- You are here:

- Home »

- Blog »

- CPA Career »

- Is Taking the CPA Exam a Waste of Time and Money? Honest thoughts about passing the CPA Exam

Is Taking the CPA Exam a Waste of Time and Money? Honest thoughts about passing the CPA Exam

Here’s a question that our readers frequently ask: Is taking the CPA Exam a waste of time and money? After all, passing the CPA Exam requires a significant amount of time and financial investment. Is it worth it?

In short, the answer is “yes!” Based on our experience, passing the CPA Exam is worthwhile because it opens new doors in your career and can lead to a higher earning potential. So, in this post, we review some of the top reasons to pass the exam and become a CPA.

In short, the answer is “yes!” Based on our experience, passing the CPA Exam is worthwhile because it opens new doors in your career and can lead to a higher earning potential. So, in this post, we review some of the top reasons to pass the exam and become a CPA.

Is the CPA Exam Worth It?

Let’s face it: passing the CPA Exam isn’t easy. The CPA pass rates are low, with only about half (or less!) of candidates passing their exam sections.

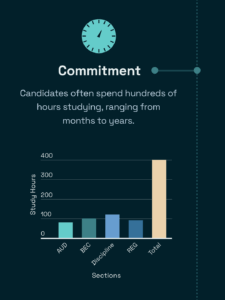

Studying for the exam also requires a significant amount of time and commitment. Although it helps to study with one of the best CPA Exam review courses (like Gleim or Becker), candidates typically spend hundreds of hours studying over the course of months or years.

Studying for the exam also requires a significant amount of time and commitment. Although it helps to study with one of the best CPA Exam review courses (like Gleim or Becker), candidates typically spend hundreds of hours studying over the course of months or years.

Therefore, given these difficulties, it’s natural to question whether the entire journey is worth the hours and money you’re going to spend to be able to add “CPA license” to your resume.

Bottom line

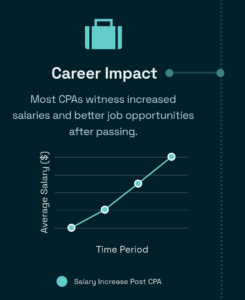

Although every candidate has a slightly different experience, most CPAs believe that passing the CPA Exam has significantly enhanced their career prospects, including increased salaries and better job opportunities.

Here’s a list of some of the best reasons to become a CPA.

You Become a Better Candidate in Job Searches

If you’re looking for a new or better job in the accounting field, having your CPA license will help your CV rise to the top of the pile. In fact, you may even receive messages from recruiters if you put your CPA license status on public sites like LinkedIn.

You’ll Have More Career Mobility

The accounting industry has many professionals who don’t hold a CPA license. And although they may be able to earn good salaries, their upward mobility options are limited. With a CPA license, you’ll be more marketable, and you’ll be able to access more job opportunities.

You May Be Able to Earn More Money

This statement almost goes without saying: most CPAs earn more money than other accounting professionals who don’t have a CPA license. The AICPA reports that accountants who are certified public accountants (CPAs) earn 10-15% more than non-CPAs.

Whether you’re looking for a new position or you’re just looking to re-negotiate your salary with your existing employer, having the CPA license can earn a return of tens of thousands of dollars a year. (To learn more, we have an entire post about CPA salaries.)

So even though there are some costs associated with the CPA Exam, this investment is small in comparison to the increase that you could see in your salary.

Gleim CPA discount applies to Premium Gleim CPA Review sections. Gleim CPA discount auto-applies in your cart once you add an item.

(Use the button – discounted price appears in cart.)

With a CPA License, You Can Do More

Of course, one of biggest reasons to get your license is that CPAs have more rights and abilities than non-CPA accountants. For instance, CPAs can represent clients on tax matters before the IRS. Enrolled agents and tax attorneys have these rights, too, but non-CPA accountants do not.

You’ll Be Proud of Yourself

Passing the CPA Exam is a huge personal achievement. Once you’ve passed all four sections of the CPA Exam, you feel incredibly proud of yourself. And that boost in confidence spills over into other areas of your life and career in ways that you won’t truly understand until you take the final steps of the CPA journey yourself.

Final Thoughts: A CPA license leads to more opportunities

Final Thoughts: A CPA license leads to more opportunities

In sum, the CPA license is worth earning, despite the time and expense that it takes. Even though it might take you several months to pass the CPA Exam, that time frame is short in comparison to the career-long benefits it could yield.

What Do You Think: Is the CPA Exam worth it?

If you’ve passed the CPA Exam, we would love to know what you think! Was it worth it to study for exams and pass them, even if you had some bumps along the way? Leave us a comment and share your story!

About the Author S ML

Susan L. is one of the biggest cheerleaders on the I Pass the CPA Exam team. She loves seeing our readers succeed. You'll often find her writing about all things accounting.

Final Thoughts: A CPA license leads to more opportunities

Final Thoughts: A CPA license leads to more opportunities