- You are here:

- Home »

- Blog »

- CPA Pass Rates »

- US CPA in China: Exam Performance + Pass Rate Trend

US CPA in China: Exam Performance + Pass Rate Trend

In 2013, there were 1,007 applicants applied directly from China. As the CPA title gradually gains reputation in the country, the increase of Chinese applicants was impressive with a 3-year growth rate of 207%.

(This post will be updated with 2015 data once from NASBA is available)

US CPA in China: Growth Rate and Pass Rate

First Timer vs Retakers

Around 70% of the candidates were first timers (pass rate at 49.9%). The large proportion is due to the fact that there were a lot more new applications, and that Chinese candidates were able to pass the exam within 12-18 months.

Gender Split

Another interesting observation is that there were a lot more women taking the exam: 3/4 were female, whereas the portion is 50/50 among US and Canada, 38% in India and as low 18% in Egypt.

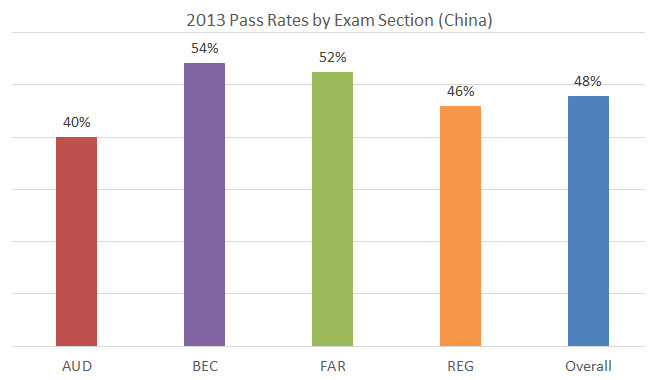

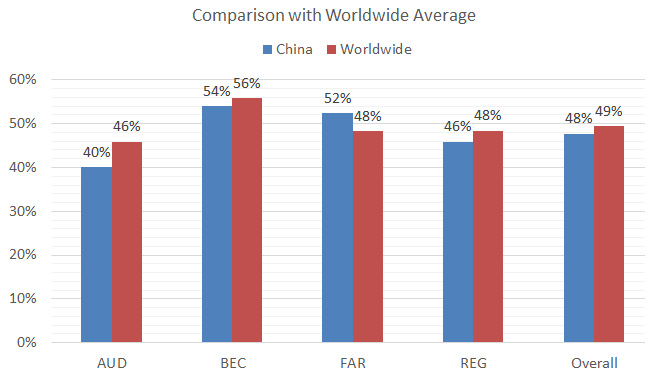

Pass Rate by Part

The relative performance by part is similar to that in global average: BEC being the highest and AUD being the lowest.

Chinese candidates have been doing well — the overall pass rate of 48% was only a tad lower than the global average of 49%. FAR scored even higher. Among the international candidates, their performance was only second to Canada and Lebanon.

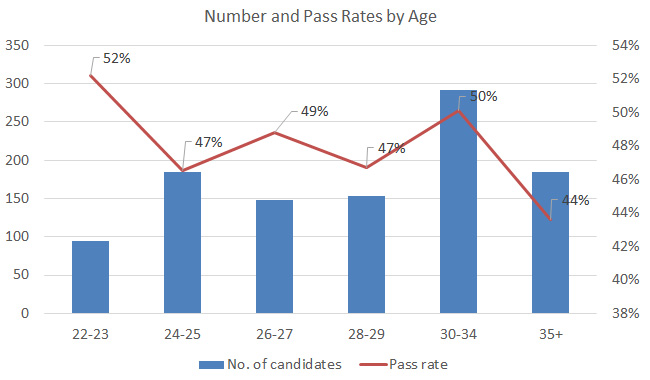

Pass Rates by Age

(x-axis: age in terms of number of years; y-axis: number of candidates)

The age of Chinese candidates is quite evenly distributed. Younger candidates seem to do better at 52%, than those in mid-thirties at 44%. This is understandable as the “exam taking prowess” declines with age, and older candidates have more commitments in work and family.

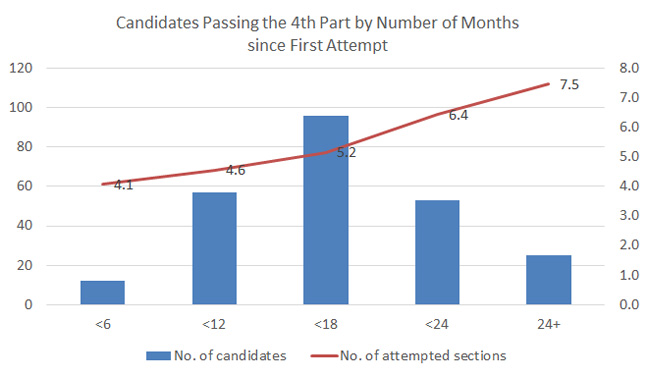

(x-axis: number of months since first attempt;

left y-axis: number of candidates; right y-axis: number of attempted sections)

This chart is showing the number of months required to pass the 4th part (i.e. compete the CPA exam), and the number of attempted sections along the way.

A good number of Chinese candidates need 12-18 months to complete the exam. Within this category, they had 5.2 attempts, meaning 4 success passes for each part plus 1.2 retake.

For those who complete the exam within 6 months, almost all of the were able to pass all on first attempt, as they only needed 4.1 times to complete 4 parts.

As the process drags on, the number of attempts increases. Overall, Chinese candidates did pretty well with an overall number of attempts at 5.5: lower than the US and global average (6.6 times).

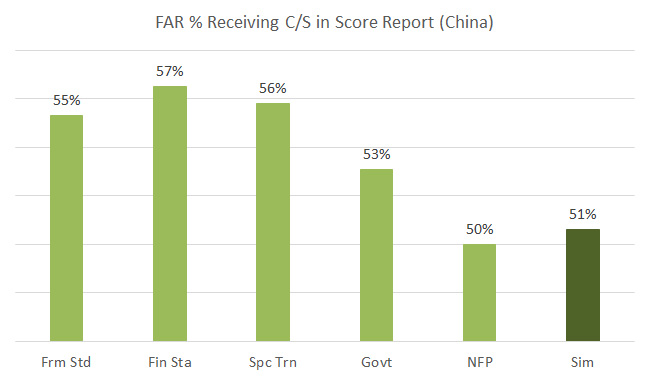

FAR Performance by Content Area

In terms of performance by exam section, we have data that can further split the performance by content area within each part. This is indicated by the percentage of candidates receiving a “comparable” or “stronger” in their score reports. This can be seen as something similar to pass rates.

| Content Area | Stands for: | Weighting |

| Frm Std | Framework and standards | 17-23% |

| Fin Sta | Financial statement accounts | 27-33% |

| Spc Trn | Specific transactions / events | 27-33% |

| Govt | Governmental accounting | 8-12% |

| NFP | Not-for-profit accounting | 8-12% |

Chinese candidates outperformed the global average in the financial accounting areas (first three content areas), showing they have a strong sense in US GAAP and accounting in general.

They didn’t do as well comparatively in governmental accounting and not-for-profit accounting, likely because they are not familiar with the specific rules and concepts. I agree that these two modules look “weird” to those who haven’t taken such course before, but once you understand how they work, they are actually quite straight-forward, and are easy ones to tackle.

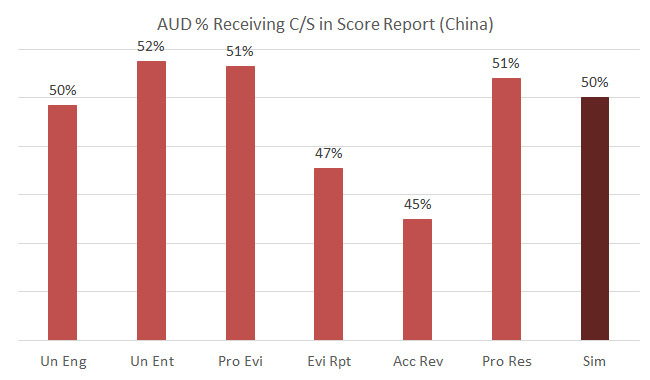

AUD Performance

| Content Area | Stands for: | Weighting |

| Un Eng | Understanding the engagement | 12-16% |

| Un Ent | Understanding the entity | 16-20% |

| Pro Evi | Procedure and evidence | 16-20% |

| Evi Rpt | Evaluation and reporting | 16-20% |

| Acct Rev | Accounting and review services | 12-16% |

| Pro Res | Professional responsibilities | 16-20% |

AUD is the area for Chinese candidates to work on. The area with the biggest discrepancies with global average are:

- Understanding the Engagement

- Evaluation and Reporting

- Accounting, Review Services

- Professional Responsibilities

with more than 10 percentage point difference.

The good thing is that the sim performance is more or less the same as the global average. No worries on that part.

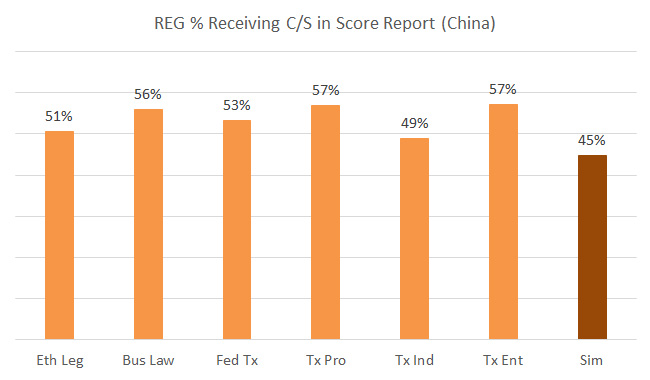

REG Performance

| Content Area | Stands for: |

Weighting |

| Eth Leg | Ethics and legal responsibilities | 15-19% |

| Bus Law | Business law | 17-21% |

| Fed Tx | Federal tax process | 11-15% |

| Tx Pro | Taxation on property transactions | 12-16% |

| Tx Ind | Taxation on individuals | 13-19% |

| Tx Ent | Taxation on entities | 18-24% |

The REG performance was also quite well considering Chinese candidates were least familiar with REG coverage among the 4 exam sections.

One important part to focus on is ethics and legal responsibilities. Chinese and Indian candidates did poorly in this seemingly straightforward section (we are talking about 20 percentage point difference here). My gut feeling is that the general idea of professional ethics is not as emphasized in these two countries. If so, this is even a bigger reason for Chinese to take note in this important global trend.

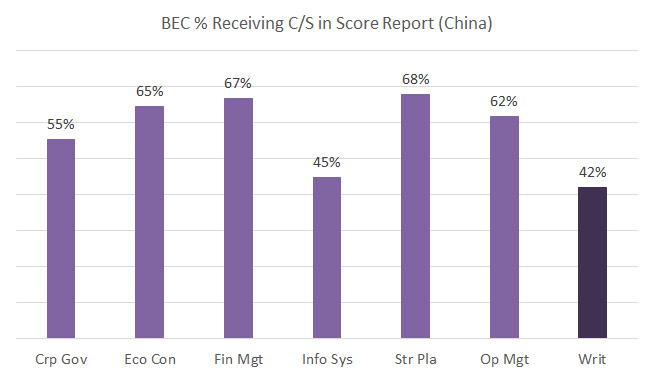

BEC Performance

| Content Area | Stands for: | Weighting |

| Crp Gov | Corporate governance | 16-20% |

| Eco Con | Economics concepts and analysis | 16-20% |

| Fin Mgt | Financial management | 19-23% |

| Info Sys | Information systems | 15-19% |

| Str Plan | Strategic planning | 10-14% |

| Op Mgt | Operations management | 12-16% |

For BEC, Chinese candidates did better than their global counterparts except for Corporate Governance and Information System.

Corporate Governance is in some ways quite similar to Ethics and therefore candidates can use the same approach to improve this section. For Information System, it covers a very broad topic with many obscure technical terms. The idea is not to memorize all those but to try imagine yourself in the IS staff’s situation and how this person uses IT for audit and accounting purposes.

However, please keep in mind that since this data was last reported, the CPA Exam has changed and the BEC section has been replace with the CPA Exam Discipline sections.

For Your Further Reading

Data Source

About the Author Stephanie Ng

I am the author of How to Pass The CPA Exam (published by Wiley), and I also passed all 4 sections of the CPA Exam on my first try. Additionally, I have led webinars, such as for the Institute of Management Accountants, authored featured articles on websites like Going Concern and AccountingWeb, and I'm also the CFO for the charity New Sight. Finally, I have created other accounting certification websites to help mentor non-CPA candidates. I have already mentored thousands of CPA, CMA, CIA, EA, and CFA candidates, and I can help you too!