- You are here:

- Home »

- Blog »

- CPA Pass Rates »

- CPA Exam in the Middle East: Pass Rates, Eligibility, and Rules

CPA Exam in the Middle East: Pass Rates, Eligibility, and Rules

US CPA exam centers are currently available in several countries in the Middle East. This convenience allows citizens as well as those in adjacent countries to take the exam without incurring additional time, stress, and cost to travel to the US exam sites. Therefore, to help you plan your path to becoming a CPA, this post covers how to become a CPA in the Middle East.

CPA Exam Candidates in the Middle East

In the past, I used to be able to gather statistics about how many candidates from different countries passed the CPA Exam. That type of information isn’t released anymore, though. However, I can still go back through my records and share what stats are available about taking the CPA Exam from the Middle East.

Specifically, in 2019:

- 73,895 US-based candidates took the CPA Exam

- In contract, 9,122 international candidates took it.

Furthermore, the top five countries outside of the US with candidates who passed the CPA Exam in 2019 include:

- Japan: 2,248

- India: 1,392

- China: 1,079

- Republic of Korea: 1,074

- United Arab Emirates: 319

- Canada: 316

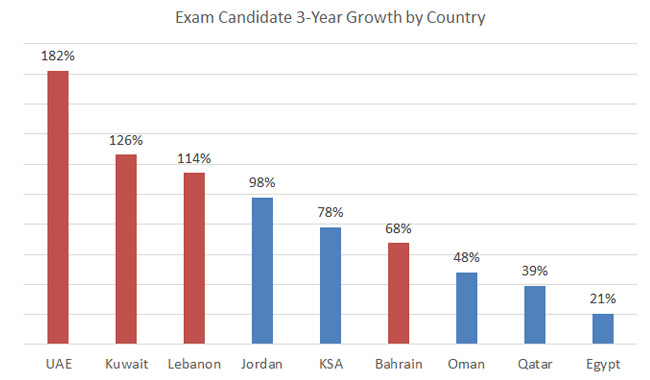

What’s more, the number of candidates taking the CPA Exam from the Middle East is increasing, as you can see in the chart below. In the past, candidates were restricted in where they could take the exam depending on their residency. That restriction was lifted in June 2022, but it’s still interesting to see this chart. The countries shown in red are those with exam centers, namely UAE, Kuwait, Lebanon, and Bahrain. So in the past, candidates in those countries were probably more likely to see for the exam since they lived near a testing center. Location and convenience have a very positive impact on growth rates.

CPA Exam Pass Rates in the Middle East

So, how do candidates taking the CPA Exam in the Middle East fare against other test-takers? Well, the CPA pass rates range from 31% in Bahrain to 51% in Lebanon. In comparison, about 50% of global candidates pass their CPA Exams.

The pass rates of international candidates are understandably lower because of the challenges in taking the exam in English, unfamiliar topics like US GAAP and US taxation, and text-based question styles such as task-based simulations.

Who is Eligible for the CPA Exam in the Middle East?

In 2022, the AICPA, NASBA, and Prometric announced policy changes for international CPA candidates. Specifically, in the past, candidates could only take the CPA exam in their country of residence and sometimes adjacent countries. For instance, if you lived in the Middle East, you couldn’t take the CPA Exam in Japan and vice versa.

But as of June 2022, the rules have changed. Depending on the jurisdiction where you plan to get your CPA license (see the note in the next paragraph), you can actually take the CPA Exam at any international Prometric testing center.

Therefore, here’s a list of international CPA Exam testing locations. If you live in the Middle East, you can take the CPA Exam at any international testing site, as long as you don’t plan to apply for your CPA license in a jurisdiction that doesn’t participate in the international exam program (Alabama, Idaho, North Carolina, and the Virgin Islands.)

- Bahrain

- Brazil

- Canada

- Egypt

- England

- Germany

- India

- Ireland

- Israel

- Japan

- Jordan

- Kuwait

- Lebanon

- Nepal

- Republic of Korea

- Saudi Arabia

- Scotland

- United Arab Emirates

Here is a short video on this arrangement, as well as the comparison of taking the exam in the US vs Middle East testing centers:

Taking the CPA in the Middle East vs US Jurisdictions

| Similarities | Differences |

|

|

Note on the Differences

The differences are mostly restrictions. Not all states choose to participate in allowing their candidates to sit for the exam at these international locations. This includes Alabama, Idaho, North Carolina, and the Virgin Islands. You can check out the list here.

Also, candidates have to obtain a full CPA license within 3 years of passing the exam, or else their exam results will be nullified. In other words, the experience verification has to be completed within this period. I don’t think there are exemptions and waivers, but you can double-check with the state boards.

For Your Further Reading

- Overview of the CPA exam application process

- Information from NASBA about the international administration of the CPA exam

Need Help in Your CPA Application Process?

You are welcome to check out the FAQ page for more info or sign up for my free mini-course to you. It will be in the form of emails and is specifically written for you as an international candidate:

Enter your name and email address and

I will send you the newsletter right away!

About the Author Stephanie Ng

I am the author of How to Pass The CPA Exam (published by Wiley), and I also passed all 4 sections of the CPA Exam on my first try. Additionally, I have led webinars, such as for the Institute of Management Accountants, authored featured articles on websites like Going Concern and AccountingWeb, and I'm also the CFO for the charity New Sight. Finally, I have created other accounting certification websites to help mentor non-CPA candidates. I have already mentored thousands of CPA, CMA, CIA, EA, and CFA candidates, and I can help you too!