- You are here:

- Home »

- Blog »

- CPA Exam Details »

- REG CPA Exam Section: 2025 Ultimate Guide to Regulation [New Tax Law Info!]

REG CPA Exam Section: 2025 Ultimate Guide to Regulation [New Tax Law Info!]

The REG CPA Exam section is one of four you must pass in order to earn the Certified Public Accountant (CPA) certification. To prepare to pass the CPA REG exam, you must know all about the content, pass rates, questions, format, difficulty, structure, timing, and more. Thankfully, you can get all that information here, so the process of defeating the REG CPA Exam section is faster and easier for you.

Table of Contents

- Introduction to the REG CPA Exam Section

- REG CPA Exam Section Content

- CPA REG Exam Pass Rates

- Types of REG CPA Exam Questions

- REG CPA Exam Section Format

- Difficulty Levels of Regulation on the CPA Exam

- Testing Process for the CPA REG Exam

- Structure of the CPA REG Exam

- Time Management for the REG CPA Exam Section

- REG CPA Exam Section Scheduling

- CPA REG Exam Passing Score and Grading

- REG CPA Exam Section Study Time

- Study Tips for CPA REG Exam

- More CPA Exam Help

Introduction to the REG CPA Exam Section

As we can see in the REG CPA Exam Blueprints, the CPA REG exam focuses on federal taxation, business law, and business ethics. The CPA Exam dedicates an entire section to tax and business law. After all, CPA candidates need a comprehensive and current understanding of these areas to fulfill the Certified Public Accountant position. So, no matter how you feel about tax, you must know all about the latest tax laws and regulations in order to pass the REG CPA Exam section.

As we can see in the REG CPA Exam Blueprints, the CPA REG exam focuses on federal taxation, business law, and business ethics. The CPA Exam dedicates an entire section to tax and business law. After all, CPA candidates need a comprehensive and current understanding of these areas to fulfill the Certified Public Accountant position. So, no matter how you feel about tax, you must know all about the latest tax laws and regulations in order to pass the REG CPA Exam section.

If you’re like me and tax isn’t your favorite, then you will have to bite the bullet with this part of the exam. But if you use your lack of tax love to stay motivated throughout your review, you can pass the first time as I did and minimize the amount of time you spend studying tax. You can also use all of this essential CPA REG exam information to start the process of passing.

REG CPA Exam Section Content

Again, a major portion of REG has the potential to deal with federal taxation. Overall, REG covers federal taxation, ethics, professional and legal responsibilities, and business law. You can see for yourself how the CPA REG exam content breaks down in this table:

REG CPA Exam Section Content: 2025

| Content Area | Title | Allocation |

| Area I | Ethics, Professional Responsibilities, and Federal Tax Procedures | 10-20% |

| Area II | Business Law | 15-25% |

| Area III | Federal Taxation of Property Transactions | 5-15% |

| Area IV | Federal Taxation of Individuals | 22-32% |

| Area V | Federal Taxation of Entities (including tax preparation) | 23-33% |

2025 REG Area I: Ethics, Professional Responsibilities, and Federal Tax Procedures

- Ethics and responsibilities in tax practice

- Licensing and disciplinary systems

- Federal tax procedures

- Legal duties and responsibilities

REG Area II in 2025: Business Law

- Agency

- Contracts

- Debtor-creditor relationships

- Federal laws and regulations (employment tax, qualified health plans, bankruptcy, worker classifications, and anti-bribery)

- Business structure

2025 Area III REG: Federal Taxation of Property Transactions

- Basis of assets

- Cost recovery (depreciation and amortization)

Area IV REG in 2025: Federal Taxation of Individuals

- Gross income (inclusions and exclusions)

- Reporting of items from pass-through entities

- Adjustments and deductions to arrive at adjusted gross income and taxable income

- Loss limitations

- Filing status

- Computation of tax and credits

2025 REG Area V: Federal Taxation of Entities

- Differences between book and tax income (loss)

- C corporations

- S corporations

- Partnerships

- Limited liability companies

- Tax-exempt organizations

Pronouncement Policies for REG CPA Exam Content

Generally, the AICPA adheres to certain policies about testing new pronouncements on the CPA Exam. This table explains the times at which pronouncements become eligible for testing. Testing eligibility always begins at the latter of the two times. Whenever a pronouncement becomes testable, the AICPA simultaneously adds the content related to the new pronouncement to the CPA Exam and removes the content related to the previous pronouncement.

CPA Exam Pronouncement Testing Policies

| Pronouncement Type | Beginning of Testing Eligibility | ||

| Accounting and auditing pronouncements | First testing window begins after the pronouncement’s earliest mandatory effective date | OR | First testing window begins 6 months after the pronouncement’s issuance date |

| Changes in the federal taxation area, the Internal Revenue Code, and federal tax regulations | 6 months after the change’s effective date | 6 months after the change’s enactment date | |

| Federal laws | 6 months after their effective date | ||

| Uniform acts | 1 year after their adoption by a simple majority of the jurisdictions | ||

However, as the situation with the new tax law reveals and as review providers assert according to their experience, the AICPA does not hold hard and fast to these policies. The REG CPA Exam may ask you to use old tax forms or old research databases to answer a question. In this case, you should use the information the exam presents, even if you are aware of the current information.

CPA REG Exam Pass Rates

The most recent REG pass rate was a bit of a shocker. It looks like, on average, candidates are increasing their performance in REG. As you can see in the chart below, the REG 2018-2023 CPA pass rates have been significantly higher than this section’s 2017 pass rates. (We’ll update this chart as soon as the rest of the 2024 CPA Exam pass rates and the REG rates for the 2025 CPA Exam are released.)

2017-2025 REG CPA Exam Pass Rates

| Year | First Quarter | Second Quarter | Third Quarter | Fourth Quarter | Cumulative |

| 2025 | N/A | N/A | N/A | N/A | N/A |

| 2024 | 63.42% | 63.45% | 62.97% | N/A | 63.26% |

| 2023 | 58.63% | 59.71% | 59.13% | 54.68% | 57.82% |

| 2022 | 60.03% | 61.25% | 44.30% | 56.41% | 59.85% |

| 2021 | 59.29% | 58.81% | 63.12% | 57.78% | 59.88% |

| 2020 | 55.42% | 75.97% | 66.12% | 58.00% | 62.29% |

| 2019 | 50.23% | 58.66% | 51.94% | 55.89% | 56.34% |

| 2018 | 49.99% | 55.75% | 56.55% | 50.22% | 53.09% |

| 2017 | 46.10% | 48.32% | 49.31% | 45.89% | 47.24% |

In the last several years, the REG CPA Exam pass rate has taken some major twists and turns. But, most recently, it seems to be on the rise. This pass rate climbed steadily from 2006 to 2010 before plummeting in 2011. It then jumped back up to an average of 48% from 2012-2017. But from 2018 to 2022, REG reached unprecedented pass rate numbers with some of the highest passing percentages in more than a decade. REG pass rates overall went down a bit in 2023, though.

Types of REG CPA Exam Questions

To assess your knowledge of the exam content, REG presents two different types of questions: multiple-choice and task-based simulations. Both types of questions account for 50% of your total score for the REG CPA Exam section.

Multiple-choice questions (MCQs):

The multiple-choice questions you’ll see on the CPA Exam look very much like the MCQs you’ve seen on other tests. But the CPA Exam MCQs can be pretty tricky. These MCQs have 3 parts:

- Question stem: the question stem contains the question being asked (usually found at the end of the stem), details necessary for answering the question, and extraneous information.

- Correct answer choice: the one answer choice of the 4 provided that best answers the question.

- 3 distractors: the other answer choices are designed to distract you from the correct answer.

Task-based simulations (TBSs):

Task-based simulations are abbreviated case studies that test your knowledge and skills in real work-related situations. TBSs ask you to use the information found either in the question or in the exhibits provided to do something like performing a calculation, filling in a series of blanks, or revising a document.

One specific type of TBS is the Document Review Simulation, which requires you to refer to various resources in order to assess a document. Another type is the Research task, which expects you to research authoritative literature and cite the appropriate guidance. REG is one of the CPA Exam sections in which you’ll see a Research task.

REG CPA Exam Section Format

Each section of the computerized CPA Exam consists of 5 testlets containing different types of exam questions.

Format of the REG CPA Exam Section

The total number of questions for each CPA Exam section includes both operational and pretest questions. The operational questions count towards your score, but the pretest questions don’t. Instead, the AICPA uses the pretest questions to collect candidate performance data in order to decide if they will use those questions on future iterations of the exam.

You can’t tell the difference between operational questions and pretest questions on the CPA Exam, so you should just answer all of the questions as well as you can. However, if you encounter a particularly challenging or unfamiliar question, you should give it your best shot, move on, and not worry because that may have been a pretest question that won’t affect your score.

The REG CPA Exam question totals include the following number of operational and pretest questions:

Difficulty Levels of Regulation on the CPA Exam

The CPA Exam’s purpose is to ensure you have the knowledge and skills necessary for CPA duties and represent the certification well. The AICPA defines the difficulty of each exam section by four different skill levels to accomplish this purpose.

CPA Exam Skill Levels

(from highest to lowest)

| Skill Level | Description |

| Evaluation | The examination or assessment of problems, and use of judgment to draw conclusions. |

| Analysis | The examination and study of the interrelationships of separate areas in order to identify causes and find evidence to support inferences. |

| Application | The use or demonstration of knowledge, concepts, or techniques. |

| Remembering and Understanding | The perception and comprehension of the significance of an area utilizing knowledge gained. |

The REG CPA Exam section tests candidates at three of these four skill levels.

CPA REG Exam Skill Levels

| Skill Level | Remembering and Understanding | Application | Analysis |

| Content Percentage | 25-35% | 35-45% | 25-35% |

| Content Areas | Mostly I & II | Mostly III, IV & V | Mostly III, IV & V |

| Question Type | Mostly MCQs | Mostly MCQs, possibly TBS | Primarily TBSs, possibly MCQs |

As you can see, REG tests the most at the Application level, so it doesn’t expect you to have the deepest understanding of most of the content. However, REG still has reason to be a hard exam section. It has the greatest number of MCQs and ties with FAR for testing the most at Analysis, the second-highest skill level. But considering its recent pass rates, REG currently is quite passable for both candidates who abhor tax and candidates who adore it.

Testing Process for the CPA REG Exam

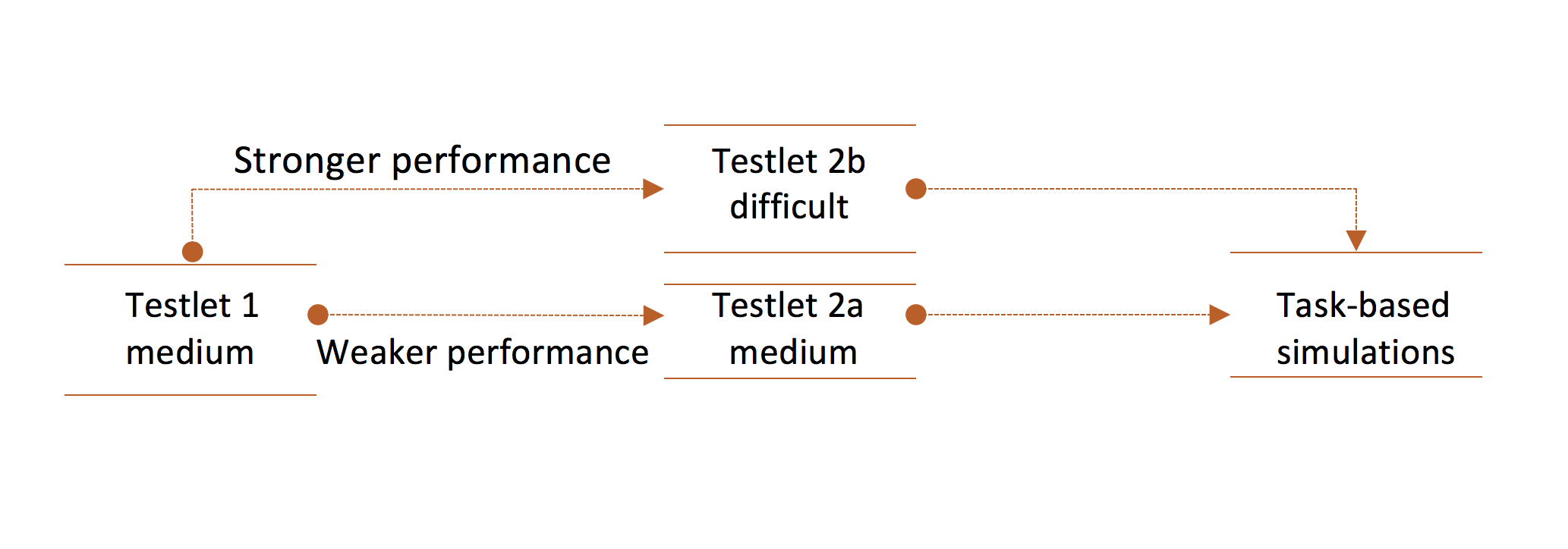

All CPA Exam sections begin with two MCQ testlets, so the exam presents all MCQ testlets using a multistage adaptive delivery model. This big term basically means that your performance in the first MCQ testlet determines the difficulty level of the second MCQ testlet you receive.

Testlet selection

As you can see in this illustration, the first MCQ testlet you will receive, whether you’re sitting for REG or any other exam section, will always be moderately difficult (“medium”). If you perform well on this testlet, the second MCQ testlet will be slightly more difficult (“difficult”). Consequently, if you don’t perform very well, the second MCQ testlet will be moderately difficult (“medium”) again.

The difficulty level of the testlets represents the average difficulty of the MCQs within the testlet. Furthermore, the difficulty level of the questions exists on a numeric scale; it’s not binary.

The exam awards points based on difficulty level, so you get more credit for answering a difficult question correctly than an easier question. As a result, you aren’t penalized for receiving a more difficult MCQ testlet or advantaged for having 2 medium MCQ testlets.

The difficulty levels of the TBSs are predetermined and therefore do not change according to your performance. However, for non-Research TBSs, you can receive partial credit for your work.

Structure of the CPA REG Exam

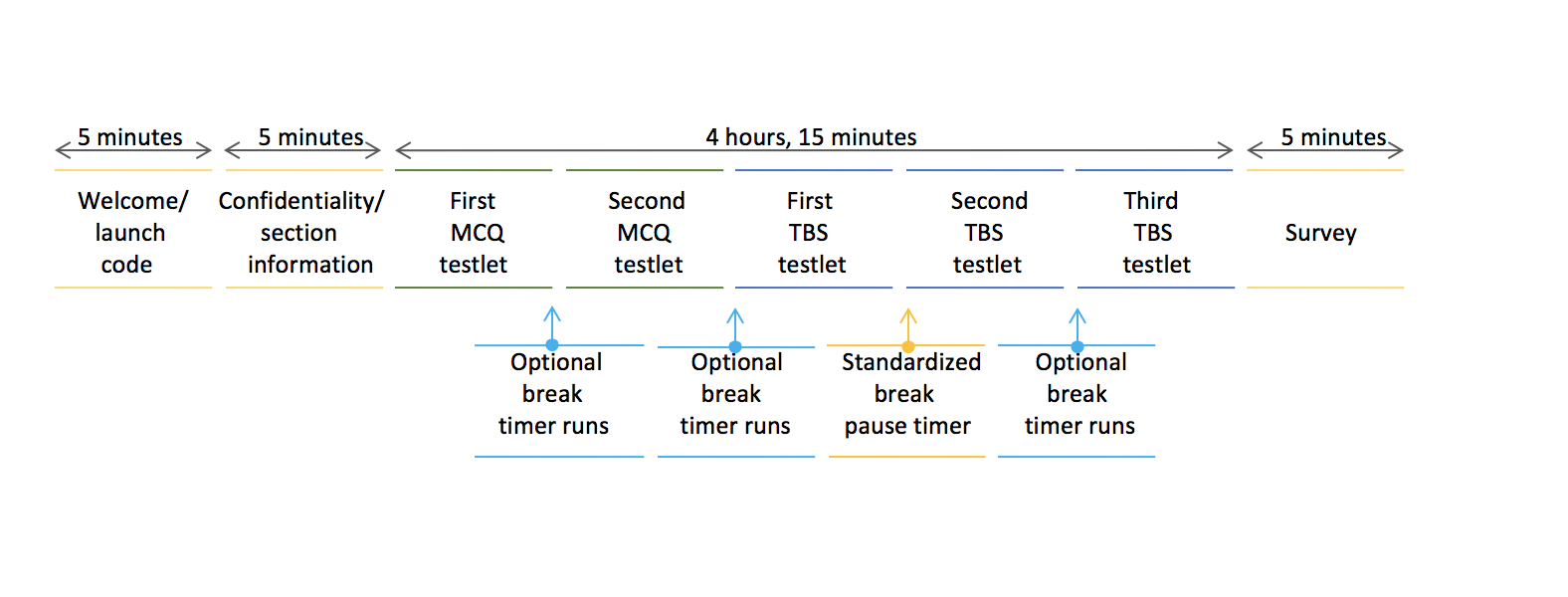

The total testing time for the REG (and all the other exam sections) is 4 hours (240 minutes). However, the testing process will last 4 hours and 30 minutes. That’s because you will use 15 of those 30 minutes to complete additional testing screens at the beginning and end of the exam. Also, you can use the other 15 minutes to take a break that pauses the exam timer after the third testlet (first TBS testlet).

- Welcome/enter launch code: 5 minutes

- Confidentiality/section information: 5 minutes

- Standardized break: 15 minutes

- Survey: 5 minutes

As this illustration depicts, you can take optional breaks after the other testlets as well. However, the exam timer will continue to run during these breaks.

Time Management for the REG CPA Exam Section

Giving yourself enough time to answer every REG exam question is essential for maximizing your score and giving yourself the best chance to pass. Therefore, you need to develop, practice, and apply a REG CPA Exam time management system.

REG Time Management System: Option 1

If you give yourself a little more than 1 minute to answer each REG MCQ, you can finish the 2 MCQ testlets in less than 90 minutes. Then, you’ll have a little more than 150 minutes left for the 3 TBS testlets. At this point, you can divide that time according to TBS type.

- Basic TBS: 10-15 minutes

- Research TBS: 5-10 minutes

- DRS: 20-40 minutes

Conversely, you can simply give yourself 18 ¾ minutes per TBS.

REG Time Management System: Option 2

If you use 1 ¼ minutes to answer each MCQ, you’ll have 145 minutes for the 3 TBS testlets. There are 2 simulations in the first TBS testlet and 3 in the second and third TBS testlets. So, if you divide your remaining time evenly between the number of TBSs (8), you will have 36 minutes for the first TBS testlet and 54 minutes for the next. Additionally, following this system, you will have 1 or 2 minutes of extra time that you can use to review your answers throughout the exam.

REG Time Management System: Option 3

Based on these two time management system options, you can allow anywhere from 1 to 1 ¼ minutes to answer each MCQ. However, as you recall, the second MCQ testlet could be more difficult than the first, depending on your performance. Consequently, you might want to give yourself 35-40 minutes for the first MCQ testlet and 50-55 minutes for the second. You would then have anywhere from 145-155 minutes left for the TBS testlets.

You can adjust one of these as you prefer, but you must follow your time management system when you answer REG practice questions. Doing so allows you to refine your system prior to the exam and apply it easily on exam day. When the perfect time management system is second nature for you, you’ll be able to answer every question in the REG CPA Exam section.

REG CPA Exam Section Scheduling

In the past, the sections of the CPA Exam were only available to take during 4 annual testing windows. And then, from 2020 to 2o23, the CPA Exam followed a continuous testing model, meaning you could take the exam any time a Prometric testing center was open. However, blackout dates for the CPA Discipline sections returned at the beginning of 2024, but you can take REG and the other Core sections on a rolling basis.

Core Section Dates: 2025 CPA Exam

- Good news! You can take the CPA Exam Core sections (AUD, FAR, and REG) on a rolling basis. Or in other words, you can take the Core sections any time a testing center is open.

Dates for Disciple Sections: 2025

Unlike the Core sections, the CPA Discipline sections (BAR, ISC, and TCP) can only be taken at certain times during the year. Basically, with the exception of some additional testing dates in June, the CPA Discipline sections are administered during the first month of each quarter.

- Q1: January 1 – January 31

- Q2: April 1 to April 30 AND June 1 to June 30

- Q3: July 1 to July 31

- Q4: October 1 to October 31

You can check on the status of your board of accountancy from NASBA.

You also must pass all 4 CPA Exam sections in a rolling period of 30 months. (The rule used to be 18 months.) Your 30-month window begins once you pass your first section, which means you have a while to pass the remaining 3 sections. If you don’t pass the rest of the sections within this time, you will lose credit for the first section you passed.

You must then pass that section again and the other sections you haven’t passed in 30 months from the time you passed your second section. If you don’t accomplish this, you will lose credit for your second passed section as well. The beginning of your 30-month window will continue to move back to the date of your earliest passed section until you pass all 4 sections in 30 months.

Because the CPA REG exam covers so much tax, it may be the easiest or the hardest section for you. If you don’t have a lot of tax experience, then you may want to start with a section covering material you know more about. You could leave REG for later in your CPA Exam schedule so you can build your confidence with a few passed sections. On the other hand, if you believe you will need a lot of study time to prepare for REG, you might want to take the CPA REG exam first. That way, you don’t have to try to fit all of that study time into your 30-month window.

CPA REG Exam Passing Score and Grading

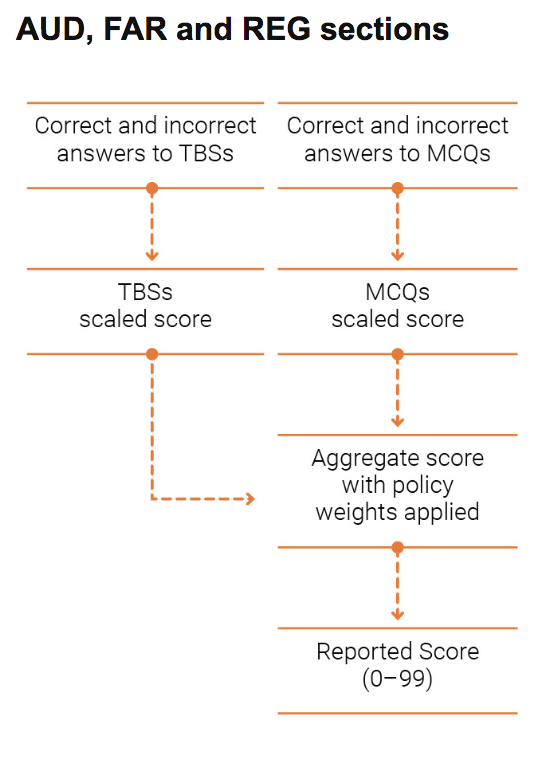

For all CPA Exam sections, a passing score is 75. This number is not the percentage of questions you got right. Rather, it is a scaled score. The AICPA grades the REG CPA Exam section (and the AUD and FAR sections as well) by following these steps:

REG CPA Exam Section Study Time

According to my personal experience, feedback from candidates, and the recommendations of CPA review providers, the total study time for the REG CPA Exam section can range from 80-120 hours.

The more familiar you are with the REG exam content, the less you need to study, and the faster you can pass. You can gauge your familiarity levels by analyzing the content areas of the REG CPA Exam Blueprints.

To pass the CPA REG exam fast, you can study for 20 hours a week and finish your review in 4-6 weeks.

If you can’t fit that much study time into your regular routine, you can study for 15 hours a week for 5-8 weeks.

Studying for just 10 hours a week would require you to extend your REG review for 8-12 weeks.

You can also do anything in between. How quickly you complete your REG review depends on how much time you have to study in a week. However, you must study regularly so you can retain the information and keep moving forward.

Study Tips for the CPA REG Exam

Some people really have a problem with tax. In fact, I am one of them. Yes, I absolutely hated REG. But I managed to get an 84 because I hated it so much that I couldn’t imagine having a retake.

Study Tips for Tax Haters

If you feel the same as I did about REG, then decide to study hard so you can get it over with! Following these study tips will help:

1. Bookend your study of taxation with a review of more preferable topics.

Personally, I found business law and ethics to be easier (but still not easy) than tax. So, whenever I was done with a section on taxation, I would “treat” myself with a section of law or ethics.

2. Break up your study sessions with practice quizzes.

It’s hard for me to concentrate on something I really don’t like. To mitigate this, I would break my studies up into smaller, more manageable sections by working on the practice quizzes and tests.

3. Don’t stress over low quiz scores in the beginning.

At the beginning of your review, you might get most of the practice quiz questions wrong. That’s normal and fine. So, don’t worry about the numbers. Instead, keep testing yourself on your weak areas until the concepts really sink in. As you deepen your comprehension of the concepts and start to strengthen your weak areas, you’ll see those quiz scores rise. You’ll then have more confidence and be more energized to keep moving forward in your studies.

Study Tips for Tax Lovers

On the other hand, if you enjoy taxation, lucky you! Now, you just have to focus on mastering business law and ethics. Don’t underestimate the ethics content. Some of my friends did and bombed the CPA REG exam because of it. Ethics can sometimes feel like a more subjective area and give candidates trouble.

If your first few practice quizzes prove that ethics is a weak area for you, then the best approach is to take many, many practice quizzes until you understand the concepts inside and out. I can’t think of any other way to work on this besides repeated practice. Also, don’t forget to keep drilling yourself on troublesome topics. My strategy was to take quizzes with questions about my weaker areas at least twice, so I knew that I really understood why I got those questions wrong. That’s how I steadily increased my score from the low 60s at the beginning to an 84 on the final exam.

More Help for the CPA Exam

With all its focus on taxation, the CPA REG exam may not be the easiest for you. But you can still pass it, especially when you learn more about how to pass the CPA Exam from this site. I can tell you how to study effectively for exams and give you the CPA Exam tips you need to succeed. Most importantly, I can help you find the best CPA review course for you. Then, once you’ve chosen a course, use my CPA review discounts to save big on your CPA Exam prep!

With all its focus on taxation, the CPA REG exam may not be the easiest for you. But you can still pass it, especially when you learn more about how to pass the CPA Exam from this site. I can tell you how to study effectively for exams and give you the CPA Exam tips you need to succeed. Most importantly, I can help you find the best CPA review course for you. Then, once you’ve chosen a course, use my CPA review discounts to save big on your CPA Exam prep!

About the Author Stephanie Ng

I am the author of How to Pass The CPA Exam (published by Wiley), and I also passed all 4 sections of the CPA Exam on my first try. Additionally, I have led webinars, such as for the Institute of Management Accountants, authored featured articles on websites like Going Concern and AccountingWeb, and I'm also the CFO for the charity New Sight. Finally, I have created other accounting certification websites to help mentor non-CPA candidates. I have already mentored thousands of CPA, CMA, CIA, EA, and CFA candidates, and I can help you too!