- You are here:

- Home »

- Blog »

- CPA Requirements »

- Colorado CPA Requirements (Rules on Exam and Licensing)

Colorado CPA Requirements (Rules on Exam and Licensing)

According to the previous Colorado CPA requirements, Colorado used to be one of the few states that didn’t require 150 credit hours to qualify for a CPA license. Since July 2015, however, Colorado has joined the rest of the states to follow the standard “3Es” requirement. So now, Colorado CPA applicants must meet the requirements for the CPA Exam, education, and experience.

According to the previous Colorado CPA requirements, Colorado used to be one of the few states that didn’t require 150 credit hours to qualify for a CPA license. Since July 2015, however, Colorado has joined the rest of the states to follow the standard “3Es” requirement. So now, Colorado CPA applicants must meet the requirements for the CPA Exam, education, and experience.

After this change, there is little reason why international candidates would register for a CPA license through the CO state board.

Colorado CPA Requirements

1. Education Requirements to Sit for the Exam

- Bachelor’s degree or above.

- Accounting courses:

- 27 credit hours in accounting. Furthermore, at least 21 semester hours must cover topics like accounting ethics, accounting information systems, accounting research and analysis, accounting theory, auditing and attestation services, financial accounting and reporting, profit entities, financial statement analysis, fraud examination, internal controls and risk management, managerial or cost accounting, taxation, tax research and analysis, forensic accounting, or tax auditing

- Must have 3 credit hours in an auditing course that concentrates on U.S. GAAS.

- What’s more, duplicate courses and introductory accounting courses do not count. Therefore, if you take two financial accounting courses from two universities, you can only count one.

- Business courses:

- 21 credit hours.

- No more than 6 hours for each subject.

- Duplicate courses do not count.

- Areas of study for these 21 hours can include topics like business and accounting communication, business ethics and law, computer information systems, economics, finance, the legal and social environment of business, management, marketing, quantitative applications in business, and statistics.

- Please go to this page for details on suggested accounting and business subjects.

Note to international candidates

New rules have been enacted to restrict the educational requirements in Colorado.

- The State Board is no longer accepting Association of Chartered Certified Accountants (ACCA) certificates as evidence of having met the educational requirement.

- Chartered Accountant (CA) qualifications from Australia, Canada, Ireland, Mexico, and New Zealand (part of the U.S. International Qualifications Appraisal Board-IQAB MRA agreement) are accepted; but those from other jurisdictions (e.g. India) are no longer accepted.

Education requirements must be met through academic coursework completed at an accredited institution. Professional training is not acceptable toward these requirements. Coursework completed as part of a Chartered Accountant program is considered professional training and is, therefore, not accepted toward the education requirements for the U.S. Uniform CPA Examination.” ~ NASBA Colorado page

- Candidates with an international education must also provide proof that they completed an audit course with a concentration in U.S. GAAS. Proof of your course should include a letter from your school, the course syllabus, and the textbook title, publisher, and author(s).

If this looks too confusing, but you still want to give Colorado a try, you can sign up for the state board’s pre-evaluation service.

2. Additional Colorado CPA Requirements for the License

There is currently two routes only one way to obtain the CPA license in Colorado:

(a) Education with Experience (Rule 2.4 and 2.5)

- Education: 6 additional accounting credits and 6 additional business credits

- Experience:

- Must include 1 year (1,800 hours) in public or non-public accounting as well as in academia

- Must have been met within 5 years preceding the date of application

- Part-time work is acceptable as long as you complete 1,800 hours within 1-3 years

- Must be under the supervision of an active CPA or Chartered Accountant from an IQAB MRA country in good standing. (IQAB MRA Countries include: Australia, Canada, Ireland, Mexico, New Zealand, and Hong Kong)

(b) Education In Lieu Of Experience (Rule 2.7)

Master’s degree, doctoral degree OR bachelor’s degree with 30 additional hours (i.e. 150 credit hour).45 semester hours in Accounting, including 6 hours in Audit with coverage of US GAAS.36 hours in General Business related subjects with no more than 9 hours in any subject.No experience is required.

*Launched in Apr 2016* The NASBA Experience Verification service is now available to those who do not have access to an active U.S. CPA for verification.

Ethics Requirement

- Pass the CPA ethics exam administered by the AICPA.

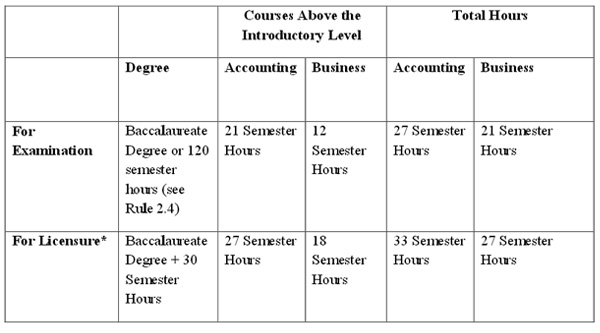

Summary of CO CPA Exam and Licensing Requirements Effective July 1, 2015

Source: CO State Board of Accountancy website – Latest Rules (PDF file p.17)

4. Colorado CPA Requirements and Residency & Age

- US citizenship is not required.

- Colorado residency is not required.

- Minimum age: none.

- Social security number is not required for those living and working outside the US, but you will need to complete a form called “Social Security Number Affidavit.”

5. Fees

- Education Evaluation Application Fee: $75.00

- Exam Section Application Fee: $339.80

6. Continuing Education

CPE is required for license holders. Please click here for Colorado CPA CPE requirements.

7. Other Useful Information

- CO CPA exam application (from NASBA — must read, very detailed)

- CO CPA licensing information (from NASBA)

8. Contact

Colorado State Board of Accountancy (within the Colorado Secretary of State)

1560 Broadway-Suite 1340

Denver, CO 80202

- Email: dora_dpo_licensing@state.co.us

- Phone: 303-894-7800

- Fax: 303-894-7693

What if the Colorado CPA Requirements Don’t Work for Me?

- CPA educational requirements: Rules, Obstacles, and Solutions

- States with more flexible CPA experience requirements

- How to get extra credit hours for the 150-hour rule

If you have questions, feel free to drop a note in the comment section, or visit my Facebook page.

About the Author Stephanie Ng

I am the author of How to Pass The CPA Exam (published by Wiley), and I also passed all 4 sections of the CPA Exam on my first try. Additionally, I have led webinars, such as for the Institute of Management Accountants, authored featured articles on websites like Going Concern and AccountingWeb, and I'm also the CFO for the charity New Sight. Finally, I have created other accounting certification websites to help mentor non-CPA candidates. I have already mentored thousands of CPA, CMA, CIA, EA, and CFA candidates, and I can help you too!