- You are here:

- Home »

- Blog »

- CPA Career »

- Number of CPA in USA: Interesting Statistics and Trends

Number of CPA in USA: Interesting Statistics and Trends

Many people have been asking me about the number of CPAs in the US. According to NASBA, the United States currently has about 654,375 actively licensed CPAs. The number of CPAs in the US has increased over the last few decades, with 639,628 in 2003 and 646,520 in 2006.

The number of AICPA members is also a good indication of the number of the accountants in the US. In 2015, there were more than 400,000 members in the American Institute of Certified Public Accountants, which is the world’s largest membership organization for the accounting profession. Today, however, AICPA has over 431,000 members. So the AICPA membership is growing.

This article will review other CPA statistics, CPA demographics, and how many accountants are in the US. We’ll also discuss trends in the accounting profession. You can use this information to decide if CPA licensure is right for your career goals.

How Many Accountants are CPAs?

All CPAs are accountants, but not accountants are CPAs. It is difficult to determine how many CPAs are in the world because countries gather this data differently. Still, we can at least estimate the data available in the US.

There are around 1.4 million US accountants and auditors, according to the US Bureau of Labor Statistics (US BLS). However, the BLS doesn’t account for what percentage of those professionals have their CPA license.

What Percentage of Accountants are CPAs?

The percentage of accountants with CPA credentials in the United States is about 30% to 45%. Let me explain why it is hard to determine what percent of accountants are CPAs.

The US Bureau of Labor Statistics estimates that the US had 1,424,000 accountants and auditors in 2018. However, the bureau doesn’t make a distinction between general accountants and CPAs.

And according to NASBA, the US had 654,375 actively licensed CPAs in 2019. But that number only includes CPAs with an active license and not those with an inactive status.

Plus, NASBA bases its numbers on the Accountant Licensee Database (ALD). Although it includes data from 52 boards, it doesn’t include Delaware, Hawaii, and Utah. So without the numbers of CPAs in those states, it’s hard to accurately determine the exact percentage of accountants in the US who are CPAs. But for argument’s sake, we can estimate about 30-45%.

Number of CPAs in the US

Here’s our calculations about the number of CPAs in the US:

Number of 2018 US Accountants according to the US BLS = 1,424,000

Number of 2020 AIPCA members = 431,000

Number of 2019 NASBA actively licensed CPAs = 654,375

| 2020 AICPA member data | 2019 NASBA data | |

| 431K / 1,424K= | 654,375/ 1,424K = | |

| % of CPAs among Accountants | 30.2% | 45.9% |

CPA Demographics

The AICPA keeps track of how many CPAs in the USA and other demographic trends. Here’s a summary of their 2019 Trends Publication that analyzes data up through 2018.

Male/Female Balance

In the past, CPA firms have had a much larger percentage of male employees than females. But now, that trend is slowly starting to change as more women pursue professional accounting careers. In 2018, the new college graduates who were hired into CPA firms were almost balanced with about 49% males and 51% females. However, when you consider all of the professional staff in accounting and finance positions at US CPA firms, 53% were males with 47% females. And if you just look at the CPAs in those firms, then 58% were males and only 42% were females.

Still, this stands in stark contrast to the balance of partners. In 2018, 77% of partners in US CPA firms were male and only 23% were female. But based on the number of women entering the field today, it’s likely that this balance will change in the future and more women climb the professional ladder and become partners.

Diversity in the Accounting Profession

Like the male/female balance, it seems that the accounting profession is slowly becoming more diverse as more Asians, Blacks, and Hispanics are entering the field in the US. Universities are seeing more racial and ethnic diversity in accounting programs. For example, according to the AICPA, the number of Hispanic or Latino new college graduates who went to work for a CPA firm increased by 2% from 2016 to 2018. The percentage of minorities who work in the field or become CPAs are also increasing, although 91% of CPA USA firm partners in 2018 were white.

What’s the Number of CPAs by State?

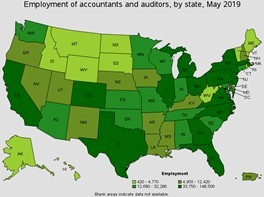

The US Bureau of Labor Statistics has some interesting data available on the number of accountants and auditors per state. As you can see in the map below, the states with the most accounting professionals tend to also have the largest metropolitan cities, like California (Los Angeles), Texas (Houston and Dallas/Fort Worth), and the densely populated states on the East Coast. And again, based on our figures above, we can assume that 30-45% of these professionals have their CPA credential.

Image Source: US Bureau of Labor Statistics

And the according to the US Bureau of Labor Statistics, these 5 states had the highest number of accountants and auditors in 2018:

- California: 148,500

- Texas: 114,410

- New York: 112,030

- Florida: 71,520

- Illinois: 51,740

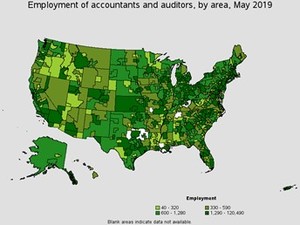

Number of CPAs by Area

The US BLS also tracks the metropolitan areas with the largest number of accountants and auditors. And remember, about 30-45% of them are probably CPAs. The cities with the most accountants in 2018, in order, were New York; Los Angeles; Chicago; Washington, DC; Dallas/Fort Worth; Houston; Boston; Philadelphia; Atlanta; and Miami.

Image Source: US Bureau of Labor Statistics

Number of CPA and What This Stat Means to You

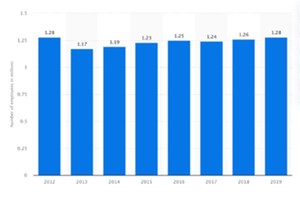

1. The number of CPAs in the US is at a standstill

The increase in the number of CPAs in the USA has been relatively stagnant in the last few years. It seems that this trend is not new and has been happening for a while, as demonstrated by past data.

The height of the profession in the US occurred in 2012 with about 1.28 million accountants. That number sharply declined in 2013 but has been gradually increasing until 2019, when the US finally reached the same numbers as 2012.

Image Source: Statista.com

The number of people who sit for the CPA Exam has also been decreasing. Therefore, the number of new CPAs entering the workforce is decreasing. The AICPA reports that the number of CPA Exam candidates decreased by 7% between 2017 and 2018. During that same time period, the number of candidates who passed all 4 sections decreased by 6%.

2. University enrollments are down

Plus, according to the AICPA, university enrollments in accounting programs have been decreasing. In fact, enrollment in 2019 was down 4% from 2016.

Possible reasons for this trend include:

- The demise of Arthur Anderson may have tarnished the reputation of the CPA license.

- New career alternatives may have lured away a number of aspiring CPAs. For example, it’s possible that some would-be CPAs are becoming more involved in internet start-up companies and emerging financial industries like structured derivatives.

- More professionals are pursuing other accounting credentials like the CIA and the CMA.

- It’s becoming more difficult for international candidates to meet the certification requirements in most jurisdictions because of stricter education levels and the existence of fewer two-tier states. (If you are an international candidate in this situation, click here for some advice.)

- The CPA Exam is associated with high fees. Not only do you have to pay a significant amount of fees just to take the exam, but most candidates also study with a CPA Exam review course that can cost hundreds to thousands of dollars. (If you’re in this boat, go to the article 2020 Best CPA Review Discounts and Promo Codes to save some money.)

Effects of the 150-hours rule

An academic research study by Professors Nicholas Schroeder and Diana Franz argued that the increase in the education requirement (the so-called “150-hours rule”) for CPA exam candidates may have been the primary cause of the declining number of college accounting majors and new CPA exam candidates. In previous decades, most jurisdictions only required CPA candidates to have 120 hours of higher education, which is equivalent to a bachelor’s degree in the United States. Since most jurisdictions are moving toward a requirement of 150 hours, or a master’s degree, it seems that these additional education hours are deterring students from pursuing the CPA.

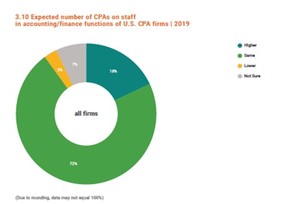

2. The demand for CPAs is increasing…a little

The US BLS anticipates that the demand for accountants and auditors will grow 6% between now and 2028. The demand for all jobs is expected to increase 5%, so the potential need for CPAs will probably be higher than other professions.

The AICPA also monitors the demand for future accountants and CPAs. They gathered data from CPA firms in the United States and inquired whether their need for CPAs will go up or down next year. According to their analysis, about 18% of firms will need additional CPAs on their staff in the coming years.

Image Source: AICPA 2019 Trends Report

3. This is the best time to become a CPA in America

While the supply stays flat, the demand for accountants and particularly CPAs increase every year. This trend is partially due to the number of new laws that address improvements in financial integrity and scrutiny after the Enron bankruptcy in 2002 and the financial crisis in 2008. Plus, the trend also reflects the fact that the older generation of “Baby Boom” CPAs is retiring, but not enough new CPAs are meeting the gap in demand.

Other reasons to become a CPA include:

- CPAs are needed everywhere

- CPAs are indispensable

- CPAs enjoy greater job security than other accountants

- CPAs are paid better!

4. International candidates are taking this opportunity

Every year, 8 to 10 thousand international candidates from more than 100 countries take the US CPA exam, representing roughly 10% of the total candidate pool. If you are an accounting professional interested in this global qualification, a lot of information for international candidates is available on this site.

FAQs

How many accountants are there in the world?

It’s really hard to estimate the number of accountants in the world. Countries have different standards for what an “accountant” does, so some data compares apples to oranges. Plus, not all countries track these figures in the same way.

How many accountants are there in the US?

According to the US Bureau of Labor Statistics, the United States had about 1,424,000 accountants and auditors in 2018. This is the most current national data available.

How many CPAs are there in the US?

NASBA and the Accountancy Licensee Database (ALD) report how many CPAs are there in the United States. Although the database does not currently include information from Delaware, Hawaii, and Utah, it is estimated that the US has about 654,375 actively licensed CPAs.

What percentage of accountants are CPAs?

We estimate that 30-45% of accountants are CPAs.

For Your Further Reading

- Why become a CPA: 5 great benefits

- How to Become a CPA: My Complete Guide to the Certified Public Accountant Certification

- The future of young accountants – number of retiring CPAs vs number of new CPAs in this decade

About the Author Stephanie Ng

I am the author of How to Pass The CPA Exam (published by Wiley), and I also passed all 4 sections of the CPA Exam on my first try. Additionally, I have led webinars, such as for the Institute of Management Accountants, authored featured articles on websites like Going Concern and AccountingWeb, and I'm also the CFO for the charity New Sight. Finally, I have created other accounting certification websites to help mentor non-CPA candidates. I have already mentored thousands of CPA, CMA, CIA, EA, and CFA candidates, and I can help you too!