- You are here:

- Home »

- Blog »

- CPA Pass Rates »

- CPA Exam in Japan: Pass Rate Trends and How to Apply

CPA Exam in Japan: Pass Rate Trends and How to Apply

Did you know that Japan has the largest number of CPA Exam candidates after the United States? Let’s take a look at the typical profile of a Japanese candidate, the overall pass rates, and how to apply for the exam.

(The following analysis is based on 2013 data from NASBA. NASBA has not released any specific pass rate data for Japan since that year.)

Japanese CPA Exam Candidate Profiles

In 2013, 1,985 CPA candidates applied directly from Japan. While this group was the biggest pool of CPA candidates outside the US, the number has been decreasing every year (3-year negative growth rate of 42%). I couldn’t find any write-up on the reasons for the decline. However, I suspect the relatively low pass rate, as well as the stagnation of the Japanese economy, could be part of the reasons.

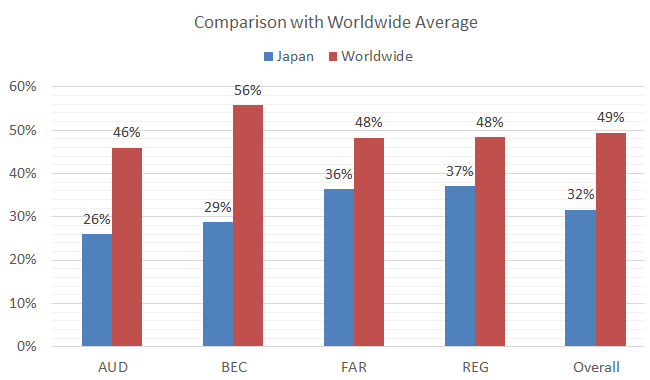

As you can see, Japanese candidates’ pass rates in each exam section are considerably lower than the global average. I believe that language is the biggest reason, given most Japanese do not learn English until they reach secondary school. There is also little interaction between Gaijin (English-speaking ex-pats) and locals, and therefore Japanese do not have much chance or need to practice their English.

Secondly, most Japanese universities offer a general degree. Almost all candidates are non-accounting majors and must make up their accounting credit hours in various coaching classes. As a result, their accounting knowledge may not be as solid as those who go through an accounting program for 4-5 years.

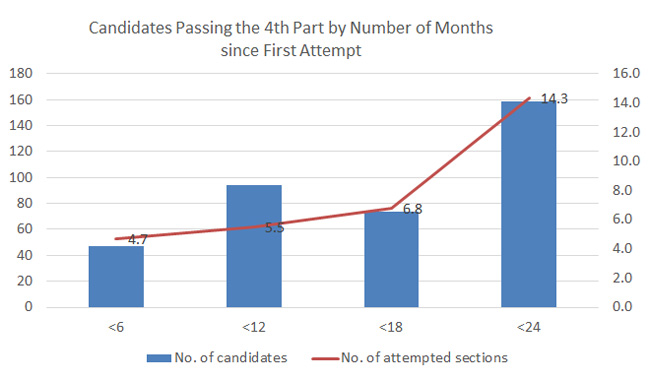

(x-axis: number of months since the first attempt;

left y-axis: number of candidates; right y-axis: number of attempted sections)

For those who passed, they did comparatively well. The chart above shows that successful Japanese candidates take 12-18 months and 4-8 attempts to pass the CPA exam. If the process drags on for more than 24 months, the average number of attempts greatly increases to 14.3 times.

How to Become a CPA as a Japanese National

Japanese CPA candidates go through the same procedure as US candidates, with one extra step of getting the foreign credential evaluation. The basic requirements are:

- Education: minimum of a 4-year bachelor’s degree and 150 credit hours of general higher education

- Exam: taking and passing the 4-part Uniform CPA Exam

- Experience: 1-2 years of verifiable and relevant experience

Taking the CPA Exam in Japan

In the past, CPA candidates could only take the exam in the United States. However, Japan was the first country to open up exam sites for the AICPA exam, but only legal residents of Japan and US citizens working abroad could take the CPA Exam in Japan. In other words, other international candidates (with a tourist/transit visa to Japan) were not allowed to sit for the exam at these non-US sites.

But now, the rules have changed again. Since June 2022, depending on the jurisdiction where they plan to apply for their CPA license (see note below), Japanese candidates can take the CPA Exam at any international Prometric testing location.

*Note: A few US jurisdictions don’t participate in the international administration of the CPA Exam, including Alabama, Idaho, North Carolina, and the Virgin Islands. You can learn more in this post about taking the CPA Exam as an international candidate.

Restrictions of Taking CPA Exam Outside of the US

You must commit to certain preconditions when you choose to take the exam in Japan. Specifically, you must meet these restrictions:

- All international candidates must be licensed within 3 years. Therefore, you must figure out how to fulfill the CPA experience requirement before taking the exam.

- Some state boards do not participate in international administration, either. As of 2023, these boards include Alabama, Idaho, North Carolina, and the Virgin Islands.

For Your Further Reading

- NASBA official page on international administration of the CPA exam

- My master page of CPA exam international sites

- JICPA vs AICPA

Need Help to Figure This Out?

You are most welcome to drop me a note on Facebook! You may also want to sign up for my free e-course for more information on the CPA exam from an international candidate perspective.

Feel free to learn more about this CPA exam mini-course here before signing up.

About the Author Stephanie Ng

I am the author of How to Pass The CPA Exam (published by Wiley), and I also passed all 4 sections of the CPA Exam on my first try. Additionally, I have led webinars, such as for the Institute of Management Accountants, authored featured articles on websites like Going Concern and AccountingWeb, and I'm also the CFO for the charity New Sight. Finally, I have created other accounting certification websites to help mentor non-CPA candidates. I have already mentored thousands of CPA, CMA, CIA, EA, and CFA candidates, and I can help you too!