing out your flashcards is just one more way to cement the CPA content into your brain.

Is there a Becker student discount?

Becker has relationships with many colleges and universities in the US. Therefore, you should check with your accounting program director about student discounts on your Becker CPA review materials.

Is the actual CPA Exam harder than the Becker mock exams?

No. Instead, most Becker users find that the opposite is true. That is, because of the “Becker bump,” users can get a failing score on their Becker CPA mock exams and still pass the real exam.

Is the CPA Exam like the Becker mock exams?

Yes. The Becker mock exams replicate the real CPA Exam as closely as possible in terms of the look, feel, functionality, and timing of questions and exam sections.

When should I take the final mock exam with Becker CPA?

You should plan to take your mock exams at least two weeks before your actual CPA Exam date. This way, you’ll have time to review whatever questions you missed and improve your exam score.

Are Becker multiple-choice questions from CPA exams?

Not all questions are from CPA Exams. However, thousands of Becker’s questions come from previously-released AICPA CPA Exam questions. Additionally, other Becker MCQs are written by their team of subject matter experts.

How many people can share Becker CPA Exam Review?

Only one person can use Becker exam review. Therefore, if you purchase a Becker course, you can’t share it with any other CPA candidates. Besides, doing so would totally negate the adaptive learning software. And in the end, you’ll lose the efficiencies of studying with Becker if you’re using the online course with someone else.

What’s the process for how to get a Becker CPA Exam Review renewal?

First, remember that if you purchase the Pro or Premium courses you’ll have unlimited access and don’t need to worry about renewals.

However, if you purchase the Becker Advantage course, you’ll have to renew your materials after 24 months. Becker offers 3-month extensions for $299 per section. Or, you could upgrade to a package that comes with unlimited access. Plus, keep in mind that you need to extend your course within 90 days of when it expires.

Links to Becker CPA extensions

Can you explain how to get Becker CPA Exam replacement textbooks?

You can request replacement textbooks from your Becker online course once you log in. Also, you can find Becker replacement books here.

Does Becker CPA charge for shipping?

Is Becker CPA Review tax deductible?

Are the Becker CPA mock exams graded like the real exam?

My team has been talking to Becker about how their mock exams are graded, and here’s what we learned. The Becker mock exams are probably graded slightly differently than the real exam – but that detail won’t hamper your studying, so I’ll explain.

First, the actual CPA Exam contains so-called “pre-test” questions that don’t count toward your final score. So that means that the AICPA doesn’t grade every question you’ll answer on exam day. But Becker does, and that’s bound to affect your mock scores a bit.

Second, Becker’s mock exams give you partial credit for TBSs, just like the actual exam. Specifically, when you answer a TBS in a table format, each answer in a horizontal line must be correct to receive credit for that line.

Third, remember that the real CPA Exam has a mix of moderate and difficult testlets. If you do well on a moderate testlet, you’ll likely get a harder one next with more difficult questions. But the Becker mock exams don’t follow that model. As a result, your mock exams could include a higher number of difficult questions than the actual CPA Exam.

Moreover, the AICPA hasn’t shared detailed grading info for the CPA Exam. Therefore, even if we can crack the code on how the Becker mock exams are graded, it’s hard to compare this to the grading of the real exam.

So what’s the bottom line? Well, the Becker mock exams might not be as exactly authentic as possible, but they could be better than another provider’s equivalent. Plus, Becker includes questions candidates have never seen before in these practice exams, which is not something every provider does.

Can you pass the CPA Exam by only doing Becker MCQs?

Since the CPA Exam has several types of questions, you should practice all of them in your Becker course. Therefore, in addition to answering Becker MCQs, you should practice the task-based simulations, too. After all, one of the biggest benefits of studying with Becker is using the SkillMaster videos to better understand the TBS problems.

Can you use supplement products with the CPA Exam Becker courses?

Absolutely! In fact, some users stick to Becker exclusively, but others actually rely on a couple of providers to pass the CPA Exam. Therefore, you can boost your Becker course with materials like test banks or lecture videos from other companies. Besides, each provider has a different team of experts. And by using supplement products, you can find different takes on the exam content.

For example, the Gleim CPA Mega Test Bank is a best-selling CPA Exam supplement that can be helpful, even if you study with Becker. It comes with 560+ simulations and nearly 10,000 MCQs to enhance your Becker course. And since Gleim explains the answers to both the correct and incorrect MCQ choices, you might learn content in a new way compared to your Becker course.

Other Becker users supplement with NINJA CPA Review for a few different reasons. First, besides standard materials like books, videos, and a 7,000+ question test bank, NINJA has study options that are totally different from Becker’s. Take the Sparring Sessions, for instance. In these weekly videoconferencing review sessions, you can participate in group tutoring. Plus, the NINJA course includes the NINJA Blitz, which is a cram course that has 115+ new videos. And second, NINJA is available as an affordable monthly subscription. So you can sign up for NINJA for a few months, and then you won’t be stuck with another big expense for a CPA review course.

My Conclusion about Becker

Basically, Becker CPA Review is the most established course in the industry, as it is pretty much the oldest and most widely used. However, Becker’s courses are on the pricey side of the market. But there is hope: Becker has been offering very generous discounts, which may make your decision much easier for you 🙂

Also, to further aid your decision, feel free to read Becker vs. Wiley CPAexcel and Surgent CPA vs. Becker CPA. Both of these comparisons show you how Becker compares to the leading CPA review courses.

Is Becker CPA Worth It? Here’s My Becker CPA Story.

So, should you invest in a Becker online review course? Well, I can understand if you’d feel more comfortable going with a top brand in the industry. Becker does have good notes, decent practice questions, adaptive technology, flashcards, a final review, and more. Therefore, if the brand of your course is important to you, and you have the budget to foot the Becker bill, then it should be a good fit.

For me personally, Becker helped me pass the CPA Exam on the first try. You can read how I did it in Part 1 and Part 2 of my story.

Can you pass the CPA with only Becker?

So, can you pass the CPA by just studying Becker? And does taking a Becker course help you pass the CPA the first time? Well, don’t take just my word for it and read some Becker CPA Review reviews. Here are some thoughts from previous Becker CPA EWS winners:

Alec Weissman, EWS winner: “The Becker CPA review course is a one-way ticket to success on the CPA Exam. The charismatic and dedicated instructors, extensive library of practice problems, and detailed lesson plan will prepare you to not only pass but excel on the CPA Exam. Becker is truly world-class.”

Elizabeth Gregori, EWS winner: “With the variety of lectures, simulations, multiple-choice questions and practice exams, I was able to learn the material in an interactive way. The self-study version of the course gave me the flexibility to study anywhere, from the comfort of my bed doing multiple choice questions at night to a cozy corner in a café with a hot cup of coffee. I can’t imagine having studied any other way.”

Becker CPA Review Discounts

You can find all the Becker CPA Review discounts on my comprehensive CPA discounts page. Or, you can use the button below to go straight to the best Becker CPA discount available.

Save on Becker CPA Review Now!About the Author Stephanie Ng

I am the author of How to Pass The CPA Exam (published by Wiley), and I also passed all 4 sections of the CPA Exam on my first try. Additionally, I have led webinars, such as for the Institute of Management Accountants, authored featured articles on websites like Going Concern and AccountingWeb, and I'm also the CFO for the charity New Sight. Finally, I have created other accounting certification websites to help mentor non-CPA candidates. I have already mentored thousands of CPA, CMA, CIA, EA, and CFA candidates, and I can help you too!