- You are here:

- Home »

- Blog »

- Site News »

- CPA Exam Changes: Your Guide to the 2024 CPA Exam Evolution

CPA Exam Changes: Your Guide to the 2024 CPA Exam Evolution

CPA Exam changes 2024 is one of the most popular searches that CPA candidates make. (And for good reason.) After all, the CPA Exam changed at the beginning of 2024. These updates ensure newly licensed CPAs continue to possess the knowledge and skills necessary to protect the public interest. I’ll go over these changes, including the new CPA Exam changes that took effect in January 2024. And then, I’ll also report on essential non-content changes (like exam testing sites and CPA Exam dates), too.

Why the Need for CPA Exam Changes?

The AICPA announces minor changes to the CPA Exam from time to time. For example, in the fourth quarter of 2020, the CPA Exam added content about the CARES Act, primarily within REG. So, when major tax policies are introduced or other significant changes appear in the careers of newly licensed CPAs, the CPA Exam will reflect those adjustments.

But in 2021, the exam underwent even more noteworthy modifications. Plus, the CPA Exam had some minor revisions in July 2022. And the exam was updated in 2024, too. So let’s review what’s on the 2024 CPA Exam.

CPA Exam International Testing: 2024 Changes

In June 2022, NASBA, AICPA, and Prometric announced changes to polices regarding international testing. But now, depending on your jurisdiction, most candidates are able to take the CPA Exam at any international location where the exam is offered.

In the past, candidates’ options were limited based on citizenship and residency. For example, before June 2022, candidates living in Japan could take the CPA Exam in the U.S. or Japan. However, they couldn’t test in other countries like India or Brazil. This policy update gives you much more flexibility to take the CPA Exam in 2024!

Note: This new policy only applies to “international Prometric testing locations.” Therefore, it does not include testing centers in the United States, Canada, Puerto Rico, Guam, and the Virgin Islands. International testing centers are located in the following countries:

- Bahrain

- Brazil

- Egypt

- England

- Germany

- India

- Ireland

- Israel

- Japan

- Jordan

- Kuwait

- Lebanon

- Nepal

- Republic of Korea

- Saudi Arabia

- Scotland

- United Arab Emirates

2024 CPA Exam Changes

The CPA Exam got a major overhaul in 2024.

The AICPA and NASBA announced plans for the “CPA Evolution” initiative at few years ago. As business practices evolve in our rapidly changing world, accountants must evolve, too. The two organizations gathered input about the skills needed for future CPAs from stakeholders like the State Boards of Accountancy. The intent is to make sure that future CPAs will have the competencies they need to meet tomorrow’s accounting challenges.

The Purpose for the CPA Exam Changes 2024

Specifically, newly licensed CPAs will be required to demonstrate increased knowledge and skills related to distinct technology. The mission of the CPA Exam is to provide reasonable assurance to boards of accountancy that candidates passing the exam possess the minimum level of technical knowledge and skills necessary for a newly licensed CPA. This level of knowledge is important to protect the public interest in today’s business and financial environment.

To ensure the knowledge, skills, and tasks assessed on the CPA Exam continue to reflect the current practices of newly licensed CPAs, the AICPA’s Board of Examiners (BOE) conducts periodic practice analyses.

For instance, the BOE conducted a practice analysis before developing the CPA Evolution initiative. Through this analysis, the BOE wanted to do the following:

(1) to explore the impact of technology on the work of newly licensed CPAs.

(2) to identify areas where the CPA Exam has become too broad and not sufficiently focused on the core knowledge and skills required of newly licensed CPAs.

CPA Evolution in 2024

The CPA Evolution is a significant effort that involves lots of different stakeholders. For example, NASBA and the AICPA has revised the Uniform CPA Examination Blueprints. They are also working with universities to develop a curriculum that reflects the 2024 changes to the CPA Exam. The revised CPA Exam launched in January 2024.

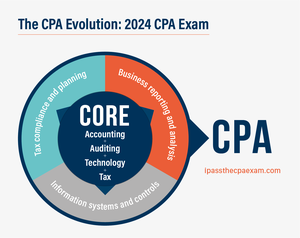

Core-Plus-Discipline Model

Under the 2024 changes, the path to CPA licensure now follows a new “Core-Plus-Discipline Model.” Candidates need to demonstrate knowledge in accounting, auditing, tax, and technology as before by passing the “Core” sections (AUD – Auditing and Attestation, FAR – Financial Accounting and Reporting, and REG – Taxation and Regulation). However, in addition to these core areas, CPA candidates also need to show deeper skills in one of these three CPA Disciplines:

- Business reporting and analysis (BAR)

- Information systems and controls (ISC)

- Tax compliance and planning (TCP)

Changes to the Format

The 2024 CPA Exam is still a 4-part exam. The first three sections will assess your knowledge of the core content, while the fourth will test one “discipline” (listed above) of your choosing. So, for example, if you’re strong in tax, you may want to consider the “tax compliance and planning” discipline.

Revisions to the CPA Exam Schedule

You should note that the timing of the 2024 CPA Exam will be different that the 2023 CPA Exam dates. For instance, the 2023 exam didn’t have blackout dates. That is, you could take the CPA Exam any time that a Prometric testing center is open. However, the 2024 exam will has blackout dates because you can only take the core and discipline sections during certain times each quarter. Therefore, it’s important that you understand the CPA Exam dates.

One CPA License

Even though you can choose from three different disciplines in the Core-Plus-Discipline-Model, there will still just be one CPA license. That is, your CPA certificate and title won’t reflect which discipline exam you choose.

Overview of the 2024 CPA Exam Changes

Since the CPA Exam has changed in 2024, I’ve broken out the changes below.

The 2023 CPA Exam vs. the CPA Exam 2024

CPA Exam in 2023:

- 4 sections: Auditing and Attestation (AUD), Business Environment and Concepts (BEC), Financial Accounting and Reporting (FAR), and Regulation (REG)

2024 CPA Exam:

- 3 mandatory core sections: Auditing and Attestation (AUD), Financial Accounting and Reporting (FAR), and Taxation and Regulation (REG)

- 1 discipline section of the candidate’s choice: Business analysis and reporting (BAR), Information systems and controls (ISC), and Tax compliance and planning (TCP)

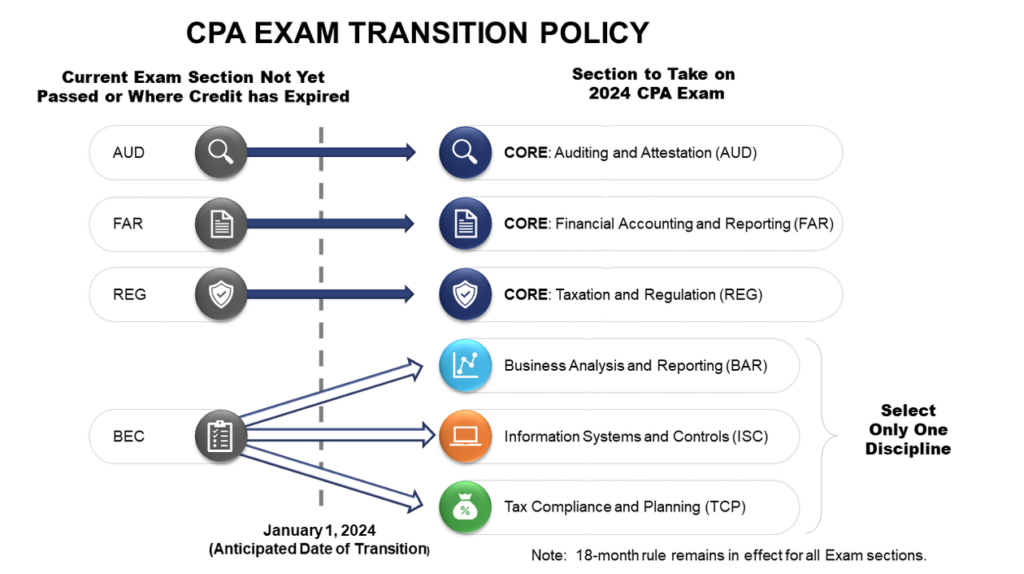

CPA Evolution Transition Policy

NASBA and the AICPA recently announced a transition policy regarding the CPA Evolution initiative that was implemented in January 2024. As NASBA notes:

The purpose of the CPA Exam transition policy is to allow you to continue your CPA Exam journey from where you are when we transition to the 2024 CPA Exam.

First of all, if you pass all four sections (AUD, BEC, FAR, and REG) before December 31, 2023, the CPA Evolution will not impact you.

However, if you will be in the middle of your journey, the transition policy will definitely affect you. For instance, if you pass one, two, or three sections before the end of 2023 and plan to pass the fourth in 2024, take notes about how the CPA Evolution will affect you. Basically, the transition policy maps out your path in case you don’t pass all sections prior to January 2024. And keep in mind that this is a hard cutoff—no exceptions will be given. You don’t have to worry if you plan ahead, though. Once the close turns over to 2024, you won’t lose your credits, as long as you’re still inside your 30-month rolling window and you follow the path outlined by NASBA and the AICPA.

Source: NASBA

Mapping your CPA journey: 2024 and beyond

As you can see from the chart above, the transition policy maps out your path if you plan to pass some of your CPA Exam sections after January 1, 2024. The good news is that you DON’T need to retake your passed exam sections after 2024, as long as you’re still within your 30-month time frame.

Basically, you just need to remember that the “old” exam sections (AUD, BEC, FAR, and REG) loosely translate to “new” sections. Furthermore, some old sections (AUD, FAR, and REG) align with the new “core” requirement of the Core + Discipline model. However, the old BEC section is more related to the “discipline” requirement.

To put it another way, here’s how your 2023 CPA credits will be applied to the new Core + Discipline model:

- AUD credits will be applied to your core requirement of Auditing and Attestation

- FAR credits will count for the core Financial Accounting and Reporting requirement

- REG credits will transition to the new requirement for Taxation and Regulation

- Unlike the other sections, your BEC credits will not count toward your “core” requirement but your “discipline” requirement instead. Furthermore, you can choose which of the three disciplines to apply your BEC credits toward. Your choices include Business Analysis and Reporting (BAR), Information Systems and Controls (ISC), and Tax Compliance and Planning (TCP).

Additionally, keep in mind that NASBA clearly states that despite the transition, the 30-month rule remains in effect for all exam sections.

Questions about the CPA Evolution or Transition Policy?

I know that the 2024 CPA Exam changes can be a bit intimidating if you will be in the middle of your CPA journey during the transition. If you have questions, you can always drop me a line. Or contact NASBA at Feedback@EvolutionofCPA.org.

What Does This Mean for You?

Basically, the CPA Evolution initiative means that the CPA Exam changed in January 2024. And since you will need to demonstrate your skills in the core content areas plus a sub-discipline, the CPA Exam could become much more challenging.

Thoughts about the 2024 Changes from CPA Candidates and Experts

“The proposed changes by the AICPA and NASBA are new and somewhat still vague at this point. However, like any profession, accounting must continue to evolve and adapt to our changing business and technological advancements. We have no doubt that CPAs will still maintain their critical role in the trustworthiness of our financial reporting and that the new CPA specialty exams will make CPAs even stronger in their subject field of choice. These changes will solidify the CPA’s role in continuing to serve the public interest in the 21st century.”

—Gleim Publications, Inc.

The main force behind AICPA/NASBA’s decision seems to be addressing how fast the world is changing, mainly in technology. They stated processes are now more automated, so entry-level CPA’s must be able to have a deeper understanding of the concepts and apply them rather than calculate (makes sense). This will likely make it more competitive, which “protects the integrity of the credential” and indirectly addresses the rise in pass rates.

It also goes hand-in-hand with college programs putting a higher emphasis on technology, AIS, database management, etc. which had also greatly changed since the exam was originally created. The flexibility of the new initiative makes sense given how fast life is moving. The new choice of discipline will be interesting, I bet some may be more advantageous than others.

–Ashley A., CPA Exam Candidate

What Is Not Changing on the 2024 Version of the CPA Exam?

There will not be significant changes to any of the following:

Aggregate CPA Exam Time

For better or worse, the total time per CPA Exam section remains the same in 2023 and 2024.

2024 CPA Exam Time per Section

| 2024 Section | Section Time |

| AUD | 4 hours |

| FAR | 4 hours |

| REG | 4 hours |

| Discipline (BAR, ISC, or TCP) | 4 hours |

CPA Exam content allocation ranges for 2024

In comparison, here is the content for the 2024 CPA Exam:

AUD – Core

| Content area | Allocation | |

| Area I | Ethics, Professional Responsibilities and General Principles | 15-25% |

| Area II | Assessing Risk and Developing a Planned Response | 25–35% |

| Area III | Performing Further Procedures and Obtaining Evidence | 30–40% |

| Area IV | Forming Conclusions and Reporting | 10-20% |

FAR – Core

| Content area | Allocation | |

| Area I | Financial Reporting | 30-40% |

| Area II | Select Balance Sheet Accounts | 30–40% |

| Area III | Select Transactions | 25–35% |

REG – Core

| Content area | Allocation | |

| Area I | Ethics, Professional Responsibilities and Federal Tax Procedures | 10–20% |

| Area II | Business Law | 15-25% |

| Area III | Federal Taxation of Property Transactions | 5-15% |

| Area IV | Federal Taxation of Individuals | 22-32% |

| Area V | Federal Taxation of Entities (including tax preparation) | 23-33% |

BAR – Discipline

| Content area | Allocation | |

| Area I | Business Analysis | 40-50% |

| Area II | Technical Accounting and Reporting | 35-45% |

| Area III | State and Local Governments | 10–20% |

ISC – Discipline

| Content area | Allocation | |

| Area I | Information Systems and Data Management | 35–45% |

| Area II | Security, Confidentiality and Privacy | 35-45% |

| Area III | Considerations for System and Organization | 15-25% |

TCP – Discipline

| Content area | Allocation | |

| Area I | Tax Compliance and Planning for Individuals and Personal Financial Planning | 30–40% |

| Area II | Entity Tax Compliance | 30-40% |

| Area III | Entity Tax Planning | 10-20% |

| Area IV | Property Transactions (disposition of assets) | 10-20% |

2024 CPA Exam Skill allocation ranges

Similar to the content allocation ranges, the skill allocation ranges for each section of the CPA Exam also changed in 2024.

| 2024 Section | Remembering and Understanding | Application | Analysis | Evaluation |

| AUD – Core | 30-40% | 30-40% | 15-25% | 5-15% |

| FAR – Core | 5-15% | 45-55% | 35-45% | – |

| REG – Core | 25-35% | 35-45% | 25-35% | – |

| BAR – Discipline | 10-20% | 45-55% | 30-40% | – |

| ISC – Discipline | 55-65% | 20-30% | 10-20% | – |

| TCP – Discipline | 5-15% | 55-65% | 25-35% | – |

CPA Exam Score Reporting in 2024

It is anticipated that the 2024 CPA Exam changes also result in delayed score reporting. Doe to essential standard-setting measures, CPA Exam scores will probably only be made available once per exam section per quarter. However, the AICPA has published the anticipated score release dates, and you can utilize our CPA Exam score release schedule regardless of when you sit for the exam.

CPA Exam in India and Nepal

The COVID-19 pandemic has hit the globe in unexpected ways. It even affects candidates who are trying to take the CPA Exam. Although most Prometric test centers around the world are now operating at full capacity, the centers can still close or operate at limited capacity due to local restrictions.

Of course, remember that with the new international testing rules, you don’t have to test in India or Nepal if that’s where you live. Instead, you can take the CPA Exam at any international testing location.

Plus, you can find a helpful chart about the international administration of the CPA Exam on NABSA’s website. Before scheduling your exam, you should also check the Prometric website to verify that your chosen test center is open.

CPA Exam in the Republic of Korea and Japan

In recent years, CPA Exam testing was expanded to the Republic of Korea and Japan. (In the past, many candidates from these countries used the Guam testing center.) But now, changes in policies allow most candidates (depending on your jurisdiction) to take the exam at any international test location. As a result, you have lots of options if you live in Japan or the Republic of Korea.

COVID-19 CPA Exam Updates (Left for Historical Info)

During the peak of the COVID-19 pandemic, Prometric testing centers, where the CPA Exam is taken, temporarily closed. However, many are now open at either full or limited capacity with new social distance and vaccination guidelines.

Here’s What You Need to Know

- Many Prometric testing centers have reopened. However, depending on COVID-19 conditions and recommendations from local officials, some centers are only allowing a limited number of test-takers to maintain social distancing.

- You can check Prometric’s website for a list of sites and their current status.

- Furthermore, many Prometric sites have restrictions regarding showing proof of a COVID-19 vaccination or a recent negative test. So again, be sure to check this list of Prometric updates well before your exam date.

- If you have a CPA Exam testing date scheduled and Prometric is or will be closed on your exam date, you will not have to pay a rescheduling fee. Further, you’ll receive an email with information on how to complete CPA Exam rescheduling.

- Plus, if you were unable to take your CPA Exam because you were ill from COVID-19, you are entitled to a refund of your exam fees. If this situation applies to you, go to the Prometric Contact Us page, fill out the “Contact Us” form, and click “Request a Refund.”

- In 2020, many state boards of accountancy granted extensions to expiring credits due to the pandemic. (A chart of these 2020 extensions appears below.) However, we don’t yet know if extensions will be granted in the future.

The Prometric closure status is likely to evolve if COVID-19 hotspots continue to develop around the globe. I’ll update this article with any new information as I have it. Please be safe.

CPA State Board CPA Exam Credit Extension Guide

Since so many candidates have been affected by the COVID pandemic and Prometric closures, the Boards of Accountancy in most jurisdictions granted credit extensions in 2020 and 2021. When you pass a section of the 4-part CPA Exam, you receive a “credit” for passing that part. The expiration date of your credit will be listed with your score. Basically, once you pass your first section, you have 30 months to pass the rest. Normally, after those 30 months pass and you haven’t passed all 4 sections, your credits will start to expire.

Since so many candidates had credits that were set to expire during the pandemic, NASBA made a recommendation that Boards of Accountancy develop plans to extend candidates’ credits. And most boards established extensions because candidates were unable to continue to sit for their exams.

Here’s a summary of 2020 and 2021 extension policies

Since the future of the pandemic is unknown, I’ve included a summary of the 2020 and 2021 credit extension policies for historical purposes. I hope this helps you understand how NASBA, the AICPA, and Boards of Accountancy work together to make sure that all candidates have fair and safe access to the CPA Exam.

Most jurisdictions automatically granted extensions to December 31, 2020, for credits with expiration dates from April 1, 2020, to December 30, 2020.

Many other jurisdictions also automatically granted extensions for credits set to expire in other time frames. Massachusetts, for example, automatically gave extensions until September 30, 2020, for credits set to expire from April 1 to June 30, 2020.

Other state boards, like Idaho, declared that their staff had the authority to grant extensions for reasons related to the COVID pandemic.

Some states have reviewed extension requests on a case-by-case basis.

| STATE or JURISDICTION | Former Board Policy on CPA Exam Credit Extensions |

| AK | Credit with expiration dates from April 1, 2020 to December 30, 2020 will be extended until June 30, 2021. |

| AL, AR, AZ, CO, DC, DE, GA, GU, IA, KS, KY, LA, MA, MT, ND, NM, NV, OH, OK, RI, SC, TX, UT, VA, WA, and WV | Credit with expiration dates from April 1, 2020 to December 30, 2020 will be extended until December 31, 2020. |

| CA, FL, IN | Credit with expiration dates from April 1, 2020 to June 30, 2021 will be extended until June 30, 2021 |

| CT | Credit with expiration dates from April 1, 2020 to September 30, 2021 will be extended until December 31, 2021 |

| HI, IL, MD, MI | Credit with expiration dates from April 1, 2020 to June 29, 2021 will be extended until Jun3 30, 2021 |

| ID | On April 28, 2020, the Idaho Board made a Proclamation already sent to candidates that Board Staff has the authority to grant credit extensions for exams passed that are expiring due to a COVID related matter, including but not limited to illness, the closure of a testing site or the unavailability of seats in an open site in 90 increments. This Proclamation is in effect through the Governor’s current Orders relating to COVID-19 or any further Order from the Governor. |

| MO, NH, SD, VT | Board will review requests for credit extensions on a case-by-case basis. |

| ME | Credit with expiration dates from March 1, 2020 to December 30, 2020 will be extended until December 31, 2020. |

| MN, NE, PR, TN | Credit with expiration dates from December 31, 2020 to September 29, 2021 will be extended until September 30, 2021. |

| MS | The Board has authorized Board staff to approve exam grade expiration extensions for candidates impacted by test site closures during the COVID pandemic and with grades expiring through September 2021. Such extensions will be for no more than 90 dates. Candidates should submit their request for grade extensions to administrator@msbpa.ms.gov. |

| NC | Credit with expiration dates from December 31, 2020 to March 30, 2021 will be extended until March 31, 2021. |

| NJ | Credit with expiration dates from March 9, 2020 to December 30, 2020 will be extended until December 31, 2020 |

| NY | Credit with expiration dates from June 30, 2020 through March 31, 2021 will be extended until June 30, 2021. |

| OR | Credit with expiration dates from March 15, 2020 to June 30, 2020 will be extended until September 30, 2020. Anything outside of that timeframe is case-by-case. |

| PA | Due to the COVID-19 emergency disaster declaration signed by the Governor on March 6, 2020, a waiver was granted of the requirement that CPA candidates must complete all parts of the CPA examination with an 18-month period. (Note: When the COVID-19 pandemic began in 2020, CPA candidates had to pass all 4 CPA Exam sections in 18 months. However, that rule has changed, and candidates now have 30 months.) Candidates whose exam credits expire during the time of the emergency declaration will be granted an extension which lasts for the duration of the emergency plus an additional 180 days from the end of the emergency. This exam credit extension replaces the 90-day extension that was recently granted to CPA candidates by way of a letter from the Board. |

| VI | All credit expiring April 1, 2020 through June 20, 2020 will be extended 90-days. |

| WI | Credit with expiration dates from March 16, 2020 to December 30, 2020 will be extended until December 31, 2020. |

| WY | All candidates who sat and passed prior to July 14th with unexpired credit will have those credits extended by 6 months from their original date. |

What about future extensions?

As for now, no additional extensions are planned. Of course, if more extensions are granted at a later date, I’ll keep you updated.

In the future, if your jurisdiction automatically grants extensions, you don’t need to do anything. Your NASBA CPA Candidate Account will be updated, but please allow 4 weeks for everything to be processed and for your records to reflect the new credit expiration dates. However, if your state is only reviewing extensions at a candidate’s request, you’ll need to contact your Board of Accountancy.

Conclusion about CPA Exam Changes

In conclusion, the CPA Exam changes are always a cause for concern. But we will only know if the new exam is harder than the old one by keeping an eye on the 2024 CPA Exam pass rates.

Changes to accounting exams are becoming the norm

For instance, a few years ago, the IIA released CIA exam changes that aligned the exam content with more relevant technology information. Similarly, the ICMA published CMA exam changes that allowed the exam to focus more on technology and analytics. Also, the CMA exam dropped topics that weren’t considered relevant for CMAs, like internal auditing. So, the AICPA updates to the CPA Exam are quite expected at this point.

2024 CPA Exam Difficulty

However, it’s possible that the 2024 CPA Exam changes could make the exam more difficult for many candidates. Unless you had additional college courses or significant practical experience in one of the “disciplines” in the new “Core-Plus-Discipline” model, you might find the 2024 version of the CPA Exam harder than the 2023 one. After all, we don’t yet know the full impact that the CPA Evolution initiative will have on the exam or the pass rates.

Planning for CPA Exam Changes

Now, should these changes cause you to plan for your exams any differently? Not really. However, I recommend you personally assess how the proposed changes may affect you and plan accordingly. (Because, of course, you can delay your CPA Exam if needed.)

And remember – you’ll always have the best chance of passing the CPA Exam if you’re fully ready and you’ve studied all of the content. If you need some advice about the best CPA Review courses, I can help!

About the Author Stephanie Ng

I am the author of How to Pass The CPA Exam (published by Wiley), and I also passed all 4 sections of the CPA Exam on my first try. Additionally, I have led webinars, such as for the Institute of Management Accountants, authored featured articles on websites like Going Concern and AccountingWeb, and I'm also the CFO for the charity New Sight. Finally, I have created other accounting certification websites to help mentor non-CPA candidates. I have already mentored thousands of CPA, CMA, CIA, EA, and CFA candidates, and I can help you too!