- You are here:

- Home »

- Blog »

- CPA Exam Details »

- BEC CPA Exam: Ultimate 2023 CPA BEC Guide to Business Environment and Concepts

BEC CPA Exam: Ultimate 2023 CPA BEC Guide to Business Environment and Concepts

Please note: The CPA Exam changed in 2024, and the BEC section was eliminated by the CPA Discipline sections. However, we have decided to keep this post about BEC for historical purposes.

The process of earning the Certified Public Accountant (CPA) license involves passing the BEC CPA Exam. The CPA Exam has 4 different sections, and one of them is Business Environment and Concepts (BEC). To pass BEC CPA Exam, you must know the content, pass rates, questions, format, difficulty, structure, timing, and more. You also need to know how long does it take to study for BEC, since BEC has question types not found anywhere else. Nevertheless, even though the BEC exam length is the same as the other CPA sections, it has the highest pass rate. But don’t be nervous about the CPA BEC format—just use this BEC exam breakdown to beat BEC!

Table of Contents

- Introduction to the BEC CPA Exam Section

- BEC CPA Exam Section Content

- CPA BEC Exam Pass Rates and Reputation

- Types of BEC CPA Exam Questions

- BEC CPA Exam Format

- Difficulty Levels of Business Environment and Concepts on the CPA Exam

- Testing Process for the CPA BEC Exam

- Structure of the CPA BEC Exam

- Time Management for the BEC CPA Exam Section

- BEC CPA Exam Section Testing Windows and Scheduling

- CPA BEC Exam Passing Score and Grading

- BEC CPA Exam Section Study Time

- BEC CPA Exam Tips

- Study Advice for the CPA BEC Exam

- More Help for the CPA Exam Sections

Introduction to the BEC CPA Exam Section

As we learn in the AICPA BEC CPA Exam Blueprints, the BEC CPA Exam section covers the knowledge of the general business environment and business concepts that candidates must know to understand the underlying business reasons for and accounting implications of business transactions. BEC also assesses candidates for the skills needed to apply that knowledge in performing financial statements, audit and attestation engagements, and other functions normally performed by CPAs that affect the public interest.

Now, many candidates find the CPA BEC exam to be the easiest (or rather, least difficult) of the four exam sections. With my background in economics, I also found BEC to be a less stressful CPA Exam section. However, if you are fresh out of college or are unfamiliar with real business operations, you cannot afford to underestimate BEC.

* Note: The CPA Exam is changing next year, and BEC will be replaced with new sections! Therefore, I’ve included information about what will replace BEC in 2024 at the end of the post. I also have a guide to the 2024 CPA Exam changes.

BEC CPA Exam Section Content

Again, the BEC blueprint focuses on business. In five content areas, BEC addresses audit, attest, accounting, and review services, financial reporting, tax preparation, and other professional responsibilities of CPAs. This table outlines the CPA BEC exam content for you.

CPA Exam BEC Section Content

| Content Area | Title | Allocation |

| I | Enterprise Risk Management, Internal Controls, and Business Processes | 20-30% |

| II | Economic | 15-25% |

| III | Financial Management | 10-20% |

| IV | Information Technology | 15-25% |

| V | Operations Management | 15-25% |

2021 vs 2022 vs 2023 Blueprints

You should also be aware that the AICPA occasionally updates the content tested on the CPA Exam. These alterations keep the exam in line with the skills needed by a newly licensed CPA.

For example, the CPA Exam Blueprints changed on July 1, 2021. Before making these updates, the AICPA first worked with professionals in the field to figure out how the roles of newly licensed CPAs are changing. They decided that while most of the exam content was still needed, some were outdated and needed to be removed. The differences between IFRS and U.S. GAAP, for instance, were deleted since newly licensed CPAs no longer deal with that information. Additionally, other new topics were included in the Blueprints for the first time, such as understanding business processes and identifying risks.

A note about the BEC Blueprint for 2020 vs. 2021-2022 and 2023

I want to answer a common question about the BEC Blueprints. CPA candidates sometimes ask if the BEC exam 2020 Blueprints are the same as the ones for 2021, 2022, and 2023. I think the confusion is because the current Blueprints are technically the 2020 Blueprints that have been updated for 2021. (The BEC exam format for 2020 is the same as the BEC exam format for 2022 and 2023, too.)

Therefore, the topics for the CPA Exam BEC content areas as updated for 2023 include:

Area I: Enterprise Risk Management, Internal Controls, and Business Processes

- Recalling concepts from and applying enterprise risk management

- Recalling concepts from and applying internal controls

- Recalling and applying key corporate governance provisions of the Sarbanes-Oxley Act of 2002

- Describing the types and purposes of accounting and financial reporting information systems and related tools and software

- Identifying aspects of an entity’s manual and automated business processes and controls

- Analyzing the flow of transactions to identify the risks in key business processes

Area II: Economic Concepts and Analysis

- Understanding business cycles and economic indicators and explaining the impact of government intervention in a market

- Quantifying the effect of changes in economic conditions on an entity’s products

- Determining the business reasons for, and the underlying economic substance of, transactions and their accounting implications

- Measuring financial risks to a business and the effect of implementing mitigating strategies

Area III: Financial Management

- Assessing the factors influencing a company’s capital structure, such as risk, leverage, cost of capital, growth rate, profitability, asset structure, and loan covenants

- Calculating metrics associated with the components of working capital, such as current ratio, quick ratio, cash conversion cycle, and turnover ratios, to determine the impact of business decisions on working capital

- Understanding commonly used financial valuation and decision models and applying that knowledge to assess assumptions, calculate the value of assets, and compare investment alternatives

Area IV: Information Technology

- Understanding the role of IT and systems in supporting an entity’s overall vision, strategy, and business objectives

- Identifying IT-related risks associated with an entity’s systems and processes, such as change management and information security, including cyber risks and risks introduced by relationships with third parties

- Identifying application and IT general control activities, whether manual, IT-dependent or automated, that are responsive to IT-related risks, such as access and authorization controls and business resiliency plans

- Obtaining and transforming data to prepare it for data analytics to support business decisions

Area V: Operations Management

- Understanding business operations and use of quality control initiatives and performance measures to improve operations

- Applications of cost accounting concepts and use of variance analysis techniques

- Utilizing budgeting and forecasting techniques to monitor progress and enhance accountability

CPA BEC Exam Pass Rates and Reputation

At this moment, the BEC CPA Exam pass rates are, quite simply, the best of the best. BEC achieved some record-breaking pass rates in 2018 and has basically dominated the pass rate charts for the last several years.

2017-2023 BEC CPA Exam Pass Rates

| Year | First Quarter | Second Quarter | Third Quarter | Fourth Quarter | Cumulative |

| 2023 | 56.98% | 59.16% | 54.90% | 38.17% | 47.44% |

| 2022 | 57.33% | 61.53% | 59.91% | 60.30% | 59.85% |

| 2021 | 62.16% | 63.31% | 61.73% | 60.27% | 61.94% |

| 2020 | 61.76% | 76.92% | 69.89% | 60.77% | 65.56% |

| 2019 | 58.00% | 59.74% | 63.04% | 58.61% | 59.98% |

| 2018 | 56.43% | 60.31% | 60.17% | 60.13% | 59.35% |

| 2017 | 50.39% | 55.09% | 55.35% | 55.33% | 52.99% |

BEC rose to the top of the CPA Exam pass rates in 2011 by coming back from behind. From 2006 to 2011, BEC lived at the bottom of the pack with the lowest pass rates. Then, after the CPA Exam changed in 2011, it pulled off an unpredictable betrayal and supplanted all the other sections. Since then, BEC has never looked back but retained its top-dog position for several years straight, even though the 2022 and 2023 rates decreased somewhat from 2021.

Still, don’t think that these high pass rates mean you can cut down on your BEC study time. The BEC topics still have some tricky subjects, and you can’t take any kind of BEC cheat sheet to the test center with you. Plus, the BEC structure is unique because it’s the only exam section with essay-like questions called Written Communications. Therefore, you should still plan to study the BEC CPA exam content.

CPA BEC Exam Difficulty

So, what enabled BEC to shake its underdog status and then subsequently rule the roost for so long? Well, of all the CPA Exam sections, BEC is the least technical. What’s more, the majority of BEC tests candidates for the second-lowest skill level, “Application.” And, BEC has only included task-based simulations (TBSs) since April 2017. But BEC still only has half as many TBSs as the other exam sections (4 compared to AUD, FAR, and REG’s 8), so BEC is still half as difficult in this regard. After all, most candidates think that the TBSs are the hardest part of the CPA exam structure.

BEC also comes away with fewer multiple-choice questions (MCQs) than any other exam section, with just 62. And finally, BEC is the only section with written communications (WCs). The BEC test format has 3 WCs, and these questions comprise 15% of your score. WCs aren’t so bad as MCQs and TBSs, though. Their purpose is to prove that you can write an organized, well-developed business document containing clearly expressed correct information.

So, all of these factors work together to make BEC the least challenging CPA Exam section and consequently the holder of the highest CPA Exam pass rates.

Types of BEC CPA Exam Questions

The BEC CPA Exam section stands out from the other three CPA Exam sections by having one additional question type. While the other three sections only have two types of questions, the BEC exam structure has three.

The AUD, FAR, and REG CPA Exam sections utilize just two types of questions: multiple-choice questions (MCQs) and task-based simulations (TBSs). However, BEC uses both of these question types as well as a third question type: written communications (WCs).

On the CPA BEC exam, the MCQs contribute to 50% of your total score. The TBSs account for another 35%, and the WCs add the remaining 15%.

Multiple-choice questions (MCQs):

The CPA Exam multiple-choice questions do look like the MCQs you’ve seen on other exams. However, the CPA Exam has made its versions more complicated. After all, BEC is an accounting exam. So the BEC test questions have to determine your accounting ability, despite the use of MCQs.

Furthermore, a CPA Exam MCQ (including the BEC exam questions) has three parts:

- The question stem: the question stem contains the question being asked (usually found at the end of the stem), details necessary for answering the question, and additional information.

- Correct answer choice: the 1 answer choice of the 4 provided that best responds to the question.

- The distractors: the 3 other answer choices designed to distract you from the correct answer.

Task-based simulations (TBSs):

Task-based simulations are the CPA Exam’s version of condensed case studies. TBSs present you with real work-related situations and require you to apply your knowledge and skills to resolve those situations. For example, you may need to use the information found either in the question or in the exhibits provided to perform a calculation, fill in a series of blanks, or revise a document to finish a TBS. If you use a review course to study for the BEC exam, your BEC course should include lots of TBS examples, so you learn how to answer them.

The BEC CPA Exam sections feature one particularly important type of TBS: the Document Review Simulation (DRS). The DRS expects you to look over various resources in the process of analyzing a document.

Written Communications (WCs):

Written Communications are the only CPA Exam questions that require you to write out your response. To answer a WC, you must read a scenario and then follow the instructions to write the appropriate document relating to the scenario and give that document the proper focus. Your written response should include the correct information and be clear, complete, and professional.

Most candidates don’t struggle with Written Communications after a little preparation. Therefore, I have an entire article about how to study for the BEC Written Communications.

BEC CPA Exam Format

The AICPA has completely computerized every section of the CPA Exam. Additionally, each section contains five testlets presenting different question types. BEC has two testlets of 62 total MCQs, two testlets of four total TBSs, and one testlet of three WCs.

Format of the CPA Exam BEC Section

| Testlet | Question Type | Number of Questions |

| Testlet 1 | MCQ | 31 |

| Testlet 2 | MCQ | 31 |

| Total MCQs: 62 (50% of your score) | ||

| Testlet 3 | TBS | 2 |

| Testlet 4 | TBS | 2 |

| Total TBSs: 4 (35% of your score) | ||

| Testlet 5 | WCs | 3 |

| Total WCs: 3 (15% of your score) | ||

BEC exam format: Pretest questions

Each CPA Exam section’s total number of questions features both operational and pretest questions. However, only the operational questions affect your CPA Exam score. The pretest questions do not count in your score because the AICPA includes them to collect candidate performance data instead. The AICPA uses this information to decide whether to use the pretest questions as operational questions in future exam iterations.

Yet, while you may assign operational and pretest questions a different value, you can’t give them a different amount of attention. I say this because the operational and pretest questions are indistinguishable in each exam section. So, you really must answer all the CPA Exam questions you receive to the best of your ability.

However, the presence of BEC pretest questions shouldn’t discourage you. Rather, pretest questions should encourage you due to the fact that some of the most challenging or surprising questions you see on BEC may be pretest questions. So, if you see such a question, you shouldn’t worry about it. You should simply answer it as well as you can and move on with the hope that it was probably a pretest question and, therefore, will not influence your score.

How many pretest questions are in BEC?

The total number of BEC CPA Exam questions includes these totals for operational and pretest questions:

Format of CPA Exam BEC Questions

| Question Type | Operational | Pretest |

| MCQ | 50 | 12 |

| TBS | 3 | 1 |

| WC | 2 | 1 |

Difficulty Levels of Business Environment and Concepts on the CPA Exam

The AICPA makes the goal of the CPA Exam explicit: to verify that candidates have the knowledge and skills needed for a newly-licensed CPA and to represent the certification well. The AICPA ensures that the CPA Exam can fulfill this purpose by defining the difficulty of each exam section with four different levels of skill.

CPA Exam Skill Levels

(from highest to lowest)

| Skill Level | Description |

| Evaluation | The examination or assessment of problems, and use of judgment to draw conclusions. |

| Analysis | The examination and study of the interrelationships of separate areas in order to identify causes and find evidence to support inferences. |

| Application | The use or demonstration of knowledge, concepts, or techniques. |

| Remembering and Understanding | The perception and comprehension of the significance of an area utilizing knowledge gained. |

The BEC CPA Exam section tests candidates at three of these skill levels.

CPA BEC Exam Skill Levels

| Skill Level | Remembering and Understanding | Application | Analysis |

| Content Percentage | 15-25% | 50-60% | 20-30% |

| Content Areas | I, II, III, IV, & V | I, II, III, IV, & V | I, II, III, & V |

| Question Type | Mostly MCQs | Mostly MCQs, possibly TBS and WCs | Primarily TBSs, possibly MCQs |

According to the chart, BEC places the most weight on the Application skill level and distributes this weight across all 5 content areas. Therefore, you need to have more than just a passing familiarity with all of BEC’s content. But, at the same time, you don’t need to know the BEC material at the deepest level of knowledge.

BEC’s lack of depth makes sense because it consists mostly of MCQs, even though it has the lowest number of MCQs of all the exam sections. Furthermore, the WCs only assess you at the Application level of knowledge, and these make up 15% of your score. So, you’re left with just four TBSs to challenge you at a higher level of knowledge than Application. Consequently, many candidates don’t find BEC to be as difficult as some of the other exam sections.

Testing Process for the CPA BEC Exam

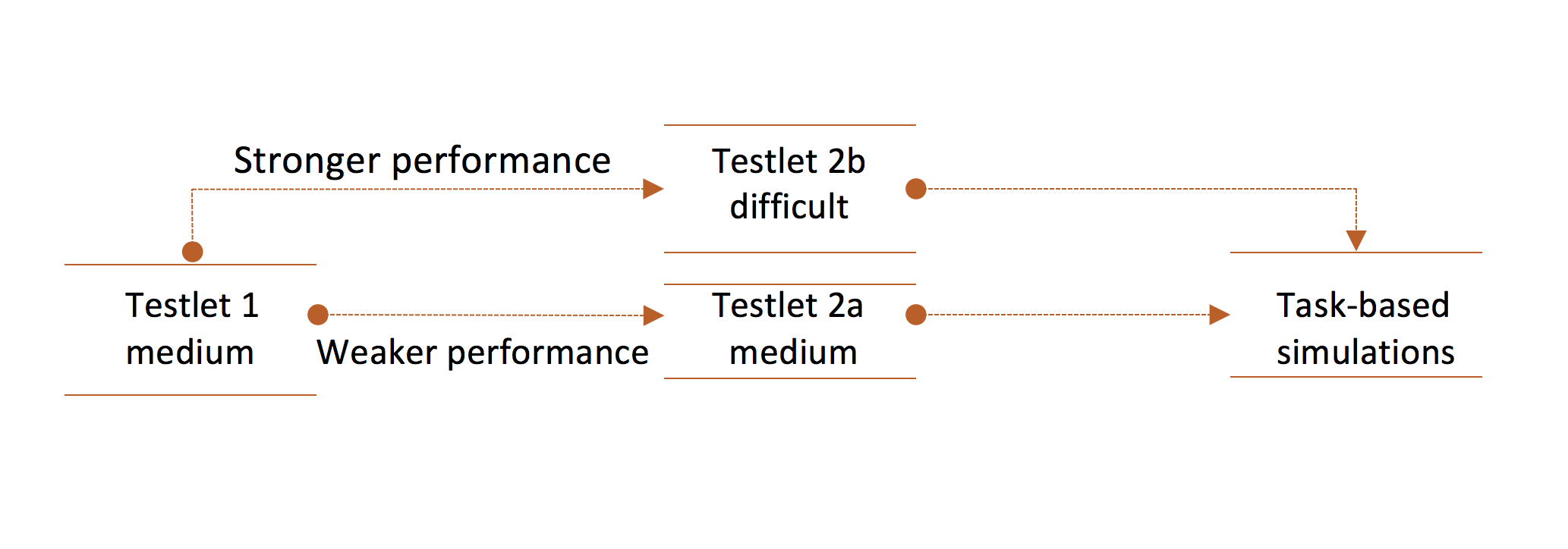

Because BEC has MCQs like the other CPA Exam sections, it follows the exam-standard presentation of MCQ testlets, which is a multistage adaptive delivery model. This big term may be ambiguous, but it just means that your performance in the first MCQ testlet determines the difficulty level of the second MCQ testlet you receive.

Testlet selection

As this graphic illustrates, you’ll always receive a moderately difficult (“medium”) MCQ testlet first for any CPA Exam section. Then, if you perform well on this testlet, you’ll receive a slightly more difficult (“difficult”) MCQ testlet second. If you don’t perform very well on the medium testlet, the exam will serve you another medium MCQ testlet. The BEC test format follows this same model.

The CPA Exam uses the average difficulty of the MCQs within a testlet to determine that testlet’s difficulty level. The MCQ difficulty level exists on a numeric scale; it is not binary.

Furthermore, on the CPA Exam, you earn more points for answering a difficult question correctly than for answering an easier question correctly. Consequently, the exam won’t penalize you for receiving a more difficult MCQ testlet or let you benefit from getting two medium MCQ testlets. So although you should be aware of the BEC CPA format, don’t stress if you think you get medium testlets on exam day.

The CPA Exam follows a different system to establish TBS and WC testlet difficulty. Instead of allowing your performance to influence the difficulty, the CPA Exam predetermines the difficulty of your TBS and WC testlets. But thankfully, you can earn partial credit for your work on the TBSs and WCs you receive.

Structure of the CPA BEC Exam

Whether you sit for BEC or any other CPA Exam section, you will have the same amount of time to finish each exam section: 4 hours (240 minutes). Plus, you’ll need to go through some additional screens at the beginning and end of the exam, and you’ll receive 15 minutes to do so. After the third testlet (first TBS testlet), you can also take advantage of a standardized 15-minute break. This optional break is the only one you can take that will pause the exam timer. Any other break you go on won’t stop the timer.

BEC CPA Exam Structure

- Welcome/enter launch code: 5 minutes

- Confidentiality/section information: 5 minutes

- Standardized break: 15 minutes

- Survey: 5 minutes

As you can see in this illustration, you are allowed to take an optional break after each testlet. But as mentioned, these breaks don’t pause the exam timer, so you’ll be taking them at your own risk.

And although the test center proctor oversees the general time monitoring for the CPA Exam, you still must manage your time so you can answer all of the questions.

Time Management for the BEC CPA Exam Section

Here’s one of my best BEC tips: Want to know the secret to having the best chance to pass BEC? Time management.

That’s right: You can only ensure that you answer every exam question and maximize your exam score by practicing time management. For this reason, you should definitely develop, practice, and apply your BEC time management system before you take this exam section.

BEC Exam Time Management System: Option 1

When you stick to a strict time limit of 1 minute per BEC MCQ question, you can knock out both MCQ testlets in a little more than an hour (62 minutes). You can then give yourself a predetermined amount of time to finish each TBS according to type:

- Basic TBS: 10-15 minutes

- DRS (Document Review Simulation): 20-40 minutes

Or, you can just give yourself 18 minutes for each TBS. Assigning 18 minutes to each TBS would leave you with 106 minutes for the three WCs, so you’d have about 35 minutes for each of those.

BEC Time Management System: Option 2

On the other hand, if you give yourself 1 ¼ minutes for each BEC MCQ, you’ll take as long as 78 minutes to complete the first two exam testlets. You may want to consider doing this in light of the fact that your second MCQ testlet could be harder than your first and therefore require more time to finish.

With the 162 minutes you have left, you could use 87 minutes for the two TBS testlets. This amount of time breaks down to a little less than 22 minutes per TBS.

Finally, with your remaining 75 minutes, you could give yourself 25 minutes for each WC.

BEC CPA Exam Section Testing Windows and Scheduling

In the past, candidates could only take the exam during the four annual CPA Exam testing windows:

- January 1 – March 10

- April 1 – June 10

- July 1 – September 10

- October 1 – December 10

However, as of July 2020, most jurisdictions now allow continuous testing. That is, candidates don’t have to wait for one of the windows to take the exam. A few states still don’t allow continuous testing, though. But you can check on the status of your jurisdiction from NABSA or the National Association of State Boards of Accountancy. (Note: The CPA Exam schedule will change in 2024 and will have some blackout dates. Therefore, it’s important to understand the 2024 CPA Exam changes and the future CPA Exam schedule.)

Regarding the timeline to pass the exam, you must pass all CPA Exam 4 sections within a rolling period of 30 months. Your 30 months begin as soon as you pass your first exam section. So, conveniently, you have a while to pass the other 3 sections.

If you fail to pass the remaining exam sections within this time, then your credit for your first passed section will expire. What’s more, the start date of your 30-month window will move back to the day of your earliest section pass. At this point, you’ll have to pass the section you already passed again as well as the sections you haven’t yet passed within the new 30-month timeframe. And until you accomplish this, your 30-month window will continue to restart, and you’ll continue to lose credit for your earliest passed section.

Your CPA Exam Schedule

Having weighed the pros and cons of placing each exam section at the beginning of your CPA Exam schedule, I’ve determined that starting with the most difficult section is the wisest way to go. And currently, FAR, not BEC, is the most difficult CPA Exam section.

FAR is the most difficult because it covers the most content and therefore requires the longest amount of study time. So, if you start your exam journey by passing FAR, then you won’t have to include all of that extra study time in your 30-month window. Another benefit of starting with FAR is that its content overlaps with that of AUD and BEC. Therefore, the material of AUD and BEC will look familiar when you come to it, and you won’t have to study for these two sections as long or as hard.

Recommended Placement of BEC in Your CPA Exam Schedule

So, if I don’t recommend putting BEC first on your schedule, where do I think it should go?

Honestly, I would leave BEC for last. The content relationship between AUD and FAR lends itself to placing them back-to-back. Then, because REG is fairly challenging on its own, addresses new material, and can take longer to study for, I’d drop REG in the third-place spot.

Though BEC also aligns with FAR and AUD, finishing the race with BEC isn’t a bad idea because studying for it shouldn’t take too long and will feel like going downhill. With the WCs accounting for 15% of your score, only four TBSs making an appearance, and the presence of very high BEC pass rates, you’re more likely to get that last pass you need if you end with BEC.

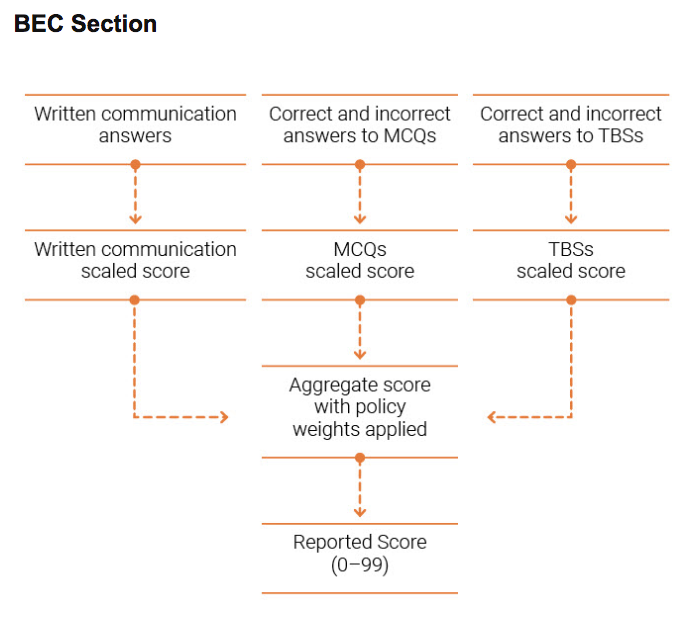

CPA BEC Exam Passing Score and Grading

The passing score for every CPA Exam section, including BEC, is 75. That 75 is a scaled score, not a percentage of correct questions. The AICPA configures your scaled BEC score by taking these steps:

BEC CPA Exam Section Study Time

Using my own personal experience, the feedback from my readers, and the suggestions of CPA review course providers, I estimate that you should prepare to spend somewhere between 60-80 hours studying for BEC. Of course, that’s just an average. Therefore, your personal BEC study time could be more or less depending on your accounting background.

Remember, if you’ve already passed FAR, studying for BEC shouldn’t take you as long. But, to give yourself a better idea of how long studying for BEC will take you, you can survey BEC’s content using the BEC CPA Exam Blueprints. The Blueprints reveal the content areas, groups, and topics you’ll see on BEC.

How many hours to study for BEC

If you want to finish BEC in a flash, you should push yourself to study for at least 20 hours a week. Then you’ll finish your review in 3-4 weeks.

Not so pressed for time in your 30-month window? Then you can slow your BEC studies down a bit by putting in 15 hours a week and concluding your review in 4-5 weeks.

If you’re lacking time in the rest of your life for BEC studying, then you can keep it to just 10 hours a week and wrap things up in 6-8 weeks.

How to pass BEC in two weeks

If you’re really ambitious and have the study time, you could even pass BEC in as little as two weeks. You would need to study 30 to 40 hours each week, which might not be manageable if you have a full-time job, too. But still, if you had a good BEC CPA study guide and were dedicated, you might be able to make it work.

BEC CPA Exam Tips

My best advice for making sure you master the BEC material? Tackle the different topics one by one.

BEC CPA Exam Study Guide

BEC is a basket of miscellaneous business, economics, and financial concepts. These topics don’t relate to each other, so some candidates struggle to retain the information. To prevent yourself from succumbing to this same struggle, take on each topic one at a time.

1. Corporate Governance

Corporate governance is an important topic with connections to other CPA Exam sections such as AUD. To do well with this topic, pay special attention to the role of the Board of Directors and the Audit Committee. This topic isn’t too difficult, but questions about it can be tricky, so you need to know your stuff when it comes to corporate governance.

2. Economics

If you’ve taken an economics class, you should find the questions on the BEC CPA Exam to be pretty straightforward, as they should only cover elementary micro and macroeconomics. Yet, even if you don’t have much prior economics knowledge, the concepts shouldn’t be too difficult. In fact, you can usually use common sense to guesstimate.

Your strategy for introducing yourself to the economics concepts on the BEC exam should be to go through the textbook or video lectures fairly quickly. Next, focus your time on the practice questions. You may be surprised by how many wrong answers you may get in the beginning, but that’s just how tricky the CPA Exam can be. Hence, the low pass rates. But don’t get discouraged. Instead, know that your performance will improve once you get used to the question format.

3. Financial Management

My experience in the strategic planning department made this topic easier for me. However, I understand that people who haven’t done much financial modeling may see it as very complex.

So, the trick for taming financial management is to really understand how the calculation works. Also, don’t memorize anything more than the basic formula. If you can’t figure the basic formula out, contact the accounting professors/experts to which your review course gives you access. These professionals should be able to offer an explanation that sets the record straight for you.

4. Information Technology (IT)

IT is such a huge topic that your CPA review course can’t really get to it all. However, IT is very important in real life, as the accounting industry continues to increase the involvement of IT in its operations. Already, accountants post all journal entries into the system that generates everything from monthly statements to management reports and more. So, due to IT’s ever-rising significance, each accountant must learn how to maintain the integrity and security of this system.

While IT is not always the most interesting thing to study (I know, I’ve been there, and the reading took forever…), it’s important to understand how IT impacts the finance and accounting industry. In fact, in the 2021 Blueprints, the CPA Exam added more coverage of technology’s impact on business environments, data management, and having a data-driven mindset. But still, you can do well with this material after studying the material in your review course and then focusing your time on the practice questions.

Do you need an information technology CPA course?

You don’t need to be a technology whiz to pass the CPA Exam. However, since all of Area IV of the BEC blueprints is devoted to information technology, you can’t be totally ignorant about it, either. Therefore, if you look through the BEC CPA exam content and are lost, an information technology CPA class wouldn’t hurt.

The easiest way to find an information technology CPA class might be right from your BEC review course. After all, some of the best CPA courses—like Becker—now include access to live (or live online) classroom-style classes. And the topics run the whole gamut of the CPA Exam, including information technology.

5. Strategic Planning and Operational Management (Cost Accounting)

You may have learned about cost accounting in college. But if you didn’t, then this BEC topic may be challenging for you. In fact, you may need extra help to get a handle on cost accounting, so don’t be afraid to call on the instructors who really understand the concepts behind it.

I must confess: I think I still don’t really get cost accounting. But at the time, I understood it well enough to pass the BEC exam. If you really can’t figure cost accounting out, work extra hard on understanding the rest of the BEC content, so you can still pass.

Study Advice for the CPA BEC Exam

Along with taking the above steps to get a solid grasp on the biggest BEC topics, you should follow these additional CPA BEC study tips to ensure exam success.

1. Do NOT underestimate BEC.

By bracing themselves for the worst, some candidates pass the other three exam sections on the first try. But then, they don’t put as much effort into BEC and get stuck on it for quite some time. It is easier for most candidates but not all candidates. So, don’t assume that passing BEC won’t still take some effort.

Therefore, one of my best BEC exam tips is simply this: Study!

2. Strengthen your weak areas.

To pass BEC, you must master every content area no matter how much you hate it. So, whether it be cost accounting or financial modeling, commit to learning the content you don’t enjoy or that you struggle with as much as the content you prefer to study.

To pass BEC, you must master every content area no matter how much you hate it. So, whether it be cost accounting or financial modeling, commit to learning the content you don’t enjoy or that you struggle with as much as the content you prefer to study.

To strengthen your weak areas, you’ll need to watch all the video lectures and read all of the chapters in your BEC CPA Exam review course about that content. You must also work through all of the practice questions that ask about those topics.

Basically, you can’t skimp on studying when it comes to your weak areas, or you won’t score as well on BEC as you want. It doesn’t matter how many BEC CPA tips I give you in the end; you just need to study the content.

3. Don’t give up.

If you find BEC to be fairly difficult when everyone else you know thought it was a breeze, don’t panic. BEC has had its fair share of pretty low passing rates. And it’s not meant to be a walk in the park.

BEC’s content is a bit more varied than the content of some of the other exam sections. Consequently, you may find an area or two in which understanding doesn’t come naturally to you. And that really is okay. As long as you stick with it and give the hard parts the attention they need to become easy, you can pass.

4. Prepare for the Written Communications.

Writing a business memo might not seem as bad as working through a DRS, but you still can’t wing your responses to the WCs. Instead, you need to practice answering them to ensure you have a plan.

Once you’ve read the question, make note of each requirement. Then, create a quick little outline that addresses each requirement. Your main goal is to stay on topic and avoid providing illegal advice. Your second goal is to provide ample evidence for all of your claims. So, fill the outline in with all the important information. Next, add the final components and finish the formatting.

After you’ve completed your draft, edit it for grammar, punctuation, word choice, and relevance. Also, confirm that you’ve said everything you could about the topic. If something else comes to mind, add it.

Unless you practice the process of crafting a well-written and well-thought-out WC, you’ll miss out on an easy 15% of your BEC score.

How to Study for the BEC CPA Exam

The easiest way to study for BEC is to use a BEC CPA course. After all, as I’ve already mentioned, the BEC CPA test covers a lot of material. Therefore, if you just download the BEC AICPA Blueprints or only download an online BEC study guide or BEC formulas, you might not get the full scope of the content to study.

However, a good BEC CPA review course will break down the topics and teach you concepts you don’t know. Although they are a financial investment, a BEC CPA exam review course is the best way to pass this section.

What’s the best BEC CPA review?

The “best” CPA BEC course is one that fits your learning style. For instance, if you liked your accounting lectures in college, you might enjoy a course with good video lectures. Or, if you like to take notes in your textbook (I personally love a good highlighter), you’ll want a course that includes hard-copy textbooks. Likewise, some people need some extra attention, and several BEC courses now include tutoring services, too.

In general, though, a good BEC CPA review will include:

- A BEC study guide, study notes, or textbooks.

- Plenty of BEC practice questions, including MCQs, TBSs, and WCs.

- Audio or video lectures that teach the BEC exam

- At least one full-length sample BEC test. It should be timed, too, so you can get comfortable with the BEC time

For example, among the best CPA review courses on the market, Becker CPA and Surgent CPA have top-rated BEC reviews, too. So if you’re looking for how to pass the BEC CPA exam, check out those courses.

2024 CPA Exam Changes and BEC

If you haven’t heard yet, the CPA Exam is changing in 2024 in a fairly substantial way. The exam content is updated from year-to-year to reflect new tax laws and accounting standards. However, in 2024, the exam format is being altered, too. Basically, NASBA and the AICPA have announced their plans for the “CPA Evolution” initiative to overhaul the CPA Exam. This initiative will:

- Revise the Uniform CPA Examination Blueprints

- Launch a new CPA Exam in January 2024

- Change the CPA Exam format to a “Core-Plus-Discipline Model”

In a nutshell, the revised exam should better test candidates’ abilities to be newly licensed CPAs. The new exam will still have four parts, but they are a little different from the 2023 CPA Exam format.

- The CPA Exam will still address the core concepts of accounting, auditing, tax, and technology just as it does now.

- Candidates will have to demonstrate deeper knowledge in one specific discipline of their choice from the following list: a) business reporting and analysis, b) information systems and controls, or c) tax compliance and planning.

How Will the 2024 CPA Exam Changes Affect BEC?

Basically, the 2024 CPA Exam won’t include a BEC section. Instead, candidates will have to pass 3 “core” sections and 1 “discipline” section of their choice:

- 3 core sections that all candidates will take: Auditing and Attestation (AUD), Financial Accounting and Reporting (FAR), and Taxation and Regulation (REG)

- Candidates must also choose 1 discipline section: Business analysis and reporting (BAR), Information systems and controls (ISC), and Tax compliance and planning (TCP)

2024 CPA Exam Syllabus – Discipline Sections

In 2024, the BEC section will be replaced by the “discipline” sections of Business analysis and reporting (BAR), Information systems and controls (ISC), and Tax compliance and planning (TCP). CPA candidates don’t have to take all of these sections; instead, they can choose the section that best fits their career plans.

Here’s a run-down of the syllabus for the 2024 CPA Exam discipline sections:

BAR: 2024

| Content Area | Title | Allocation |

| Area I | Business Analysis | 40-50% |

| Area II | Technical Accounting and Reporting | 35-45% |

| Area III | State and Local Governments | 10-20% |

Area I: Business Analysis

- Financial statement analysis

- Non-financial and non-GAAP measures of performance

- Managerial and cost accounting

- Budgeting, forecasting, and projection

- Capital structure

- Investment alternatives using financial valuation decision models

- Risk management

- Economic and market influences on business

Area II: Technical Accounting and Reporting

- Indefinite-lived intangible assets, including goodwill

- Internally developed software

- Revenue recognition

- Stock compensation (share-bared payments)

- Research and development costs

- Business combinations

- Consolidated financial statements

- Derivatives and hedge accounting

- Leases

- Public company reporting topics

- Financial statements of employee benefit plans

Area III: State and Local Governments

- Government-wide financial statements

- Governmental funds financial statements

- Proprietary funds financial statements

- Fiduciary funds financial statements

- Notes to financial statements

- Management’s discussion and analysis

- Budgetary comparison reporting

- Required supplementary information (RSI) other than management’s discussion and analysis

- Financial reporting entity, including blended and discrete component units

- Net position and components thereof

- Fund balances and components thereof

- Capital assets and infrastructure assets

- General and proprietary long-term liabilities

- Intern activity, including transfers

- Nonexchange revenue transactions

- Expenditures and expenses

- Budgetary accounting and encumbrances

ISC: 2024

| Content Area | Title | Allocation |

| Area I | Information Systems and Data Management | 35-45% |

| Area II | Security, Confidentiality, and Privacy | 35-45% |

| Area III | Considerations for System and Organization Controls (SOC) Engagements | 15-25% |

Area I: Information Systems and Data Management

- IT Infrastructure

- Enterprise and accounting information systems

- Availability

- Change management

- Data management

Area II: Security, Confidentiality, and Privacy

- Regulations, standards, and frameworks

- Threats and attacks

- Mitigation

- Testing

- Confidentiality and privacy

- Incident response

Area III: Considerations for System and Organization Controls (SOC) Engagements

- Considerations specific to planning and performing a SOC engagement

- Considerations specific to reporting on a SOC engagement

TCP: 2024

| Content Area | Title | Allocation |

| Area I | Tax Compliance and Planning for Individuals and Personal Financial Planning | 30-40% |

| Area II | Entity Tax Compliance | 30-40% |

| Area III | Entity Tax Planning | 10-20% |

| Area IV | Property Transactions (disposition of assets) | 10-20% |

Area I: Tax Compliance and Planning for Individuals and Personal Financial Planning (30-40%)

- Individual compliance and tax planning considerations for gross income, adjusted gross income, taxable income, and estimated taxes

- Compliance for passive activity and at-risk limitations (excluding tax credit implications)

- Gift taxation compliance and planning

- Personal financial planning for individuals

Area II: Entity Tax Compliance

- Net operating and capital loss utilization

- Transactions between a shareholder and a C corporation (contributions to and distributions from a corporation and loans)

- Consolidated tax returns

- International tax issues

- Basis of shareholder’s interest

- Transactions between a shareholder and an S corporation (contributions to and distributions from a corporation)

- Partnerships

- Trust

- Tax-exempt organizations

Area III: Entity Tax Planning

- Formation and liquidation of business entities

- Tax planning for C corporations

- Tax planning for S corporations

- Tax planning for partnerships

Area III: Property Transactions

- Nontaxable disposition of assets

- Amount and character of gains and losses on asset disposition and netting process

- Related party transactions, including imputed interest

Why You Should Take the Exam Now Before the 2024 CPA Exam Changes

Moreover, if you’ve been on the fence about applying for the CPA Exam, now is the time. After all, I can’t imagine that the 2024 exam changes are going to make the exam easier. In fact, the opposite is probably true, and the post-2024 CPA Exam might actually be more difficult than the current one.

BEC Study Tips and FAQs

What is the BEC section of the CPA Exam?

BEC—or Business Environment and Concepts—is one section of the 4-part CPA exam structure. The other sections include AUD (Auditing), FAR (Financial Accounting and Reporting), and REG (Regulation).

What is on the BEC CPA Exam?

The BEC accounting exam tests your knowledge and skills in audit, attest, accounting, and review services. The BEC CPA Exam format also has content that addresses financial reporting, tax preparation, and other professional services.

How many hours to study for the BEC CPA exam?

If you’re wondering how long to study for BEC, that really depends on your education and background. However, the average CPA candidate studies about 60-80 hours studying for the BEC exam, while the total CPA Exam study time (for all four sections) is about 330-440 hours.

Is BEC hard? What is the BEC CPA Exam pass rate?

The BEC section has the highest CPA Exam pass rates among the four parts. In 2022, the BEC CPA Exam pass rate was 59.68%. Regardless, over the last several years, the average BEC pass rate has fluctuated between 52% and 65%.

What’s the number of BEC CPA exam questions?

The BEC exam has 62 multiple-choice questions, 4 task-based simulations, and 3 written communications.

Where can I find a BEC CPA Exam cheat sheet?

First of all, remember that you can’t take any papers or notes into the CPA Exam testing room, and that includes a BEC formula cheat sheet. Therefore, you should have an understanding of the BEC formulas before exam day.

More Help for the CPA Exam Sections

BEC really isn’t as bad as some of the other CPA Exam sections, but you still need to put time and effort into passing it. Therefore, you must prepare for BEC by using the right CPA review course. You can find the best CPA review course for you in my comparison of the most popular options. Then, you can use my great CPA review course discounts to save big on your BEC CPA Exam prep.

If you haven’t already, you can also learn all about the benefits of becoming a CPA, the details of the CPA process, the best way to ensure that you pass the CPA Exam, and more in my free e-course. Get answers to your questions about my free CPA Exam guide now or sign up below to begin your CPA journey today!

About the Author Stephanie Ng

I am the author of How to Pass The CPA Exam (published by Wiley), and I also passed all 4 sections of the CPA Exam on my first try. Additionally, I have led webinars, such as for the Institute of Management Accountants, authored featured articles on websites like Going Concern and AccountingWeb, and I'm also the CFO for the charity New Sight. Finally, I have created other accounting certification websites to help mentor non-CPA candidates. I have already mentored thousands of CPA, CMA, CIA, EA, and CFA candidates, and I can help you too!