- You are here:

- Home »

- Blog »

- CPA Career »

- I Passed! Now What’s the Next Step after CPA Exam?

I Passed! Now What’s the Next Step after CPA Exam?

You passed! But do you know what to do after passing the CPA Exam?

First of all, congratulations! You have completed the most difficult part of the CPA qualification journey: the Uniform CPA Exam. But don’t give up yet, because you still have some work before you can call yourself a CPA. So if you’re wondering, “What is next after I pass the CPA Exam,” this article will point you in the right direction.

I Passed the CPA Exam – Now What?

After passing the CPA Exam, you still have work to do before applying for a CPA license or permit to practice. Depending on which jurisdiction you choose for your license, you’ll have to fulfill some other requirements to become a truly minted CPA. For example, you may need to complete additional education hours based on the requirements in your state. You might have to pass an ethics exam, too. And then, you’ll need to complete your work experience and have it verified.

Finally, the CPA license process takes a little legwork to gather the documents to verify your education and experience. And last but certainly not least, you’ll want to update your resume and celebrate your new status as a CPA.

What happens after you pass all 4 parts of the CPA Exam?

You should take very specific steps after passing the CPA Exam. So please, read the following advice about what to do after you pass all four CPA exams.

1. What Happens After Passing the CPA Exam? First, You Wait…

After passing the CPA Exam, what’s next? Well, most states will mail you a successful candidate letter for the CPA examination. And yes, you might have a long wait before you receive your actual USCPA congratulatory letter from your state board of accountancy.

In fact, your wait could be a few days, weeks, or even months in some cases. For example, if you passed in late 2024, don’t expect a CPA congratulatory letter in 2024, because it might not arrive until early 2025. So, don’t freak out if you haven’t received it after a week.

And while you’re waiting…

Here’s another important consideration for what to do after you’ve passed the CPA Exam. While you’re waiting for your congratulatory letter to arrive, you can look ahead at the CPA license application form. It’s the next step for how to get the CPA license after passing the exam.

Additionally, start thinking about the right person to verify your experience (see the other points below) and how to ask for the favor. In any case, the process can be more time-consuming than expected.

2. Take Some Time for Yourself

Before your official congratulatory letter arrives, do something value-added for yourself. Because despite everything, there is life after the CPA Exam.

- Spend some good, overdue quality time with your spouse, children, colleagues, friends, and pets…They miss you! After all, in one way or the other, they have made sacrifices to support you during these difficult months. It’s now time for you to thank them back.

- Pamper yourself! Get a nice gift and decompress.

- Check out this list of CPA gifts. Many CPAs like to frame their congratulatory letters, for example.

3. Take the CPA Ethics Exam if Required

Depending on your state’s requirements, your congratulatory letter may indicate you need to take a CPA Ethics Exam as the next step. If your letter doesn’t mention an ethics exam, don’t worry—some states don’t have this requirement.

A few states, such as California, run their own exam. Other jurisdictions ask candidates to pass the AICPA’s Comprehensive Course and Exam. But either way, most candidates consider the ethics exam to be much easier to pass than the core exam. Likewise, most states allow the ethics exam to be taken as an open-book test.

4. Complete Additional Education Hours, If Needed

In some jurisdictions, you only need 120 hours of higher education to sit for the CPA Exam. However, almost all jurisdictions require 150 hours for the license, even if candidates passed the CPA Exam with only 120 under their belt. Furthermore, some states have time limits for completing your education. Take Alabama, for example. In Alabama, CPA candidates can take the exam with only 120 hours. But within 36 months, candidates must complete additional hours to reach 150.

What to do after you pass the CPA exams? Finish all 150 education hours.

So if you need more education hours, now is the time to finish them. Click here for more information about CPA education requirements.

5. Fulfill the Working Experience if Needed

Do you have to gain experience after passing the CPA Exam? Well, it depends on the rules in your state. Most jurisdictions require CPA candidates to accumulate 1 to 2 years of relevant accounting experience. However, some states allow you to gain experience before your exams. Other states, though, want you to complete your work experience later as part of the process of getting a CPA license after passing the exam.

So after passing the CPA Exam, what is the next step? Well, it’s important to check your state’s experience requirements. Furthermore, a handful of states only recognize experience in public accounting, but most states nowadays are fine with general accounting and taxation work.

Additionally, the majority of state boards require your experience to be supervised and verified by an active CPA licensee as part of the license requirement. For details, check the CPA Exam Requirements by State and click on the corresponding link for your state or territory.

4. Submit Your CPA License

So, what to do after passing all 4 CPA exams, accumulating your 150 education hours, and completing your experience? Well, you can finally apply for your CPA license!

When you are ready, download the license application form from the state board. Send it in together with the initial license fee. How long does the CPA license application take? In most states, turnaround time is usually fast.

Moreover, keep in mind that some states require your forms to be notarized. So if you live in an area with few notary publics, you should plan ahead.

Submitting your CPA license application

Do you have to submit an application for licensure before you take the CPA Exams or after? Generally, you should wait until after you pass the exam to submit a license application to your state.

And how soon do you have to get a license after the CPA Exam? Well, that depends on your state. In Minnesota, for example, you have three years after you pass the exam to meet all requirements and submit your license application. Other states, however, don’t have this time limit. So please check the specific requirements for your state.

Additionally, keep in mind that if you’re an international candidate who took the exam abroad, you must obtain the CPA license within 3 years of passing the exam. If you miss that 3-year window, you’ll have to retake the exam.

For more advice about how to apply for a CPA license after passing the exam, check out CPA License Requirements: Rules, Obstacles, and Remedies.

5. Apply for AICPA Membership

Once you are finished with your state CPA licensing, you may apply for membership in the AICPA — the largest professional accounting body in the world. By becoming an AICPA member, you can network with fellow CPAs. Plus, you’ll be able to stay up-to-date about pressing issues in the field.

To maintain an active AICPA membership, you must also fulfill the organization’s CPE requirements. However, in most cases, the AICPA CPE requirements are the same as the ones required by your state board.

6. Update Your Resume

Your job opportunities available after passing the CPA Exam will likely increase. So, now is the time to redraft your resume. Besides, with the CPA credential, you may see higher earning potential, more job stability, and greater job flexibility.

But do you know what to write in a resume after you passed the CPA Exam? Remember, you can’t call yourself a “CPA” until you’ve actually received your license or permit to practice. You can, however, state that you’ve passed the exam and are fulfilling the other requirements. Just be sure to clearly indicate your current status.

What about jobs after passing the CPA Exam?

Are you wondering, “After passing all four parts of the CPA Exam, where should I apply for jobs?” Well, one of the benefits of the CPA is that the credential is in demand by the top employers in the business and finance world.

Click here to read more about where CPAs work.

7. Explore CPE Providers

In order to keep your license active, you are required to take continuing professional education on a regular basis. Typically, state boards are looking for 80-120 hours every 2-3 years. So, it’s important to learn more about the requirements for your state board and for the AICPA.

FAQs

Does a CPA Exam expire after you pass?

Technically, CPA scores do not expire. However, some jurisdictions cap how much time can lapse between passing the CPA Exam and applying for a CPA license. Actually, I have an entire article about this issue. Check out Do CPA Exam Credits Expire? Dates, Rules, and Remedies.

How long after passing the CPA Exam do I have to get licensed?

The answer depends on the requirements in your state. But some states only give candidates a few years to apply for a license after passing the CPA Exam. For more information, check out CPA Requirements by State: Complete Guide to the CPA Exam Requirements.

How long does it take to get a CPA license after passing your exams?

Honestly, the answer to that question depends on a lot of factors. First, if you only have 120 hours of higher education, you’ll need 30 more. And that takes at least 2 semesters if you go to school full-time. Then, if you haven’t yet met your state’s work experience requirement, you’ll need to complete 1-2 years of verifiable qualified work. And finally, you should apply for the CPA license in your state and wait for the reply from the state board of accountancy.

What certification should I get after the CPA?

Some professionals choose to pursue multiple accounting credentials. So if you’re thinking about what to study after the CPA, you have several considerations like the CFA, CIA, CMA, or EA. However, before you start studying for more exams, I suggest weighing the benefits with the cost and time commitment. I have an entire article about this topic: Best Accounting Certifications – CPA, CFA, CMA, CIA, and more.

When should my NASBA congratulatory letter for 2024 or 2025 arrive?

First, note that congratulatory letters normally come from your state board. Second, the timing for letters varies from state to state, and don’t be surprised if you have to wait for several weeks. And finally, remember that although it’s great to have, you don’t need your letter in hand to proceed with becoming a CPA. That is, if you’re wondering what to do after finishing all CPA Exams, you can complete your education and work experience and apply for your license before receiving that letter.

How hard is it to complete all four of your CPA exams the summer after you graduate?

The time it takes to pass the CPA exams depends on many factors, like your availability to study and your overall content knowledge. First, I suggest reading How Many Hours Do You Need to Study for the CPA Exam? Then, I recommend choosing the right CPA review course for your learning style, which can reduce your study time. Click here for reviews of the top courses on the market.

For Your Further Reading

- Is the CPA Ethics Exam difficult?

- My Recommended CPA CPE Courses

- Does CFA / MBA make sense after the CPA?

Last but Not Least… Have You Announced the Good News Yet?

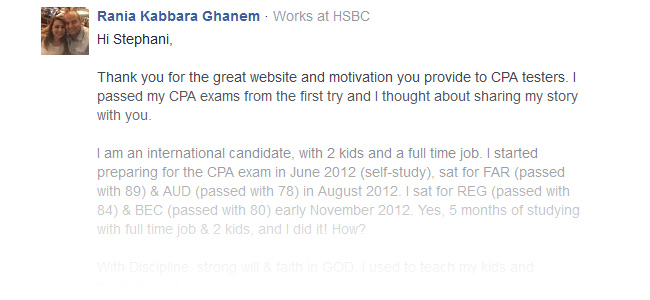

Share your own success story here. Be an inspiration to my readers!

About the Author Stephanie Ng

I am the author of How to Pass The CPA Exam (published by Wiley), and I also passed all 4 sections of the CPA Exam on my first try. Additionally, I have led webinars, such as for the Institute of Management Accountants, authored featured articles on websites like Going Concern and AccountingWeb, and I'm also the CFO for the charity New Sight. Finally, I have created other accounting certification websites to help mentor non-CPA candidates. I have already mentored thousands of CPA, CMA, CIA, EA, and CFA candidates, and I can help you too!