- You are here:

- Home »

- Blog »

- CPA Exam Details »

- CPA Exam Disciplines: How to pass the new CPA Discipline exam sections

CPA Exam Disciplines: How to pass the new CPA Discipline exam sections

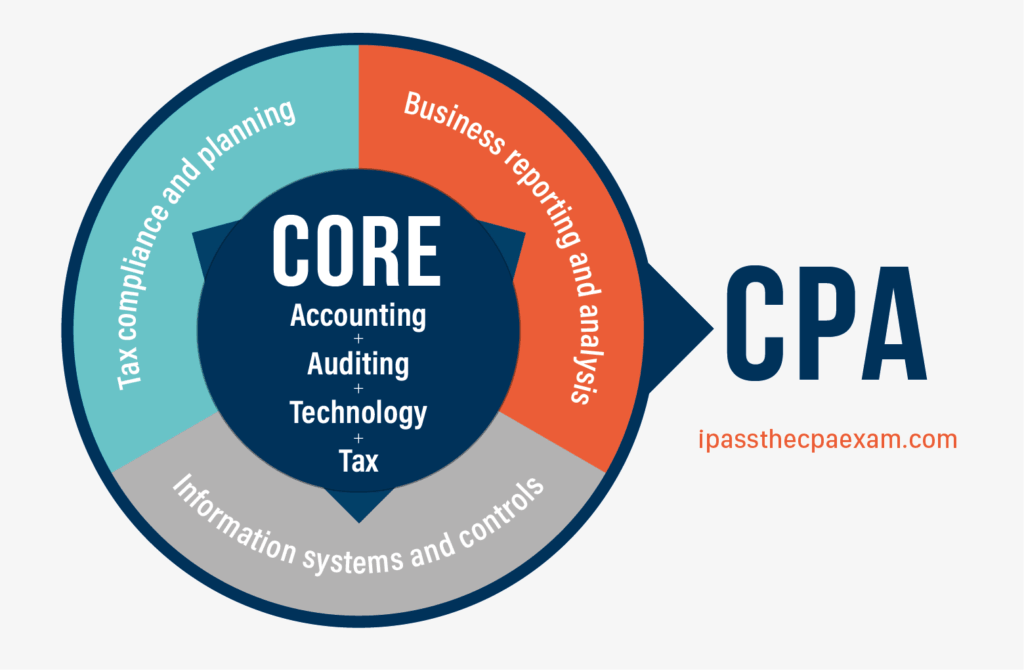

Are you prepared for the new CPA Exam Disciplines? After all, the CPA Exam changed in January 2024 and now follows a new Core + Discipline model. The exam still has four parts, including three required Core sections (AUD, FAR, and REG), plus candidates must pass one of three Discipline sections. So in this post, we’ll go over the new CPA Discipline exam sections, the CPA Evolution, and give you tips for picking the best Discipline for your career path.

The New CPA Evolution + CPA Exam Changes 2025

The AICPA and NASBA work together to modernize the CPA license model when needed. This overhaul that happened in 2024 was called the CPA Evolution, and the goal was for the CPA Exam to better represent the knowledge and abilities needed to practice accounting in today’s world. You can read more about the CPA Exam changes, but the approach is intended to strengthen the field while allowing CPA candidates to demonstrate specialization in specific accounting disciplines.

2025 CPA Exam Sections: New CPA Evolution

The new CPA format that was implemented in 2024 (which is still in place for 2025) is called the “Core + Discipline” model. Here’s how it works, in a nutshell.

To obtain a CPA credential prior to 2024, a candidate needed to pass four sections of the CPA exam:

- Auditing and Attestation (AUD)

- Business Environment and Concepts (BEC)

- Financial Accounting and Reporting (FAR)

- Regulation (REG)

However, starting in 2024, CPA candidates must pass three “Core” sections. You’ll notice that the BEC section has been removed for 2024 and 2025, too. In fact, a lot of the content that was previously tested in BEC has been moved to AUD, FAR, and REG. (That is, the new CPA Exam still tests on the business environment and related concepts, but many of those questions appear in the other exam sections.)

- Auditing and Attestation (AUD)

- Financial Accounting and Reporting (FAR)

- Regulation (REG)

Plus, candidates must pass one Discipline section related to three accounting disciplines. You have three CPA Discipline sections to choose from:

- Business Analysis and Reporting (BAR)

- Information Systems and Controls (ISC)

- Tax Compliance and Planning (TCP)

But still, the 2025 CPA Exam is administered the same as the old exam. In addition, each section you take (3 Core sections and 1 Discipline section) will have a 4-hour exam, so the CPA Exam overall is still a 16-hour test.

Choosing your CPA Discipline in 2025

Since the Core + Discipline CPA Exam format is new, it might feel a little overwhelming to pick a CPA Discipline section. But don’t stress about it! After all, you can choose the Discipline exam that most meets your abilities and interests.

So, to help you pick a CPA Discipline section, I’ve put together a few pointers:

- No matter what CPA Exam Discipline you choose, you will be able to work in any area of the accounting field. For example, if you chose TCP (Tax Compliance and Planning), you won’t be stuck in a tax position for the rest of your career. Therefore, think of the Discipline exam as a way of trying out a future career specialization.

- Your future boss won’t consider one Discipline to be better than the others. After all, the accounting field needs professional to fill all sorts of CPA-related positions, and they all offer growth opportunities.

Discipline Sections: 2025 CPA Exam Format

I explain the CPA Exam Disciplines in the section below. To pick a Discipline, think about what areas of accounting interest you. You can also think about the type of accounting job you want in the future.

BAR – Business Analysis and Reporting

BAR is the right choice for CPA candidates interested in assurance or consulting services, technical accounting, financial and operations management, and analyzing and reporting on financial statements. The BAR exam focuses on data analytics and tests concepts like financial risk management and methods for making projections. If you’re thinking about working as an auditor as a public firm, an accountant at a large corporation, a controller, or a CEO or CFO, consider taking the BAR exam.

Information Systems and Controls (ISC)

If you are interested in computers, IT, or data management, ISC could be right for you. ISC is all about technology and business controls, so it’s for people who want to work in assurance or business advisory roles, IT systems, information security and governance, and IT audits. ISC test material includes IT and data governance, testing internal controls, and information system security, such as network security, software access, and endpoint security. So if you’re thinking about becoming a data manager, data engineer or scientist, or an IT inspector, take a look at the ISC Discipline.

Tax Compliance and Planning (TCP)

If you want to work in tax and compliance, choose TCP. TCP’s exam focuses on tax topics like more complex individual and business tax compliance, as well as extra questions about personal and business financial planning. For instance, if you take the TCP Discpline test, expect questions about tax issues that affect more than one jurisdiction, transactions between a business and its owners, and consolidated tax returns, just to name a few topics. Future tax analysts, tax compliance officers, and other future tax specialists should consider taking the TCP section.

But remember, after you pass the CPA Exam and you have your license, you can practice in any area.

Scoring Weight on 2025 CPA Exam

The 2025 CPA Exam’s scoring weight will be divided between MCQs (multiple-choice questions) and TBSs (task-based simulations), just as the pre-2024 exam was scored. However, the new CPA Exam does not include Written Communications, so that’s a big change from 2023.

- Core Sections AUD, FAR, REG score weight: 50% MCQs and 50% TBSs

- Discipline Sections BAR and TCP score weight: 50% MCQs and 50% TBSs

- Discipline Section ISC score weight: 60% MCQs and 40% TBSs

Number of Questions and Time Limits

Basically, the amount of time you have to take each CPA Exam section is not changing. The Core and Discipline section tests will each be 4 hours long.

And here’s the mix of MCQs and TBSs:

- AUD (Core): 78 MCQs and 7 TBSs

- FAR (Core): 50 MCQs and 7 TBSs

- REG (Core): 72 MCQs and 8 TBSs

- BAR (Discipline): 50 MCQs and 7 TBSs

- ISC (Discipline): 82 MCQs and 6 TBSs

- TCP (Discipline): 69 MCQs and 7 TBSs

Content Tested on 2025 CPA Exam: Disciplines

Here’s a summary of the content that will be tested on each Discpline section of the 2025 CPA Exam.

BAR 2025: Discipline

| BAR Content Area | Allocation |

| Area I: Business analysis | 40-50% |

| Area II: Technical accounting and reporting | 35-45% |

| Area III: State and local governments | 10-20% |

2025 ISC Exam: Discipline

| ISC Content Area | Allocation |

| Area I: Information systems and data management | 35-45% |

| Area II: Security, confidentiality, and privacy | 35-45% |

| Area III: Considerations for system and organization controls (SOC) engagements | 15-25% |

TCP Exam in 2025: Discipline

| TCP Content Area | Allocation |

| Area I: Tax compliance and planning for individuals and personal financial planning | 30-40% |

| Area II: Entity tax compliance | 30-40% |

| Area III: Entity tax planning | 10-20% |

| Area IV: Property transactions (disposition of assets) | 10-20% |

What Should I Study for 2025 Discipline Exam Sections?

Since the CPA Exam Disciplines were new for 2024, it’s important to know what you need to study in advance. Of course, if you study with the best CPA Exam materials, you’ll have the most up-to-date content to study to pass the Discipline sections. But still, here’s a breakdown of the content that will be tested on each Discipline CPA Exam section in 2025.

Overview of BAR Discipline Content Areas

Area I: Business Analysis

- Financial statement analysis, including comparison of current period financial statements to prior period or budget and interpretation of financial statement fluctuations and ratios.

- Non-financial and non-GAAP measures of performance, including use of the balanced scorecard approach and interpretation of non-financial and non-GAAP measures to assess an entity’s performance and risk profile.

- Managerial and cost accounting concepts and the use of variance analysis techniques.

- Budgeting, forecasting, and projection techniques.

- Factors that influence an entity’s capital structure, such as leverage, cost of capital, liquidity, and loan covenants.

- Financial valuation decision models used to compare investment alternatives.

- The Committee of Sponsoring Organizations of the Treadway Commission (COSO) Enterprise Risk Management framework, including how it applies to environmental, social and governance (ESG) related risks.

- The effect of changes in economic conditions and market influences on an entity’s business.

Area II: Technical Accounting and Reporting

- Indefinite-lived intangible assets, including goodwill.

- Internally developed software.

- Revenue recognition, specifically focusing on the analysis and interpretation of agreements, contracts, and other supporting documentation to determine whether revenue was appropriately recognized.

- Stock compensation.

- Research and development costs.

- Business combinations.

- Consolidated financial statements, specifically focusing on topics including variable interest entities, non-controlling interests, functional currency, and foreign currency translation adjustments.

- Derivatives and hedge accounting.

- Leases, specifically focusing on recalling and applying lessor accounting requirements and analyzing the provisions of a lease agreement to determine whether a lessee appropriately accounted for the lease.

- Public company reporting topics, specifically focusing on Regulation S-X, Regulation S-K and segment reporting.

- Financial statements of employee benefit plans.

Area III: State and Local Governments

- Basic concepts and principles of the government-wide, governmental funds, proprietary funds and fiduciary funds financial statements.

- Preparing government-wide, governmental funds, proprietary funds and fiduciary funds financial statements and other components of the financial section of the annual comprehensive financial report.

- Deriving the government-wide financial statements and reconciliation requirements.

- Accounting for specific types of transactions such as net position, fund balances, capital assets, long-term liabilities, inter-fund activity, non-exchange revenue, expenditures and expenses and budgetary accounting within the governmental entity financial statements.

ISC Discipline Content for 2025 CPA Exam

Area I: Information Systems and Data Management

- IT architecture components and the use of cloud-based models for IT infrastructure, platforms and services.

- Enterprise and accounting information systems, the business processes they enable and controls over processing integrity.

- System availability and IT change management.

- Data collection, storage, structured query language (SQL) queries and integration of data from different data sources.

- Business process models.

Area II: Security, Confidentiality and Privacy

- Select portions of specified regulations, standards and frameworks related to information security and privacy that are considered by management in designing and implementing information systems and related controls.

- Types of threats and attacks (including cyber) to which an entity may be subject.

- Controls the entity uses to prevent, detect, and respond to those threats and attacks.

- Controls the entity uses to maintain the confidentiality and privacy of information.

- Testing an entity’s controls over security, confidentiality, and privacy.

- An entity’s incident response plan.

Area III: Considerations for System and Organization Controls (SOC) Engagements

- Form, content and management assertions in SOC 1®, SOC 2® and SOC 3® reports and the intended users of those reports.

- Aspects of engagement planning and reporting for SOC 1® and SOC 2® engagements.

- Procedures related to complementary user entity controls and complementary sub-service organization controls.

- Procedures related to the system description criteria for SOC 1® and SOC 2® engagements.

- Trust services criteria for SOC 2® engagements.

TCP Discipline Section for 2025

Area I: Tax Compliance and Planning for Individuals and Personal Financial Planning

- Tax compliance issues related to incentive compensation, at-risk and passive loss limitations, and gifting assets.

- Tax planning issues related to accelerating or deferring income and deductions to minimize tax liability, estimated tax payments, gifting assets, changing tax rates and legislation.

- Personal financial planning for individuals, including the assessment of qualified retirement plans, investing, education funding and risk mitigation through the use of insurance.

Area II: Entity Tax Compliance

- Utilization of net operating losses, consolidated tax returns and international tax issues for C corporations. International tax issues will focus on general concepts of income sourcing and allocation as opposed to specific foreign laws or treaties.

- Transactions between an entity and owner, specifically recognized income and losses from the contribution of non-cash property, liquidating and non-liquidating distributions of non-cash property and services performed by an owner.

- Impact on an owner’s basis resulting from contributions and distributions of non-cash property to an entity.

- Partnership elections and the impact of ownership changes to a partnership.

- Identifying characteristics of different types of trusts, calculating income, and allocating items between income and corpus.

- Obtaining and maintaining tax-exempt status as well as recalling the types of unrelated business income for a tax-exempt organization.

Area III: Entity Tax Planning

- Formation and liquidation of various entities, including comparisons of different entity types.

- Tax planning for C corporations, S corporations and partnerships, including the tax implications of a proposed transaction to both the entity and owner.

Area IV: Property Transactions (disposition of assets)

- Nontaxable dispositions of property, and the realized, recognized, and deferred tax gains resulting from the transaction.

- Character of recognized gains and losses on the disposition of property used in a trade or business, including installment sale transactions.

- Sale of property to a related party, including nonrecognition of gain or loss.

CPA Exam Discipline FAQs

Why does the 2025 CPA Exam have Discipline sections?

Starting on January 1, 2024, the CPA Exam moved to a “Core + Discipline” model. CPA candidates must now pass three Core sections (AUD, FAR, and REG) as well as one Discipline section of their choice (either BAR, ISC, or TCP). This new model gives candidates more chances to prove their expertise in accounting specializations.

How do the CPA Exam Discipline sections differ from each other?

BAR (the Business Analysis and Reporting exam) tests CPA candidates about advanced financial statements, technical accounting and reporting rules set by FASB and SEC that apply to for-profit businesses, higher-level skills like recognizing revenue and accounting for leases, and a lot more.

In contrast, ISC (or the Information Systems and Controls test) covers technology and business controls. More specifically, it tests candidates skills regarding IT, auditing and advisory services (including SOC engagements), and data management (including gathering data, storing it, and using it throughout its life cycle).

And finally, TCP (Tax Compliance and Planning) tests on non-standard and more complicated tax issues, as well as the knowledge and skills a CPA needs to show when it comes to U.S. federal tax compliance for individuals and businesses, with a focus on non-standard and more complicated transactions, U.S. federal tax planning for individuals and businesses, and financial planning for individuals.

Will my CPA license state which Discipline section I passed?

No. You need to pass one Discipline section, but your license won’t indicate which section you decided to take.

Do all CPA candidates have to take a Discipline Exam in 2025?

Unless you have a valid (that is, not expired) credit for passing the BEC section prior to January 1, 2024, you must pass a Discipline section.

However, we have a post explaining the transition policy for the new CPA Exam. Plus, some jurisdictions are giving candidates an extension of the BEC credits for several months during the transition. So if you’ve already passed BEC and plan to take AUD, FAR, and REG in 2025, you might want to contact your jurisdiction’s state board of accounting to see what your timeline will be if you’ve already passed BEC.

Which CPA Exam Discipline is the easiest?

This question is difficult to answer for a couple of reasons. First of all, the Discipline tests are new, and we don’t have any pass rates for them yet. Plus, since each Discipline sections covers vastly different content, the “easiest” section is the one that you are best prepared for. The Discipline is meant to make you an even more focused and sought-after job candidate in the end.

How do I study for the CPA Disciplines?

The best CPA Exam review courses already have study material for the Discipline sections waiting for you! For example, the Becker CPA updates for 2025 include study material for the Disciplines.

When do I have to select a Discipline?

Technically speaking, you don’t have to pick a Discipline section until it’s time to register for it. However, keep in mind that you’ll need plenty of time to study, so don’t put your decision off for too long.

How do I pick a CPA Exam Discipline for the new CPA Evolution test?

If the content of one Discipline speaks to you more than the others (either because of your previous experience or because of your intended career plans), then pick that Discipline. However, if you’re not sure, you could sign up for a trial plan for one of the best CPA Exam courses – many of them offer a free trial of a Discipline section. This way, you can work through the study material for a few days to determine if you want to tackle that section or not.

When can I take a CPA Discipline Exam in 2025?

The schedule for the Discipline exams is a little different from the CPA Exam schedule as a whole. In fact, you can only sit for a Discipline section for about 1 month per testing quarter. Here are the dates for the 2025 CPA Discipline exams:

Dates for the CPA Exam in 2025: Discipline sections

- Q1: January 1-31, 2025

- Q2: April 1-30 and June 1-30, 2025

- Q3: July 1-31, 2025

- Q4: October 1-31, 2025

What’s the CPA Exam score release dates for the 2025 Disciplines?

- January 1-31 exams: Scores released March

- April 1-30 exams: Scores released May 16

- June 1-30 exams: Scores released July 17

- July 1-31 exams: Scores released September 11

- October 1-31 exams: Scores released December 16

Gleim CPA discount applies to Premium Gleim CPA Review sections. Gleim CPA discount auto-applies in your cart once you add an item.

(Use the button – discounted price appears in cart.)

Further Reading

About the Author S ML

Susan L. is one of the biggest cheerleaders on the I Pass the CPA Exam team. She loves seeing our readers succeed. You'll often find her writing about all things accounting.